This year has been hard for SO many people this year. I’ve been feeling extra grateful lately, even with not working these last few months, I have plenty to be grateful for. Because of that, I thought I’d turn back to my couponing days, and figure out ways to give back while utilizing credit card rewards points. I am going to highlight two powerful women who have started something that has grown over the last few months (years?).

First, I will get into how I was able to get over $1,000 in items and got paid to do so.

There are many ways you can “Double Dip” or in this case, I’m going to say “7x dip”. (I don’t know what 7 times dip would be? lol) I’ll explain what I did, then how you can essentially repeat the same thing.

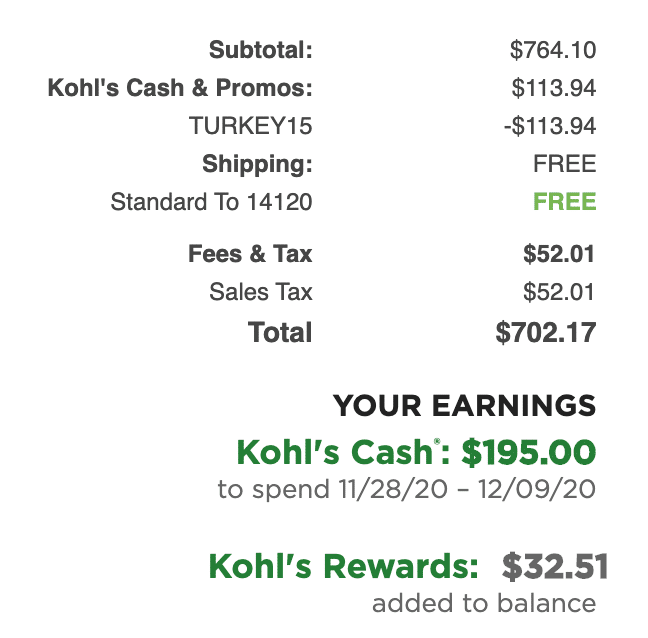

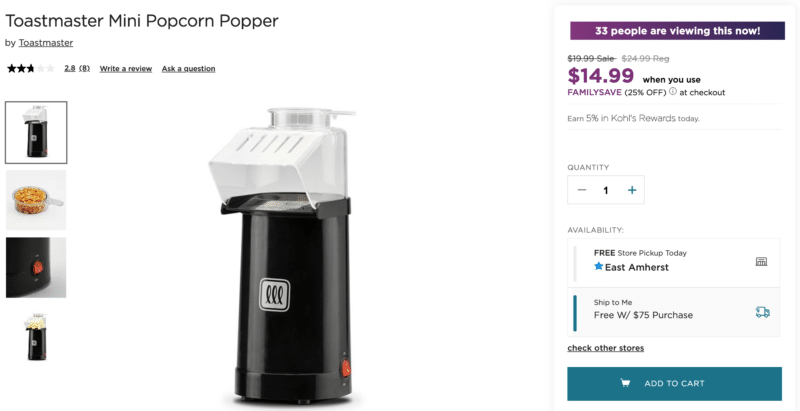

- ➡️ Kohl’s had a sale during black Friday week on Toastmaster items. Each item is normally $24.99, but they were on sale for 19.99. They had 8 items left so I bought 5 of each.

- ➡️ Used a 15% off coupon making each item $16.99 (was on Kohl’s website)

- ➡️ There was a Mail-in Rebate offer for $14. You could get up to 5 of each item per household.

- ➡️ On this purchase, I also earned Kohl’s cash of $195, plus Kohl’s Rewards of $32.50.

- ➡️ I made sure to shop using Rakuten to get another $17.04 back

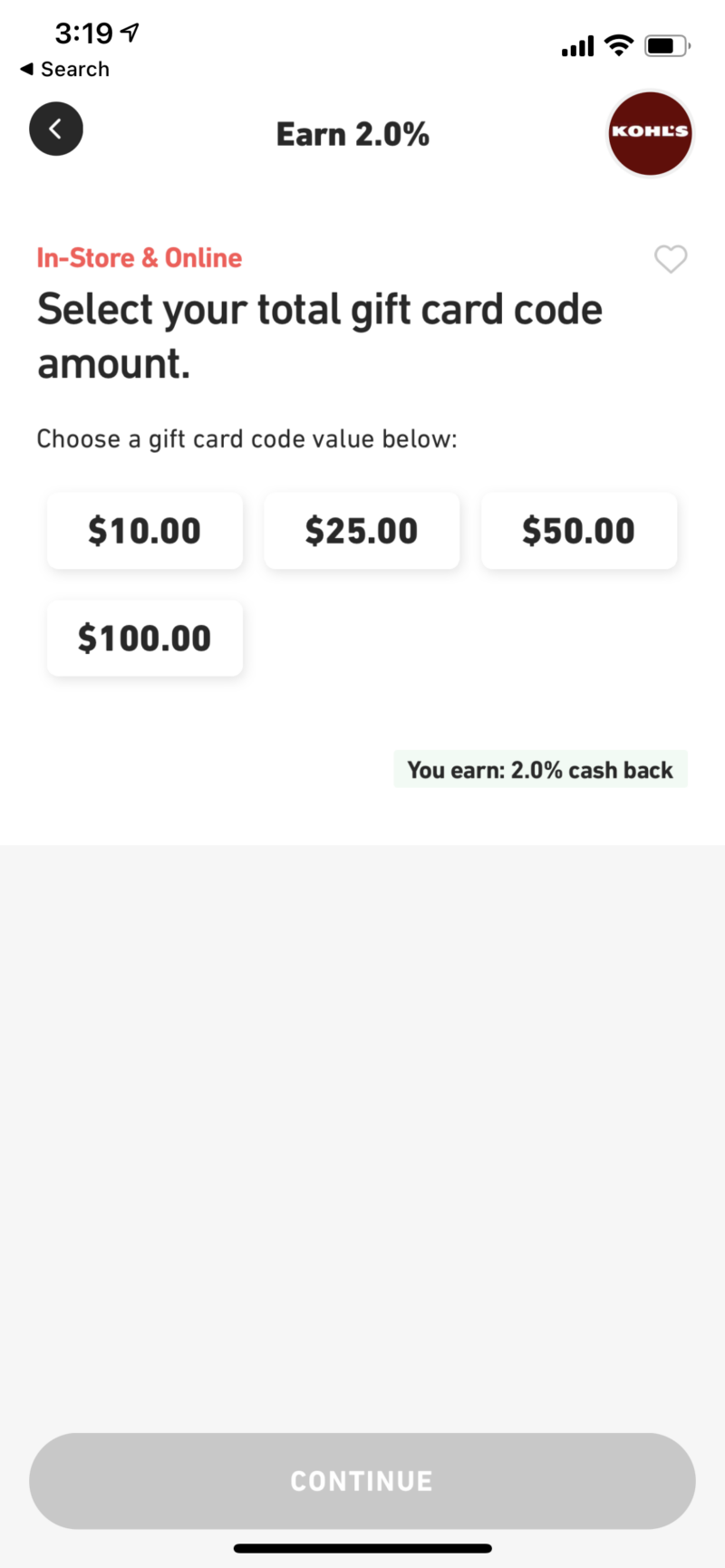

- ➡️ Bought a gift card through FLUZ to get another 2% on – $702.17 = $14.04

- ➡️ Paid with Chase Freedom Unlimited (in the FLUZ) for 1.5% cashback. (I will convert those UR points to my Chase Sapphire Reserve at 50% more for pay yourself back= $15.80

Total Items cost: $702.17

Total “Savings”: $834.38

I essentially got paid $132.21 to combine multiple “Basic Travel Strategies” and savings onto this. With these savings, I will also be donating the money.

Donations for a cause

I donated the items to Brittany Kotarski, who is raising money and collecting donations for local families in Buffalo, NY. This is her second year collecting donations. If you are interested in giving back, you can read more about her story on wgrz’s website here. She is collecting for 15 more days.

Secondly, my friend Sami McKay created D.O. it for Denny- you can follow it on Facebook here. D.O. it for Denny is a kindness initiative to pass along kindness to everyone. Sami is also a member of our insiders’ Facebook group and over time has utilized some of our Basic Travel strategies to save money. Her latest trick was a recent shopping trip she utilized a few different Target promotions to save almost $100! Let’s break it down:

Total order should have been $202.43

- Did one transaction for over $100 to get $25 off the purchase. Also shopped sale items

- The second transaction got $10 off of a $50 purchase. Also used a 20% off coupon in the Target Circle Coupon.

- Used a gift card of $17.26, then used the red card on the remaining balance to get another 5% off

Total out of pocket cost: $107.26

It is awesome to be able to utilize these different strategies to save money on not just travel, but other purchases in life too! I love even more to utilize these amazing savings to donate to people/organizations that have so much good in their hearts and want to give back.

You can venmo either of these ladies at the below venmo usernames to donate to either cause.

- Brittany: Brittany-Kotarski-1

- Sami: Sami-mckay

How you can save money and give back

This is just one example of how you can utilize combining different credit card cash back opportunities as well as promotions and discounts. We typically always do some sort of research for credit card points when we are looking to make a purchase on something. One of those tricks was last year when Dave had been eyeing up an Air Fryer that he finally managed to score a great deal on by combining these tricks. So let’s get into the step by step of how to utilize these tricks.

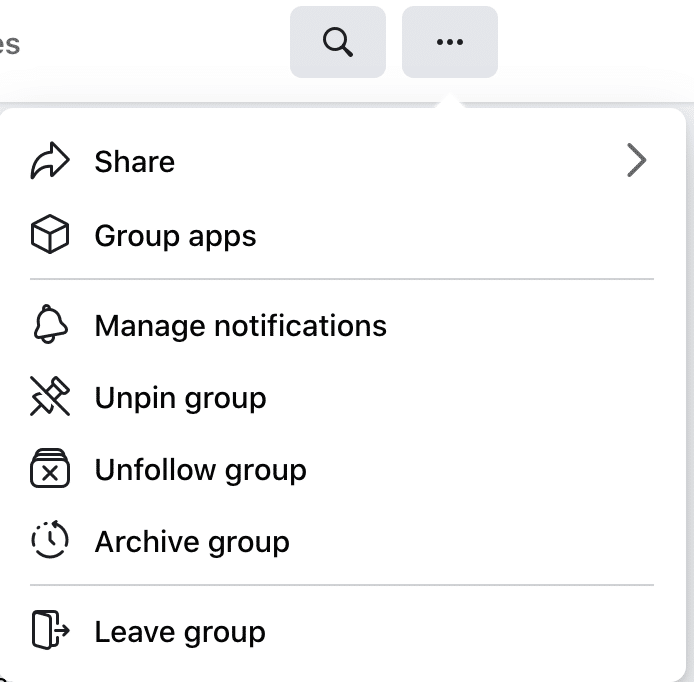

Step 1: Join our FB group.

Seriously, join our Facebook Group. If you haven’t already, we are always posting random deals to save money and learn how to travel strategically with our proven ways. These include our Top Credit Card Bonuses and Top Bank Account Bonuses when there are new offers. These are our #1 tricks utilized in the Basic Travel world. We even post random ‘freebies’ or when items are on sale- like a bunch of Amazon Prime day deals and other great discounts. Make sure you turn on notifications to see all posts in your feed! Sometimes deals we post are limited so you want to be sure to see them first.

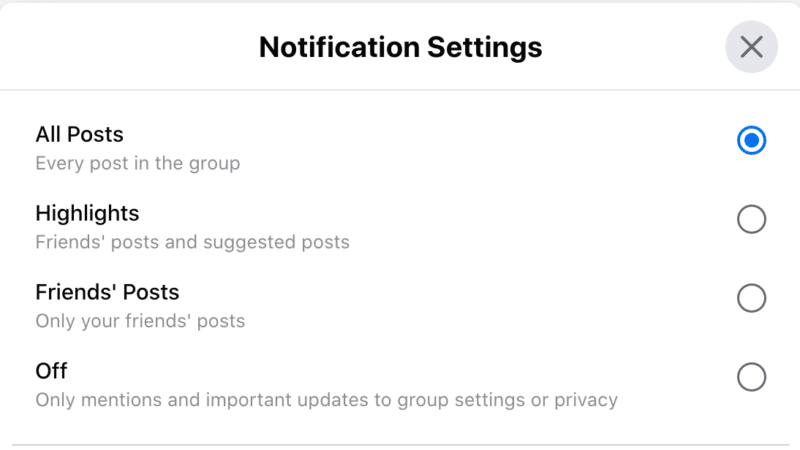

To turn on notifications: Click the 3 dots in the top right hand corner, then click Manage Notifications

Click the circle that says “All Posts” and click save

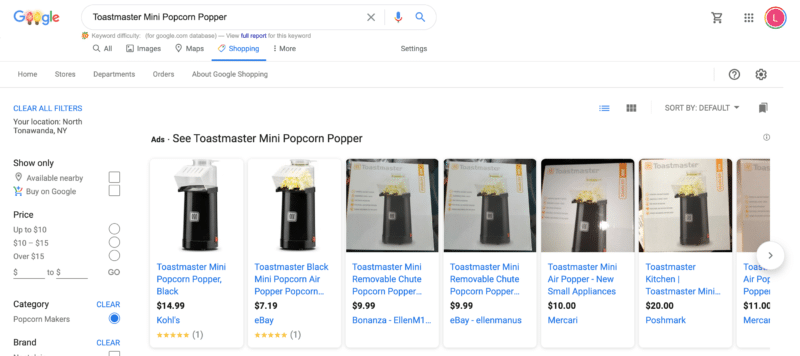

Step 2: Quick Google Shopping Search

Okay so now let’s say you have a specific item in mind that you want to Basic Travel your way into saving money. I am going to use one item from the above deal as an example. These steps will essentially work for any item you are looking for. We did this with the Air Fryer Purchase to combine a few different deals. So you have your item in mind.

What I usually do first is give a quick google search and then click ‘shopping’ to see who might have the lowest price. (This might not have been the best example as I see a ton of people have re-listed on re-selling websites such as Mercari, eBay, Poshmark, and so on.) Anyway, usually, you’d see like Kohls, Target, Walmart, and all the big-name retailers.

Step 3: Check for Discounts

Usually, Walmart and Target do not have too many deals and discounts, unless you are using something like the Target Red Card for 5% off. Check to see who has any discounts going on. For this purchase, when you clicked on each item it said below the item “Kohl’s Rebate Offer.” Kind of where it says “Earn 5% in Kohl’s Rewards Today” on the below photo. So I knew even though it might have been cheaper on eBay or Mercari, getting a $14 off rebate would have saved more in the long run. If you can’t find a rebate, check for any percent off coupons. This is also just another google search- “Kohl’s coupon codes”. Sometimes Kohl’s even has banner coupons right on their website you can utilize. In this example, you can see there is 25% off using FAMILYSAVE.

Step 4: Extra Rewards with loyalty programs

A lot of retailers are now offering “loyalty programs” where they give you perks for spending more money with them. I’ll briefly talk about a few top ones.

Kohl’s Cash

Kohl’s has a great rewards program, such as Kohl’s Cash. You can earn $10 for every $50 you spend. This rebate is given in your account and you have a certain redemption period. You can learn more about Kohl’s Cash here.

Target Circle

Joining Target Circle earns you 1% when you shop utilizing the Target Circle Account. You can learn more about Target Circle Here. You can also maximize the value by getting a Target Red Card (Debit or Credit card) to get 5% savings. Target circle also offers different coupons and deals within the app or online.

Bed Bath & Beyond PLUS

This is a paid membership that enables you to get a 20% discount on all items, plus free shipping. Membership costs $29 for the entire year and you can learn more about it here.

My favorite that I utilize is Kohl’s cash, but each program has its own benefits depending on what you are shopping for.

Step 5: Cash Back Websites

Anytime you make an online purchase, you should ALWAYS go through a cash back portal. We have a pretty extensive breakdown of Cash Back Portals here, but I will name a top few that we use.

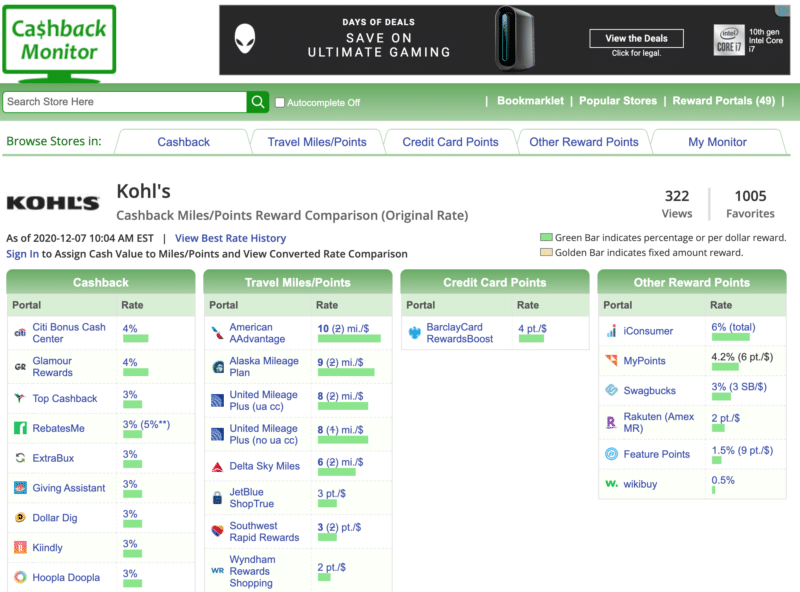

I always like to use cashbackmonitor.com to find out which cash back option has the best offer. Then I click through that website and get the rebate.

Step 6: Double Dip on the Cash back with FLUZ

Fluz is awesome because you essentially are buying a gift card for whatever store you are shopping at. So when you cash out, you can still utilize the above rebates, but get an extra % cash back by taking one extra step to get that gift card. For this scenario, Kohl’s has 2% back on Fluz. If you don’t have a Fluz account yet- download it NOW! Seriously. Use our referral link and once you make your first purchase- we both get three 35% off vouchers! The coupons are limited to $10, but I love using these at Starbucks and then uploading them to my Starbucks app.

Anyway, Fluz gave me another 2% back on my Kohl’s Purchase.

Step 7: Cashing out with Cash Back Cards

Before you buy that gift card from Fluz, check to see if you have any cards you are trying to meet a minimum spend on. This is great to utilize points for your purchases! If not, I would recommend a great cash back card like Chase Freedom Unlimited Or Chase Ink Business Unlimited to get more than 1% on your purchases. You can also check out all of our Top Cash Back credit card offers here to see which card will give you the best value.

Chase Ink Business Unlimited® Credit Card

Chase Ink Business Unlimited® Credit Card

Basic Review

This might seem like a lot of steps, but it really doesn’t take me much longer to add in a few extra key points to maximize my cash back for items I am purchasing. My example is probably one of the best redemptions that I’ve done and there is a variety of ways to make it work for what you are purchasing. There is always a way to get discounts on items you are looking at purchasing. Let us know any cash back or shopping tips you might have or if I missed something. I hope these tips and tricks can help you save some money this holiday season, and maybe save enough to give back.