Lounge access is by far one of my favorite Basic Travel Strategies. I sure don’t miss those days of packing snacks and getting ripped off on overpriced airport beers. Nowadays, food and drinks are typically complimentary for me and my guests. Instead of dreading time spent at the airport I’m planning in extra time on layovers. The best part is that membership to lounge networks is a free perk. Learn about all of the options in the basic guide to credit cards that offer Priority Pass Lounge Access.

In this Basic Guide you’ll find:

- Priority Pass Lounges

- Capital One Venture X

- Chase Sapphire Reserve

- The Platinum Card® from American Express

- Hilton Honors American Express Card

- Marriott Bonvoy Brilliant® American Express® Card

- Citi Prestige

- U.S. Bank Altitude Reserve

- Basic Breakdown

Priority Pass Lounges

The Priority Pass Lounge Network is made up of over 1,300 airport lounges spread across the world. These private spaces are home to relaxing seats, complimentary refreshments (including alcohol), and appetizers. You’ll also find each lounge equipped with high-speed Wifi and some even offer showers (like The Club Lounge in New Orleans). A priority pass membership can cost over $400 a year but thankfully many credit cards offer a complimentary membership.

Below you’ll find all of the different credit cards that offer a priority pass membership!

Capital One Venture X

The Capital One Venture X offers the cardholder a Priority Pass Select Membership. With this membership, the cardholder receives unlimited access while the Venture X is open. The cardholder can also bring two guests for free into each lounge.

Capital One Venture X Authorized users also receive their own priority pass select membership. Up to four authorized users can be added for no additional cost.

As an added benefit, Capital One Venture X Holders also have access to special credits at priority pass restaurants. Show the membership card to the host at any of the restaurants included in order to receive credit towards a meal (Average $28 in credit per person).

Capital One Venture X Lounge Basics

- Priority Pass Restaurant Credit

- Can bring 2 Guests into a lounge for free

- Unlimited Priority Pass Lounge Access

- Authorized users receive their own Priority Pass Membership

Chase Sapphire Reserve

The Chase Sapphire Reserve offers the cardholder a Priority Pass Select Membership. With this membership, the cardholder receives unlimited access while the Sapphire Reserve is open. The cardholder can also bring two guests for free into each lounge. As you can see, this membership alone can certainly add up savings quickly for frequent travelers.

Chase Sapphire Reserve Authorized users also receive their own priority pass select membership. It costs $75 to add an AU to the Reserve but the value can be earned back after only a few lounge visits.

Chase Sapphire Reserve®

Chase Sapphire Reserve®

As an added benefit, Chase Sapphire Reserve Holders also have access to special credits at priority pass restaurants. Show the membership card to the host at any of the restaurants included to received credit towards a meal (Average $28 in credit per person).

Chase Sapphire Reserve Lounge Basics

- Unlimited Priority Pass Lounge Access

- Can bring 2 Guests into a lounge for free

- Priority Pass Restaurant Credit

- Authorized users receive their own Priority Pass Membership

The Platinum Card® from American Express (Or The Business Platinum® Card from American Express)

The The Platinum Card® from American Express (And Business Platinum) offers the cardholder a Priority Pass Select Membership. With this membership, the cardholder receives unlimited access while the American Express Platinum card is open. The cardholder can also bring two guests for free into each lounge. As you can see, this membership alone can certainly add up savings for frequent travelers.

Amex Platinum Authorized users also receive their own priority pass select membership. It costs $175 to add up to 3 AU’s to the Platinum card but the value can be earned back after only a few lounge visits. (See Rates & Fees; terms apply)

As an added benefit, the Amex Platinum card also provides access to other airport lounges like the Centurion and Escape lounges. Unfortunately, the Amex Platinum Priority Pass membership discontinued restaurant credits which is a major difference between this option and the Chase Sapphire Reserve.

Amex Platinum Card Lounge Basics

- Unlimited Priority Pass Lounge Access

- Can bring 2 Guests into a lounge for free

- Authorized users receive their own Priority Pass Membership

- No Priority Pass Restaurant Credit

- Same benefits for Amex Business Platinum Cardholders

American Express Hilton Honors Credit Cards

There are three American Express Hilton Honors credit cards that offer different versions of a priority pass membership. The personal Hilton Honors American Express Aspire Card & ilton Honors American Express Surpass® Card, and the The Hilton Honors American Express Business Card all provide lounge access. Let’s break down all three below:

American Express Hilton Honors Aspire Credit Card

The American Express Hilton Honors Aspire is similar to the Sapphire Reserve and Platinum in that it offers unlimited priority pass visits plus two guests. One big difference is that authorized users of the Aspire do not receive their own priority pass membership. Additionally, there is no priority pass restaurant credit with any of the Amex Hilton Honors Credit Cards. However, it’s important to note that the Aspire does come with Hilton Honors Diamond status which can provide access to the hotel lounges.

Amex Hilton Honors Aspire Card Lounge Basics

- Unlimited Priority Pass Lounge Access

- Can bring 2 Guests into a lounge for free

- No Priority Pass Restaurant Credit

- Hilton Hotel Lounge Access (Only certain locations

Hilton Honors American Express Aspire Card

Hilton Honors American Express Aspire Card

Amex Hilton Honors Surpass Credit Card (And Business Version)

The Hilton Surpass Card (And Hilton Business Card) offers a unique priority pass membership, not like the others. Surpass holders will receive 10 priority pass visits per year. Any guests brought into a lounge will be taken away from the 10 passes. After the 10 passes are gone, it will cost $32 per visit plus an additional $32 for each guest. This is a great option for folks who only travel a few times per year.

Amex Hilton Honors Surpass Card Lounge Basics

- 10 Priority Pass Lounge Access Visits

- No free Guests (Can use a pass or pay $32)

- No Priority Pass Restaurant Credit

- Same benefits for Hilton Honors Business Cardholders

card_name

card_name

Marriott Bonvoy Brilliant® American Express® Card

The Amex Marriott Bonvoy Brillant Card is similar to the Sapphire Reserve and Platinum in that it offers unlimited priority pass visits plus two guests. One big difference is that authorized users of the Bonvoy Brilliant do not receive their own priority pass membership. Additionally, there is no priority pass restaurant credit.

Amex Marriott Bonvoy Brilliant Card Lounge Basics

- Unlimited Priority Pass Lounge Access

- Can bring 2 Guests into a lounge for free

- No Priority Pass Restaurant Credit

Citi Prestige® Credit Card

The Citi Prestige Card offers unlimited priority pass visits plus two guests. One big difference between the Prestige and other options is that in lieu of two guests, the cardholder can bring in their whole immediate family into the lounge. This includes a spouse, domestic partner, and/or children under 18 years of age. In addition, authorized users of the Citi Prestige card will receive their own priority pass membership.

To make the Citi Prestige even better, the priority pass membership also includes restaurant credits like the Chase Sapphire Reserve.

Citi Prestige® Credit Card Card Lounge Basics

- Unlimited Priority Pass Lounge Access

- Can bring 2 Guests into a lounge for free OR

- Can bring entire immediate family into the lounge for free

- Includes Priority Pass Restaurant Credit

- Authorized users receive their own Priority Pass Membership

U.S. Bank Altitude® Reserve Visa Infinite® Card

The U.S. Bank Altitude Reserve comes with four complimentary priority pass lounge visits. Additionally, the cardholder can bring a complimentary guest with each of those four visits. It’s important to note that authorized users do not receive their own priority pass membership cards but restaurants are included (used in lieu of a lounge pass).

U.S. Bank Altitude® Reserve Credit Card Lounge Basics

- 4 Visits to a Priority Pass Lounge

- 4 Guest Passes to a Priority Pass Lounge

- Restaurant Access can be used for the 4 Visits

- Authorized users do not receive their own membership

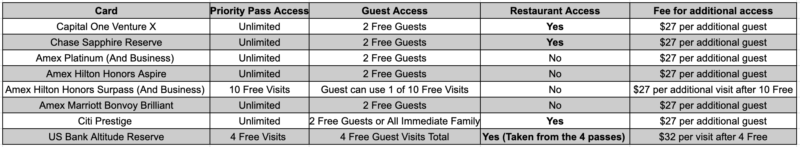

Basic Breakdown

As you can see there are a lot of options that lead to priority pass lounge access. Depending on your situation the best one for you will vary. I’m a big fan of the Chase Sapphire Reserve and Capital One Venture X as I get a lot of value from the lounges and restaurant credit. Other folks who don’t encounter many restaurants may opt for the Amex Platinum which includes more options for lounges. Folks who only travel a few times each year will benefit from Amex Hilton Honors Surpass card. Finally, families will find the best value from the Citi Prestige.

What’s your favorite option for priority pass lounge access? Do you have a favorite lounge you tend to visit?

I’d love to hear in the comments below or over in our 8,700+ Member Basic Travel Facebook Group!

More Basic Reading

- Our Top Strategies for Cutting Travel Costs (Free eBook)

- Basic Guide to Airport Lounge Access

- How I saved $774 on Home Internet

- 7 Reasons to Plan a Summer Road Trip

- Top Credit Card Offers of the Month

For rates and fees for American Express cards mentioned in this post, please see the following links: The Platinum Card® from American Express (See Rates & Fees; terms apply); American Express® Gold Card (See Rates & Fees; terms apply); The Business Platinum® Card from American Express (See Rates & Fees; terms apply); American Express® Business Gold Card (See Rates & Fees; terms apply);Marriott Bonvoy Brilliant® American Express® Card (See Rates & Fees; terms apply); The Hilton Honors American Express Business Card (See Rates & Fees; terms apply); Hilton Honors American Express Surpass® Card (See Rates & Fees; terms apply); Hilton Honors American Express Card (See Rates & Fees; terms apply); Hilton Honors American Express Aspire Card (See Rates & Fees; terms apply)