Chase Ink Business Credit Cards have always been a favorite of ours in our wallets. There are currently Four Ink Business Branded cards. Chase just launched an updated bonus offer on two of the cards which makes these cards EVEN MORE VALUABLE and has anyone under 5/24 rushing to apply. If you aren’t familiar with the Chase family, Chase provides points called “Ultimate Rewards.” These are some of the best points in the travel industry. Being super versatile, Ultimate Rewards or UR points can be used for flights, hotels, cash back, or even booking excursions. I’m going to let you in on a way to maximize your everyday spending, and WHY I don’t recommend the famous Chase Ink Business Preferred Credit Card. First, let’s review small business credit cards real quick. card_name

Small Business Credit Cards

Small Business Credit Cards are a great way to maximize your business. Similarly, it can as well as keeping your business and personal expenses separate. You might be surprised to find out what actually qualifies as a small business, but it is probably more than you think. For example, driving for Uber, selling items online, or even having an evening gig of walking neighbors’ dogs could qualify. Our Basic Guide to Small Business Cards can give you a better idea of what a small business card is. Finally, you can also check out our step-by-step guide to applying for a small business card. This will walk you through understanding the application process for a small business card and includes screenshots.

Chase Business Cards

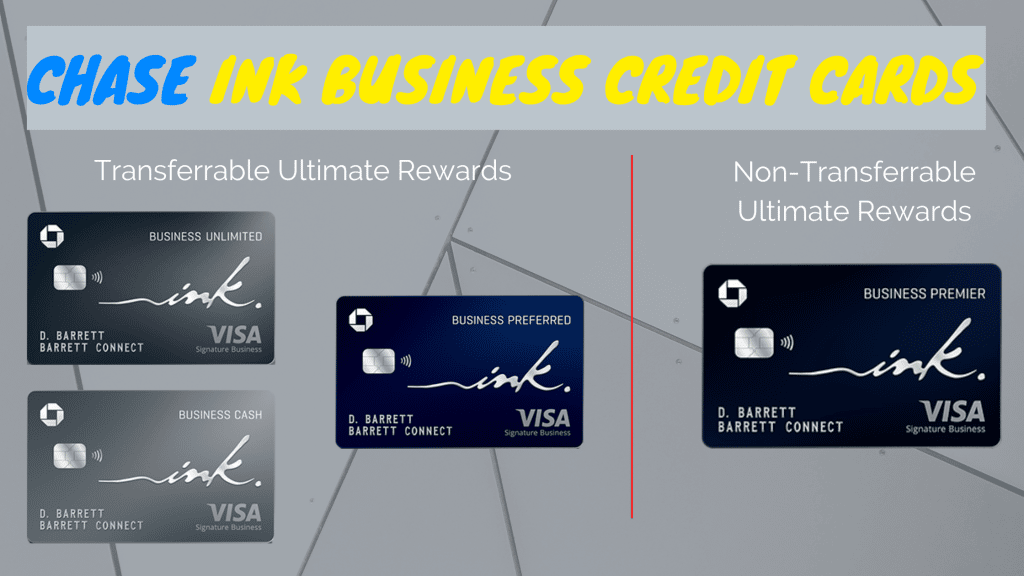

Chase has 4 Business Ink cards. Three of the cards earn Ultimate Rewards Points that are transferable/combinable with the others. 1 of them also earns Ultimate Rewards Points, however, these points are not able to be combined or transferred with the other Chase Ultimate Rewards Points. I usually transfer to our Chase Sapphire Reserve Card or Chase Sapphire Preferred Card to utilize the higher redemption values. So what are the cards?

Transferrable Ultimate Rewards Points

Non-Transferrable Ultimate Rewards Points

Now, before I get too far, let me say you can actually have all 4 cards per business. Let’s dig into how these cards differ.

Ink Business Preferred Credit Card

The Chase Ink Business Preferred is offering a 100,000 welcome bonus after spending $8,000 in the first 3 months of account opening. It also comes with an annual fee of $95. In addition, you can earn bonus points of 3x on categories up to $150,000 per anniversary year. This is an incredible offer, and straight out of the gate offers $1,000 in value. If you transfer those points to your Chase Sapphire Reserve or Preferred, you can get 50% or 25% more. So up to $1,500 in value.

They also offer 3x on the below categories, up to $150,000 in purchases each account anniversary year:

- Shipping purchases

- Advertising purchases with social media sites and search engines

- Internet, cable, and phone services

- Travel

So it sounds like a great card, right?

It absolutely is, and I don’t disagree with you. In fact, we have written about the Top 10 reasons why we love the Chase Ink Business Preferred card. However, if you are going to spend $10,000, I have a better way to maximize your value. In addition to Chase Ink Business Preferred, let’s chat about the other two transferrable business cards.

Ink Business Cash Credit Card

Chase Ink Business Cash (or CIC as it is often abbreviated) is offering $750 Bonus Cash Back points after spending $6,000 in the first 3 months. This is promoted as a “Cash back” card but, if you have other Ultimate Rewards cards such as Chase Sapphire Preferred, or Chase Sapphire Reserve, you can use those points for travel or hotels when transferred to another card. Next, this card comes with NO annual fee. Finally, each anniversary year, you can earn 2x or 5x bonus points up to $25,000 per category.

To maximize these bonus categories, you can earn 5x on up to $25,000 spend and another 2x on $25,000 spend.

Earn 5x cash back on:

- Office supply stores

- Internet, cable, and phone services

Earn 2x cash back on:

- Gas stations

- Restaurants

Ink Business Unlimited Credit Card

Chase Ink Business Unlimited (or CIU as it is often abbreviated), is similar to the CIC. Also offering $750 points after spending $6,000 in the first 3 months of card opening. Next, it ALSO comes with NO annual fee. However, the main difference is CIU is really a straightforward unlimited 1.5% cash back card. Finally, this is great if you do a lot of random spending that wouldn’t necessarily fit into the categories above for 2x-5x points.

Ink Business Premier Credit Card

Chase’s newest business card on the block, the Ink Business Premier Credit Card, has one of the better offers out there. Offering $1,000 Cash Back after you spend $10,000 in purchases in the first 3 months of account opening. Now, you might think this is a great deal but remember, these points are solely for cash back and cannot be transferred or used in conjunction with other points. So if you are trying to book a trip, these points will not work for you.

Maximize value

So how do we maximize value? Well, two of the 4 cards have the lowest spend options at $6,000 per card. This means you could get BOTH cards for a total of $12,000 spend, AND, earn $1,500. I don’t know about you but I’m always for maximizing my spend. If you were to get the Ink Business Preferred Card, you’d have to spend $8,000 for $1,000, which leaves $500 on the table. If you went for the Ink Business Premier, you are also leaving $500 on the table and also can’t transfer your points. So your best bet is to first open the Chase Ink Business Cash, meet your spending (or get close to it), THEN open the Chase Ink Business Unlimited. Not only does this MAXIMIZE your overall point value, BUT, it can even give you a longer time to spend the $6,000 each. If you opened the first one and took the 3 months to meet $6,000, then you open the second and still have another 3 months to meet the spend.

Why I don’t recommend Chase Ink Business Preferred

Don’t get me wrong, I think CIBP is a great card if you can maximize the spending categories. I also think if you are going to spend $8,000 in 3 months, you will want to maximize your spending. With Chase business cards, you can actually be a cardholder for each card per business. For example, if I have 3 businesses, each business could have its own set of 4 business cards for a total of 12 Chase Ink Business Cards. Similarly, this means for $4,000 more spend, you could actually get 50,000 more points with this little trick.

How it works

Instead of opening ONE card (CIBP) for 100,000 points after $8,000 spend and a $95 annual fee, I’d open TWO cards. Therefore, opening ONE Chase Ink Business Cash and ONE Chase Ink Business Unlimited. This would give you $6,000 spend each for a total of $12,000 total spend. BUT you’d be getting 150,000 Ultimate Rewards points instead of 100,000. So for 50,000 more points, and the $4,000 more spend (sans the $95 annual fee), you actually make over $500 in extra value for opening two cards vs. one. Another perk is you could even space out the two applications to give you a 4-6 month time frame for the spending requirements.

Rules to applying

5/24 Rule

A few caveats I want to note. Again if you are new to the Chase world, you have to be under 5/24 in order to apply for a business card. Chase’s 5/24 rule means you cannot have opened more than 5 credit cards (from ANYWHERE, even certain store credit cards) in a matter of 24 months or they will deny you. What is interesting is that Chase Business cards will not count against your 5/24 status. However, you have to be under that threshold in order to be approved. To check your 5/24 status, our basic guide will give you step-by-step instructions with an easy-to-track spreadsheet.

2/30 Rule

The 2/30 rule means you cannot be approved for more than TWO Chase cards in a 30-day time frame. So if you were to apply for the two cards, make sure you have not applied for any chase cards in the past 30 days. In addition, you could apply for both cards on the same day if you knew you were going to be able to meet the $8,000 in 3 months.

Basic Recap

I’m not sure about you, but I like doing less work for more value. If you are going to spend $12,000 anyway, opening two cards vs one is the better option. Now, this won’t work if you already have one of the CIC or CIU cards (unless you have another business). Also remember sole proprietors, can qualify for business cards. But, this is the strategy I actually showed my parents and multiple readers to maximize the value. Let us know if you double-dipped for 50,000 extra value!

As always, if you value our articles, we appreciate it if you utilize our affiliate links when applying.