Planning a honeymoon and saving thousands of dollars by strategically paying for your wedding is no easy feat. However, it is certainly not impossible and easy to learn with some basic knowledge of credit card rewards points. Since Dave and I first got into points and miles, we dreamed of visiting the infamous Hilton Conrad Maldives. We knew the points needed to get there, but we never expected to turn 5 days in the Maldives into an epic 6-week $70,000 adventure. If you want to learn the ins and outs, where we went, and how we did it, keep reading. You can also be sure to follow us on Instagram @BasicTravelCouple for our daily adventures.

Backstory

Our basic adventure started in 2018 where he famously proposed in front of the Egyptian Pyramids. We had a few delays with an unfortunate incident of me breaking my leg in the Galápagos Islands in 2019. Then we all know what happened in 2020 to delay our wedding yet another year. However, these delays gave us some extra time to work on earning more points & miles, saving money, and paying off over $45,000 in debt. June 12, 2021, came and went (way faster than I ever imagined), and next up we knew we had a few weeks to spare for our travels.

Honeymoon Planning

After planning, canceling, and re-planning our bridal shower, wedding, and honeymoon, we decided to be more go with the flow for the honeymoon in 2021. With Dave working in the public schools, and me being on an extended leave from work, we estimated we’d have about 4-7 weeks for travel in the summer. We also accumulated over three million miles and points. Just for some background info – since starting with points & miles in 2017, we’ve each opened about 50 cards which has helped us earn the points as well as free night certificates.

July 3rd, 2021 we ventured off with no set plans besides the first week or two. Starting with the Hilton Conrad Maldives and then going to Dubai. We planned our next moves a few days in advance based on the current environment. Originally we had a rough idea to head to South Africa but decided to head to Europe instead. After an amazing six-week journey, we found ourselves having traveled to 13 new countries together, walked 574,515 steps, rode on 15 airplanes, 5 trains, and stayed for 38 hotel nights.

So without further ado, the moment you’ve all been waiting for– let’s get into the points & miles breakdown!

Maldives Honeymoon

Maldives has been on my DREAM bucket list ever since I saw my friends travel there on a private yacht for a “babymoon”. The place looked as luxurious as it sounded, and I wanted that little slice of paradise. The $20,000 price tag, however, was nowhere near my Basic Budget. Always having that trip in mind, I KNEW one day, I would make it to the Maldives. Once I learned about points & miles, I knew we had to make the trip a special one. We had been saving the trip to the Maldives for our honeymoon for as long as I can remember and it was oh SO worth the wait.

Flights

Q-Suites Flights

Firstly, we had been eying the Q-Suites to have the “couple bed” if you book rear-facing seats E&F. Q-Suites are easily bookable on Qatar Airways by utilizing American Airlines for 70,000 points each. Finding space out of Chicago, we had to “re-position” ourselves from Buffalo to Chicago to take the flights. We decided to go a day early to enjoy a deep-dish pizza, and avoid any issues. Using our Southwest Companion Pass to fly into Midway Airport saved us half the cost. Then we took an uber to stay near O’Hare International Airport for the night.

I had used the Citi® / AAdvantage® Executive World Elite Mastercard® to book our flights on Qatar with AA miles for 70,000 points each. For more tips and tricks- check out this article on booking flights to the Maldives. Q-Suites would get us from Chicago to the Maldives with a stop in Doha. After that, you will have to take a private seaplane to fly into the Hilton Conrad. Therefore, this is the most expensive part of the trip and costs about $590 per person. You could easily use a card such as Capital One Venture Rewards to get a statement credit with your Venture Miles.

Flights: Southwest Companion Pass BUF-MDW

Points Cost: 11,472

Credit Cards Used: Chase Sapphire Preferred Ultimate Rewards Points (Transferred to Southwest)

Cash Rate: $325.96

Amount Paid: $11.20 for taxes & fees

Flights: Q-Suites – ORD-DOH-MLE

Points Cost: 140,000

Credit Cards Used: AAdvantage

Cash Rate: $11,412.00

Amount Paid: $31.40 for taxes & fees

Flights: Seaplane

Points Cost: 0

Credit Cards Used: Paid with Chase Sapphire Preferred Card to erase the cost later

Cash Rate: $1,179.98

Amount paid: $1,179.98

Hotel- Hilton Conrad Maldives

Going to the Conrad Maldives we knew we needed Hilton Honors points. To get a full breakdown of booking an overwater bungalow at the Hilton Conrad, you can read this step-by-step breakdown. We used the book 4 nights on points, get the 5th night for free. Therefore, our total cost was 380,000 Hilton Honors Points. Earning Hilton Honors points was easy enough with multiple credit cards available. We each utilized a welcome offer from the Hilton Honors Aspire Card which earned us Diamond status and a free night certificate. Offers typically range from 80,000-150,000 Hilton Honors Points but you can check out the latest offer here. Being a little short on points, we also both opened the Hilton Honors Surpass card. This put us over the 380,000 points needed and gave us points to spare for activities.

All information about Hilton Honors American Express Aspire Card has been collected independently by basictravelcouple.com

Hotel: Hyatt Place Chicago Airport

Number of Nights: 1

Points Cost: 8,000

Credit Cards Used: Chase Sapphire Preferred transferred to World of Hyatt

Cash Rate: $161.36

Hotel: Hilton Conrad Maldives

Number of Nights: 5

Points cost: 380,000

Credit Cards Used: Hilton Honors Aspire (we each opened this card), and 1 Hilton Honors Surpass Card

Cash rate: $7,680.72

All information about Hilton Honors American Express Aspire Card has been collected independently by basictravelcouple.com

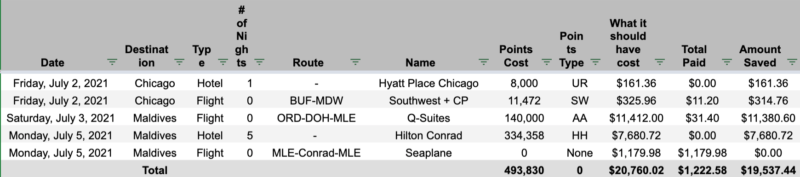

Maldives Overview

Points Used: 493,830

Should have cost: $20,760.02

Paid for Maldives: $1,222.58

Amount Saved: $19,537.44

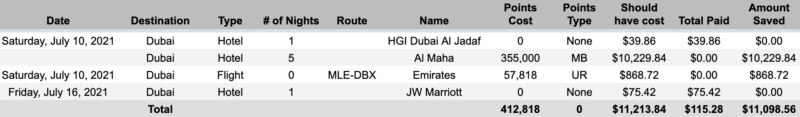

Dubai

For our second country after the Maldives, we searched for where direct flights were available out of MLE airport. Dubai was one we could easily get to and happened to be where Al Maha was located. We first heard of Al Maha from @TheRoamingRozos when we visited Kara and Nate’s 100 country party. It sounded marvelous and we knew it would be a short flight on our way back from the Maldives so we decided to head there next. We utilized a mixture of points for Dubai, including Ultimate Reward Points.

Points/Cost breakdown

Flights

Flying into Dubai we could take Emirates airlines. Since we were kind of on a time crunch, we just booked by using the Chase Ultimate Rewards Portal to easily book our flights.

Flights: Emirates – MLE-DXB

Points Cost: 57,818

Credit Cards Used: Chase Sapphire Preferred

Cash Rate: $868.72

Amount Paid: $0.00

Hotel

Arriving in Dubai it was pretty late. We didn’t want to try to venture to Al Maha since it was an all-inclusive resort and we would have lost out on a day. Therefore, we found a cheap night at Hilton Garden Inn Dubai Al Jadafnear the airport to sleep for the night. To book Al Maha, we again utilized the book 4 nights get the 5th night free on points. Combining our points between different Marriott Branded cards, we had enough to use for our travels. After 5 magical days at Al Maha Resort & Spa, we also booked a night at the JW Marriott Dubai to give us some time to explore the city. Al Maha is about an hour outside of the city in the desert. So this extra night (which almost wound up with a hospital visit) gave us some time to explore the city more.

Hotel: Al Maha Resort & Spa

Number of Nights: 5

Points cost: 355,000

Credit Cards Used: Marriott Bonvoy Brilliant® American Express® Card

Cash rate: $10,229.84

Amount paid: $0.00

Hotel: Hilton Garden Inn Dubai Al Jadaf (night of arrival, close to the airport)

Number of Nights: 1

Points cost: $0 – the cash rate was super cheap

Credit Cards Used: Hilton Honors Aspire

Cash rate: $39.86

Amount paid: $39.86

All information about Hilton Honors American Express Aspire Card has been collected independently by basictravelcouple.com

Hotel: JW Marriott Dubai

Number of Nights: 1

Points cost: 0 – the cash rate was super cheap

Credit Cards Used: Marriott Bonvoy Boundless Card

Cash rate: $75.42

Amount paid: $75.42

Dubai Overview

Points Used: 412,818

Should have cost: $11,213.84

Paid for Dubai: $115.28

Amount Saved: $11,098.56

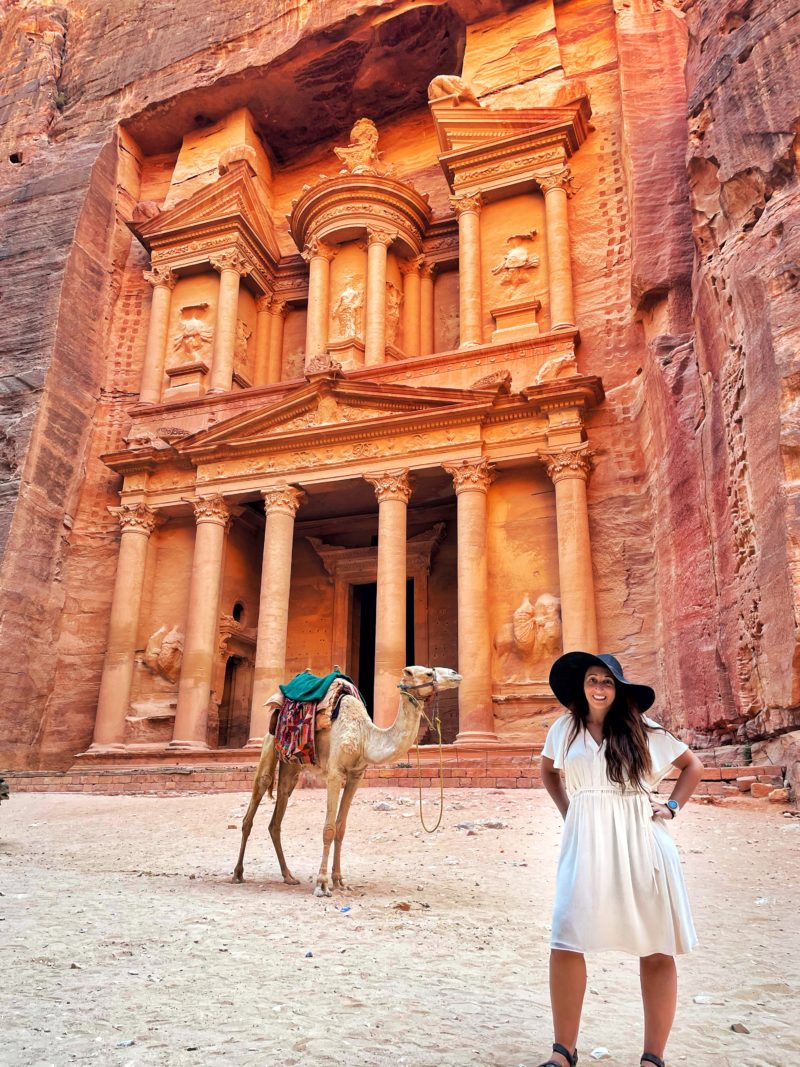

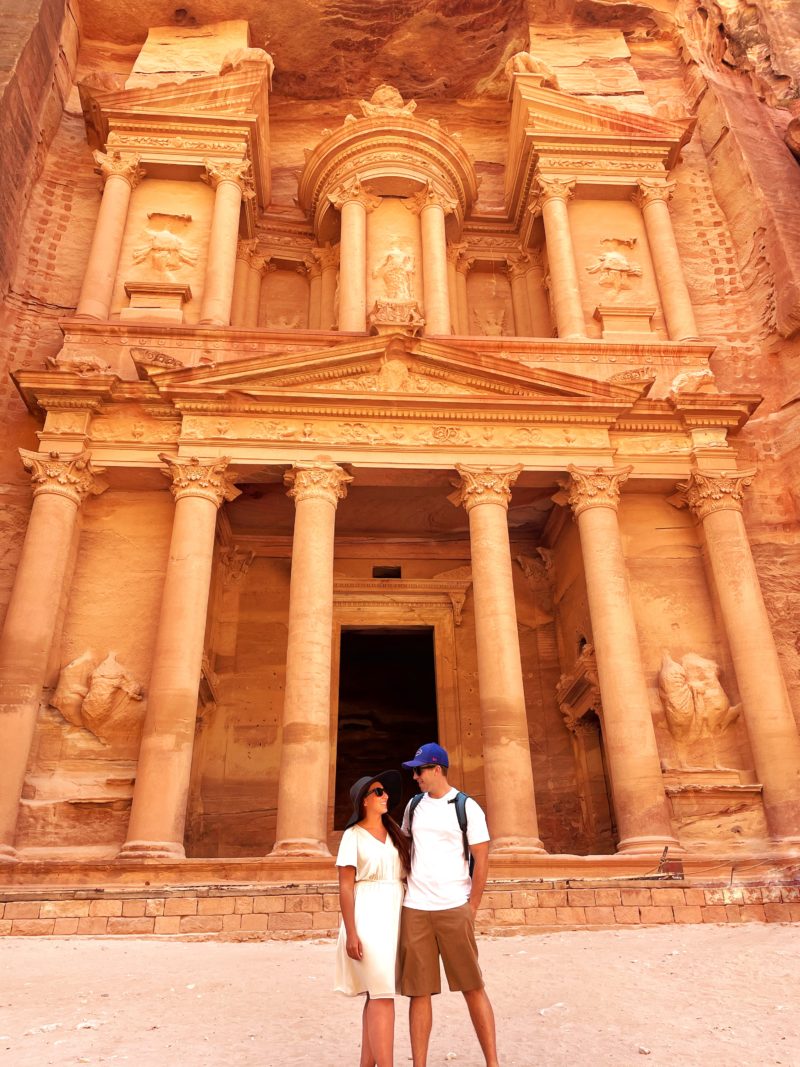

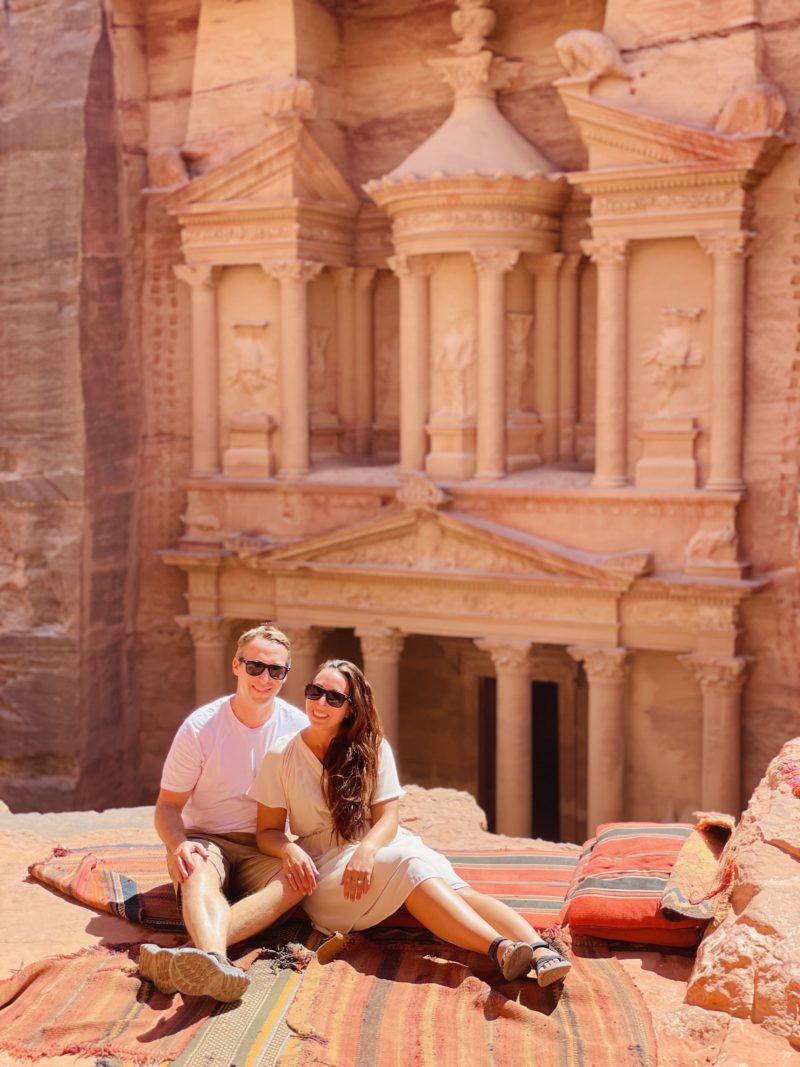

Jordan

When we got engaged in Egypt in 2018, we both really wanted to try to make the trip to the Dead Sea. So much so that we almost did this crazy itinerary with little sleep and overnight bus tours to get there. However, the trip didn’t happen. So for our honeymoon, we thought it would be the perfect time to head to Jordan to stop at the Dead Sea and also take a trip down to Petra. We also were able to charge the day trips to our room at Hyatt for Petra and the Dead Sea, which meant we were able to earn points.

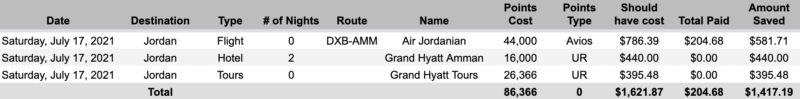

Flights

Searching last minute, Dave was able to find flights on Air Jordanian from Dubai to Amman. He then took it a step further to see that using Avios points, it would only cost us 44,000 points that we could transfer over from American Express Membership Reward points.

Flights: Air Jordanian Business DXB-AMM

Points Cost: 44,000

Credit Cards Used: Avios Points- Transferred Membership Rewards Points from The Platinum Card® from American Express

Cash Rate: $786.39

Amount Paid: $204.68

Hotel

To clarify, for our hotel bookings, two nights at the Grand Hyatt Amman only cost 8,000 points per night. We simply transferred Chase Ultimate Rewards points over to my World of Hyatt account. The hotel was gorgeous, and the staff was super accomodating. I highly recommend Grand Hyatt Amman if you are heading to Jordan.

Hotel: Grand Hyatt Amman

Number of Nights: 2

Points cost: 16,000

Credit Cards Used: Chase Sapphire Preferred

Cash rate: $440.00

Amount paid: $0.00

Tours: Dead Sea & Petra

Points Cost: 26,366

Cash Rate: $395.48

Amount Paid: $0.00

Total paid for Jordan: $204.68

Jordan Overview

Points Used: 86,366

Should have cost: $1,62187

Paid for Jordan: $204.68

Amount Saved: $1,417.19

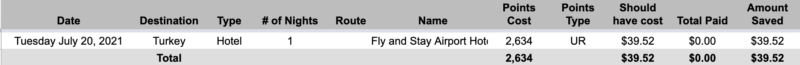

Istanbul, Turkey

Flying Turkish Airlines we were able to get a 27-hour layover in Istanbul. Our flights were going to Croatia, but, we just happened to have a long stopover in Turkey. We took advantage of it and spent the day sightseeing, eating amazing food, trying to get sold to buy silk rugs, and losing some money on a silk scarf instead. All in all, it was worth it. I will include the flights in the Croatia segment since this was just an “add on” stopover bonus.

Originally we were planning to just run around without getting a hotel, but since the IST Business Class lounge was closed, and we were exhausted, we got a room last minute using our Chase Ultimate Rewards Points.

Hotel

Hotel: Fly and Stay Airport Hotel

Number of Nights: 1

Points cost: 2,634

Credit Cards Used: Chase Sapphire Preferred

Cash rate: $39.52

Amount paid: $0.00

Istanbul, Turkey Overview

Points Used: 2,634

Should have cost: $39.52

Total paid for Istanbul: $0.00

Amount Saved: $39.52

Dubrovnik, Croatia

Croatia was on our list for a few reasons- well one it is gorgeous. Two, it did not require a COVID test if you are vaccinated, Once you are in Croatia, you could easily travel through other European countries. We planned to spend a week here with some day/night trips to Montenegro and Bosnia & Herzegovina, then two nights in Split. I highly recommend all three destinations and was a perfect add on to our honeymoon adventure.

Flights

To book our flights, we used Citi Premier ThankYou Points to transfer to Turkish Miles & Smiles program. This did involve a little delay for transferring the points, then calling multiple times to book the flights. You CAN call ahead to put a hold on flights you are interested in if you are waiting for points to transfer. However, if the trip is less than 7 days away, the hold is only for 24 hours which is not typically enough time for the points to transfer. If it is more than 7 days in advance, they will hold the rate for 48 hours.

Flights: Turkish Airlines Business Class – AMM-IST-DBV

Points Cost: 57,000

Credit Cards Used: Citi Premier ThankYou Points

Cash Rate: $2,231.60

Amount Paid: $397.60

Hotel

Chase Sapphire Preferred came through again with the last-minute hotel booking. For this trip, we also ended up renting a car so we could travel to Montenegro, then Bosnia and Herzegovina as well.

Hotel: Hotel Ivka

Number of Nights: 2

Points cost: 11,112

Credit Cards Used: Chase Ultimate Rewards

Cash rate: $166.68

Amount paid: $0.00

Croatia Overview

Points Used: 68,712

Should have cost: $2,398.28

Paid for Croatia: $397.60

Amount Saved: $2,000.68

Montenegro

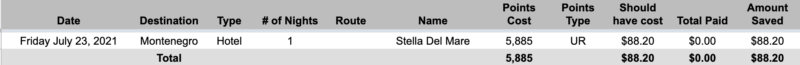

We rented a car right out of DBV airport and learning how to re-drive stick shift was quite the challenge while stopping uphill at lights. After a few stalled times, I eventually got back into the swing of things and actually enjoyed driving. We left early morning from Croatia to head to Kotor, Montenegro. It was a super cute town that we hiked up to the Kotor Fortress, ate some delicious food, and then headed to our hotel for the night. This was another find through the Chase Sapphire Preferred Card.

Hotel: Stella del Mare

Number of Nights: 1

Points cost: 5,885

Credit Cards Used: Chase Sapphire Preferred

Cash rate: $88.20

Amount paid: $0.00

Montenegro Overview

Points Used: 5,885

Should have cost: $88.20

Paid for Montenegro: $0.00

Amount Saved: $88.20

Bosnia and Herzegovina

Next, after Montenegro, we planned to spend a day in Bosnia and Herzegovina. However, we didn’t anticipate the 3ish hour wait at the border to get into Bosnia. Therefore we only had time to stop in Mostar, walk around the town, grab some lunch, and take a few photos. We tried local food and it was the best food I had in a long time. We also watched as people would jump from the famous Stari Most Bridge.

Split, Croatia

Sadly our time in split got cut short due to a flight cancellation from Vueling airlines. Instead of spending 2 nights, we only got to spend one short night and had to fly out the next morning. Despite our delay, the Air BnB-type property was super close to the main strip and we got to walk around town, get some food and check out a few spots. We booked again using our Chase Sapphire Preferred card. Therefore, if you don’t have this card yet, the 100,000 point offer is incredible and could cover a ton of nights on points.

Hotel: Villa Spaladium

Number of Nights: paid for 2, but stayed 1

Points cost: 19,634

Credit Cards Used: Chase Sapphire Preferred

Cash rate: $300.78

Amount paid: $6.26 (for local taxes)

(We are still working on being refunded. TBD through Vueling airlines and Chase Trip Insurance)

Split, Croatia Overview

Points Used: 19,634

Should have cost: $300.78

Paid for Split, Croatia: $6.26

Amount Saved: 294.52

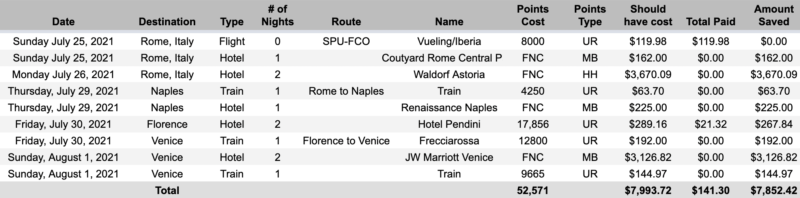

Italian Honeymoon Segment

Rome, Italy

Rome did not disappoint and was a great addition to our honeymoon. We walked, ate, drank, and enjoyed the gorgeous architecture and history. I had visited briefly two years ago but I was still on crutches from breaking my leg in Galapagos Islands. So this was a great redemption trip, and even better as it had way fewer tourists. We ended up staying at 2 hotels in Rome due to the flight cancellation.

Flights: Vueling- SPU-FCO

Points Cost: 8,000

Credit Cards Used: Chase Sapphire Reserve- used Pay Yourself Back

Cash Rate: $119.98

Amount Paid: $0.00

Hotels

Originally we booked 2 nights in Rome at the Waldorf Astoria. After all, it was our honeymoon. Normally the Waldorf has a pretty high price tag for a 5-star property. Utilizing a free-night certificate is a great value at these types of properties as it doesn’t matter what the nightly cost is, but if there is a “Standard Award Availability” you are able to book with a free night certificate!

To book the Courtyard Rome Central Park, since we last minute had to change our plans, we searched for availability for the free night certificates. The Marriott Bonvoy Brilliant card enabled us to utilize one free night certificate, saving us $162 for the night.

Hotel: Courtyard Rome Central Park

Number of Nights: 1

Points cost: 0 – used a Free Night Certificate

Credit Cards Used: Marriott Bonvoy Brilliant® American Express® Card

Cash rate: $162.00

Amount paid: $0.00

Hotel: Waldorf Astoria Rome

Number of Nights: 3

Points cost: 0 – used 3 Free Night Certificate

Credit Cards Used: Hilton Honors Aspire Card

Cash rate: $3,670.09

Amount paid: $0.00

All information about Hilton Honors American Express Aspire Card has been collected independently by basictravelcouple.com

Chase Sapphire Preferred® Card

Chase Sapphire Preferred® Card

Naples, Italy

Heading down for a quick visit to Naples, solely because it was where pizza originated from. We were sure to visit L’Antica Pizzeria Da Michele and had the best pizza of our lives. I’m sure I will be dreaming about this pizza for years to come. On our night in Renaissance Naples, we also used a free night certificate.

Train: FCO-Naples

Points Cost: 4,250

Credit Cards Used: Chase Sapphire Reserve – Pay yourself back

Cash Rate: $63.70

Amount Paid: $0

Hotel: Renaissance Naples

Number of Nights: 1

Points cost: 0- Used a Free Night Certificate

Credit Cards Used: Marriott Bonvoy Boundless Credit Card

Cash rate: $225.00

Amount paid: $0

Florence, Italy

I think Florence might have been my favorite place we visited in Italy on our Italian honeymoon adventure. Whether it was the unique and perfect hotel location, incredible food, or just exploring the winding streets and meeting different people. I can’t forget about all of the wineries in the Tuscan region. We got to take a day tour that also visited Pisa, Siena, San Gimignano, and Chianti. For our hotel in Florence, we easily reserved Hotel Pendini with our Chase Sapphire Preferred card through the portal.

Train: Naples-Florence

Points Cost: 12,800

Credit Cards Used: Chase Sapphire Reserve (Pay Yourself Back)

Cash Rate: $192.00

Amount Paid: $0

Hotel: Hotel Pendini

Number of Nights: 2

Points cost: 17,856

Credit Cards Used: Chase Sapphire Preferred

Cash rate: $289.16

Amount paid: $0.00

Venice, Italy

Venice was a few-hour train ride from Florence, where we really wanted to experience a gondola ride. This is a perfect honeymoon spot and we stayed at the JW Marriott which was off-site- so had to take a daily shuttle in and out of the property. For someone who likes to wander around the streets and walk back, this was a small annoyance. I will also say that they no longer offer a complimentary breakfast with status unless you are booked in a certain room. The breakfast WAS incredible though. However, the island/resort is kind of small and has not much to do unless you want to relax in the room/at the pool. Venice was so fun to wander the streets, taste different foods, and just people watch.

Train: Florence-Venice

Points Cost: 9,665

Credit Cards Used: CSR – Pay yourself back

Cash Rate: 144.97

Amount Paid: $0

Hotel: JW Marriott Venice

Number of Nights: 2

Points cost: 0- used 2 Free Night Certificates

Credit Cards Used: Marriott Bonvoy Brilliant® American Express® Card 50,000 free night certificate

Cash rate: $3,126.82

Amount paid: $0

Italy Overview

Points Used: 52,571

Free Night Certificates: 5

Should have cost: $7,993.72

Paid for Italy: $141.72

Amount Saved: $7,852.42

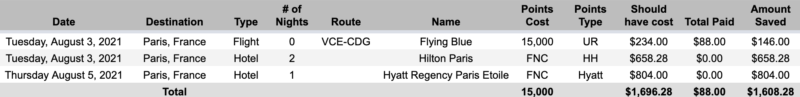

Paris, France

We spent 3 nights in Paris and I wish we would have added a few more! This magical city is a great honeymoon spot to explore, eat, drink and relax. There was so much to do/see between the Eiffel Tower, The Louvre, Notre Dame, eating and searching for invaders. We also got to meet up with like-minded travelers who are working towards FIRE (or already have). Find out how we booked a night river cruise (that actually didn’t exist).

Flight: Flying Blue- VCE-CDG

Points Cost: 15,000

Credit Cards Used: transferred points to Flying Blue

Cash Rate: $234.00

Amount Paid: $88.00

Hotels

Booking two different hotels in Paris, we really wanted to stay at the Hyatt Regency but we also had a bunch of free night certificates from Hilton that we had to use. So we split our time with 2 nights at the Hilton Paris Opera and 1 night at the Hyatt Regency Paris Etoile. The highlight of the Hyatt Regency was the happy hour they had for Diamond members which included snacks and wine, beer, and champagne.

Hotel: Hilton Paris Opera

Number of Nights: 2

Points cost: 0- used 2 Free Night Certificates

Credit Cards Used: Hilton Honors

Cash rate: $658.28

Amount paid: $0.00

Hotel: Hyatt Regency Paris Etoile

Number of Nights: 1

Points cost: 0- used 1 Free Night Certificates

Credit Cards Used: World of Hyatt

Cash rate: $804.00

Amount paid: $0.00

Paris, France Overview

Points Used: 15,000

Free Night Certificates: 3

Should have cost: $1,696.28

Paid for Paris: $88.00

Amount Saved: $1,608.28

Brussels, Belgium

Belgium was a great spot for some Beer, Chocolate, and Waffles! We also happened to stumble upon a weekend of festivals, so we just ate and drank our way walking through the city. It was a great place to walk around explore with no real plans in mind. It was a nice change of pace from the daily planning of our honeymoon.

Train: Paris-Brussels

Points Cost: 6,185

Credit Cards Used: Chase Ultimate Rewards – Pay Yourself Back

Cash Rate: $92.78

Amount Paid: $0.00

Hotel

There were two Hilton Garden Inn’s in Brussels City Centre, but one is definitely farther than the other. We booked the cheaper one since it was $115 for 2 nights. We still walked around into the city but it was a pretty far walk. The hotel was nice and an easy walk from the train station as well as to the city. We paid cash for this to save our points for those buy 4 get one free night.

Hotel: Hilton Garden Inn Brussels City Centre

Number of Nights: 2

Points cost: 0

Credit Cards Used: paid cash

Cash rate: $114.99

Amount paid: $114.99

Brussels, Belgium Overview

Points Used: 6,185

Should have cost: $207.77

Total paid for Belgium: $114.99

Amount Saved: $92.78

Amsterdam, Netherlands

I absolutely loved Amsterdam. We actually split our time between two hotels- the Waldorf Astoria Amsterdam and Kimpton De Witt. Waldorf Astoria honestly blew us away in their incredible hospitality from the moment we walked in the door. In fact, within mere seconds of walking into our room, we immediately said we wanted another day there and moved our next hotel booking back to promptly use another free night hotel certificate. We stayed at some pretty great places along our honeymoon, but I would absolutely go back to Waldorf Astoria Amsterdam.

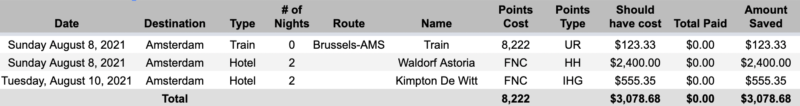

Train: Brussels to Amsterdam

Points Cost: 8,222

Credit Cards Used: Chase Ultimate Rewards – Pay Yourself Back

Cash Rate: $123.33

Amount Paid: $0.00

Hotel

Booking the Waldorf Astoria we were able to find Standard Room Nights available. As a note, if you ever book a Standard Room Night Award and then try to change the date- make sure they CANCEL and REBOOK because changing the date actually caused them to take 80,000 Hilton Honors points instead of using my hotel certificate. This was super disappointing but a lesson was learned for next time.

For Kimpton DeWitt we also utilized 2 free night certificates with IHG.

Hotel: Waldorf Astoria

Number of Nights: 2

Points cost: 0- 2 Free Night Certificates

Credit Cards Used: Hilton Honors Surpass

Cash rate: $2,400

Amount paid: $0

Hotel: Kimpton De Witt Amsterdam

Number of nights: 2

Points cost: 0- 2 Free Night Certificates

Credit Cards Used: Chase IHG Rewards Club Premier

Cash rate: $555.35

Amount paid: $0.00

Amsterdam Overview

Points Used: 8,222

Free Night Certificates: 2

Should have cost: $3,078.68

Total paid for Amsterdam: $0.00

Amount Saved: $3,078.68

Frankfurt, Germany

We had less than 24 hours in Frankfurt to tie up our honeymoon adventure., However, we wanted to make the best of it and went out to explore the city. We made sure to check out an authentic beer garden, scooter around some of the sights, and eat some Bratwurst.

Flight: AMS-FRA

Points Cost: 21,360

Credit Cards Used: Chase Ultimate Rewards

Cash Rate: $320.40

Amount Paid: $0.00

Hotel: Hyatt Place Frankfurt Airport

Number of Nights: 1

Points cost: 8,000

Credit Cards Used: World of Hyatt Credit Card

Cash rate: $150.12

Amount paid: $0.00

Frankfurt, Germany Overview

Points Used: 29,360

Should have cost: $470.52

Total paid for Germany: $0.00

Amount Saved: $470.52

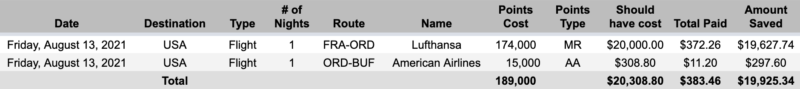

The Journey Home from our Honeymoon

Our last part of the journey- Flying home. We were ready to dive into another first-class flight. Knowing that Lufthansa’s beautiful 747-8 will be retiring soon, we decided to check out flying in the nose on our way home. If you want to see the breakdown to booking Lufthansa First, you can check it out here. We were sad to learn that the infamous First Class Terminal was closed out of Frankfurt, but we still had an incredible First Class Experience.

Flight: Lufthansa First Class

Points Cost: 174,000 Membership Rewards

Cards Used: American Express® Gold Card

Cash Rate: $20,000

Amount Paid: $372.26

Lufthansa Overview

Points Used: 189,000

Should have cost: $20,308.80

Total paid for Lufthansa First Class: $383.46

Amount Saved: $19,925.34

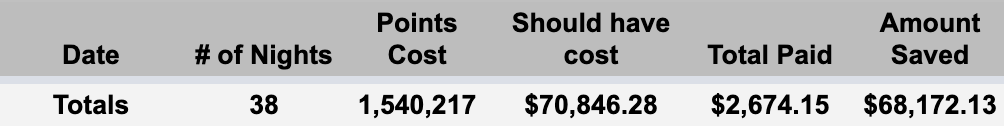

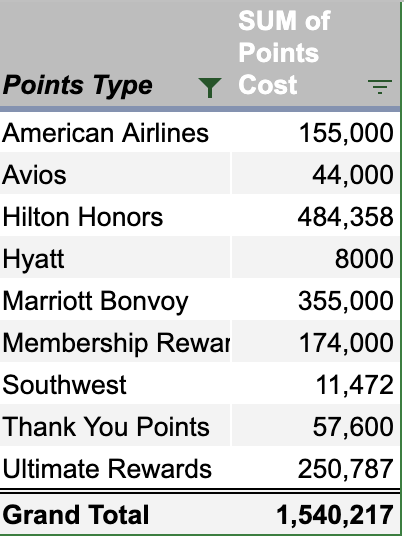

Overall Costs of our Honeymoon

Finally, we spent over 1.5 million points. We “paid” $2,674 and saved over $68,000. I say paid loosely because we actually utilized Chase’s pay yourself back promo at the end of the day and ended up paying off our cards with points. If you include that, we used another half a million points to pay for EVERYTHING, including our food/activities/whatever else. This brought our total to over 2 million points and miles for 6 weeks of travel. 2,099,234 points to be exact.

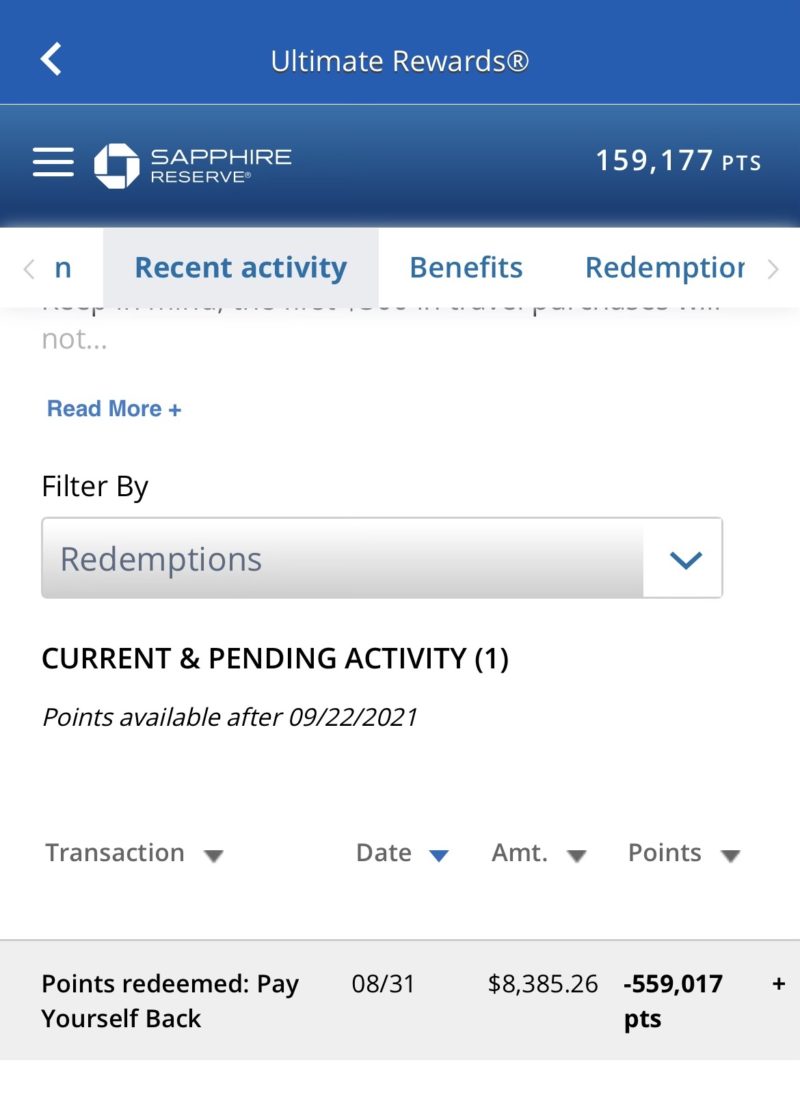

Chase’s Pay Yourself Back

Lastly, there are other ways to save money on your vacations for those “non” point costs. For instance, you can use credit cards that can essentially “erase” the cost. I talked about utilizing Chase’s Pay Yourself Back option quite a bit. For every purchase that wasn’t a specific hotel for a credit card, we put everything on our Chase Sapphire Reserve Card. Luckily for us, food and groceries counted for “pay yourself back.” By the end of the trip, we had spent well over $8,000 on food/activities and whatnot that we eventually “erased” with our points.

How Pay Yourself Back works

We were able to log into our chase portal, and “erase” most of our costs from the 6-week honeymoon, thus netting us $0 out of pocket. To do so, you log in and click your Ultimate Rewards Points portal and click on the “pay yourself back” option. Next, you select the items you want to “pay yourself back” on. Lastly, note that the Chase Sapphire Preferred gets an extra 25% and the Chase Sapphire Reserve gets an extra 50%. I did include prices just for reference as to what we “should have” paid. Since we had a lot of extra points (and enjoy earning them), we used them to erase all of our balances from the trip.

Basic breakdown of our Honeymoon Adventure

This 6-week honeymoon was no easy trip. We never would have afforded to travel for so long, or in business/first class and 5-star hotels. Amassing points and miles over the years made this possible. I know that cliche saying “if we can do it, anyone can,” but honestly it is so so true. A few years ago we knew nothing about points and miles, and we struggled to even take a trip to Fort Lauderdale. Seriously, we slept on a friend’s floor, and I recall having to go to a bank to transfer myself like $20. We spent years learning and making mistakes. Now, we created a course to teach you how to earn points and miles in 6 easy steps. If you read this article, you can still get our BIGGEST discount on the course we have offered! If you are looking to build your own honeymoon adventure, don’t forget to check out How to Strategize your Wedding for a FREE honeymoon.

I’d love to hear in the comments below or over in our 8,700+ Member Basic Travel Facebook Group!

New to Credit Card Rewards Points? Check out the BASICS Below!

- Learn how to utilize credit card points with our Basic Travel Course

- Basic Travel 101

- Basic Travel 102

- Credit Scores 101

- Knowing the Rules

- 5/24 Status

- Top Credit Card Offers

- How to Earn Credit Card Bonuses

- Expedited Airport Screening

- Cashback Sites

For rates and fees for American Express cards mentioned in this post, please see the following links: The Platinum Card® from American Express (See Rates & Fees; terms apply); American Express® Gold Card (See Rates & Fees; terms apply); Marriott Bonvoy Brilliant® American Express® Card (See Rates & Fees; terms apply); Hilton Honors American Express Surpass® Card (See Rates & Fees; terms apply)