The Chase Freedom Flex is a great card to have in your purse, wallet, or BASIC binder clip when heading out for a number of reasons including 7,500 Chase Ultimate Rewards bonus points every 3 months! We absolutely love those Chase Ultimate Rewards bonus points as there is SO much you can do with them! Luckily the Chase Freedom Flex Quarterly challenge gets you 5 TIMES bonus points each Quarter!

First the Basics

We love the Chase Freedom Flex card that was introduced in late 2020. It was a bit of an upgrade from the old Chase Freedom card. Still utilizing the 5% quarterly categories, you can also earn 5% on travel purchased through chase as well as 3% on dining and drugstores.

Chase Freedom Flex℠

No Annual Fee

Earn Cash Back

Cash Back Calendar

The 5% Categories are what get me excited in the Basic Travel Household. Every three months, the Chase Freedom Categories for 5% Cashback rotate and reset. For example, from April 1st through June 30th, I was able to earn 5% Cashback on up to $1,500 in purchases through Grocery Stores and Home Improvement Stores.

The 5% Cashback works out to be $75 if I max the $1,500 quarter. If I max out all four quarters that equals $300! This is a great return on purchases that I’m already going to need.

Chase Freedom Flex℠

What makes me really excited about this card and the Quarterly Challenge Promotion!

If you concurrently have opened a Chase Sapphire Preferred Card or Chase Freedom Reserve Card along with the Chase Freedom Flex it is possible to transfer points. In doing so, that $75 Cashback for the quarter or $300 for the year turns into 7,500 Chase Ultimate Rewards Points for the quarter and 30,000 Chase Ultimate Rewards Points for the year! You could also cash these points out with Chase’s Pay Yourself Back Promotion, set to expire September 30th, 2021.

Be sure to check out the different Quarterly Challenge Promotions!

- Chase Freedom Quarter 1 Promotion

- Chase Freedom Quarter 2 Promotion

- Chase Freedom Quarter 3 Promotion

- Chase Freedom Quarter 4 Promotion

Here are some fun examples of what I could do with 30,000 Chase Ultimate Rewards Points.

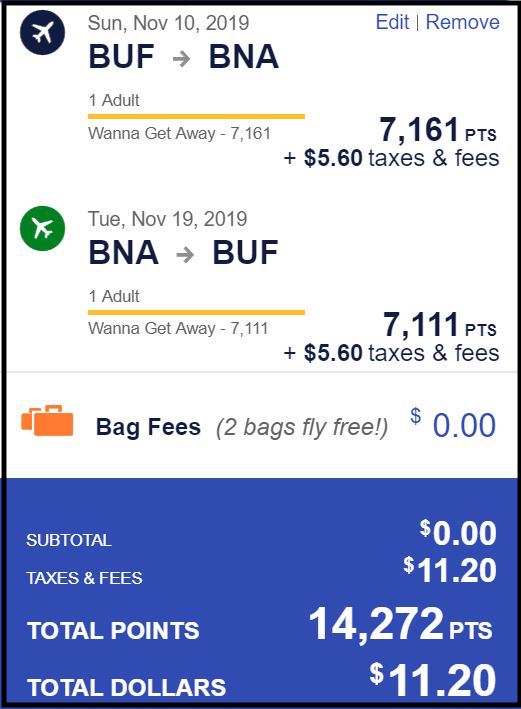

Southwest Airlines is a transfer partner and you can book 2 roundtrip flights to one of my favorite cities in the United States!

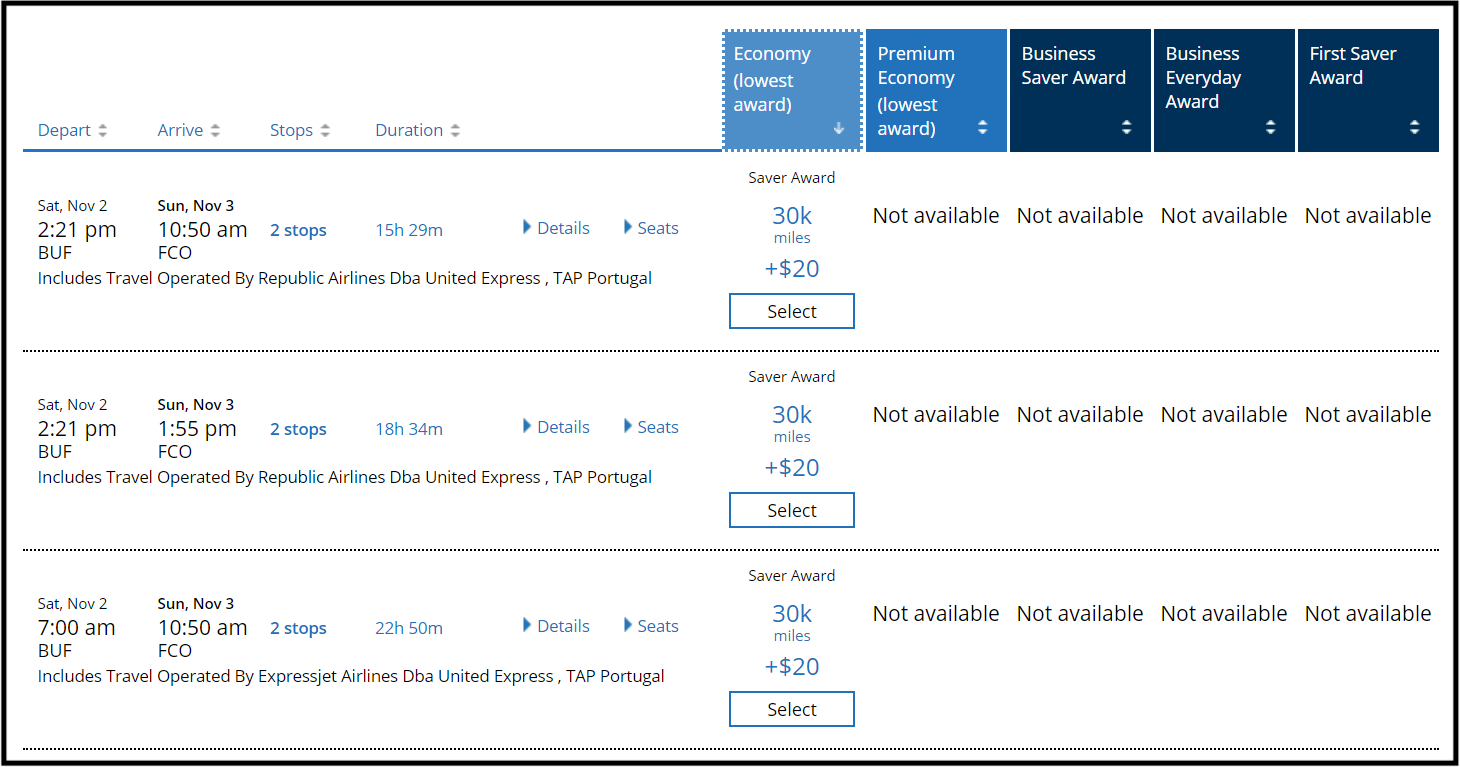

Transfer to United for a one-way flight to Italy!

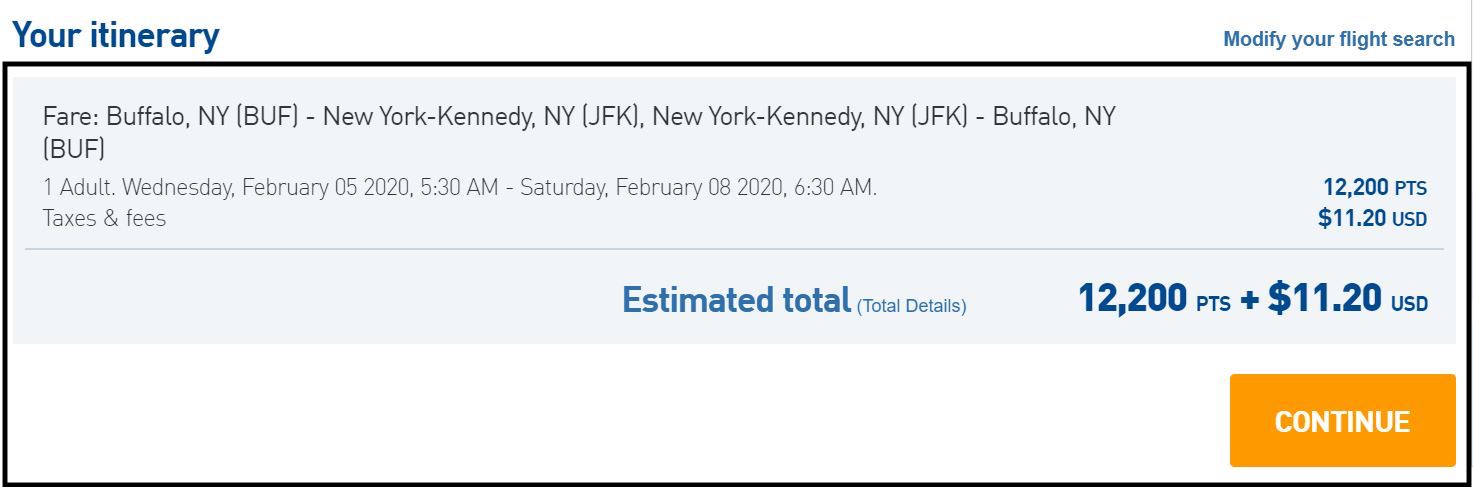

JetBlue can also be transferred to for 2 Roundtrip Flights to New York City

If you decide to open a credit card, we appreciate using our affiliate links! Be sure to check out our Top Credit Card Offers

Which card to get

Only the Chase Freedom Flex will get you the 5x Quarterly spending categories. However, there are a few other offers that will get you the coveted Chase Points! Pick your favorite offer below.

Chase Freedom Flex℠

Final Thoughts

We both LOVE all things Chase! Seriously the points are our favorite award booking points as they are so versatile. You can use the points in the Chase Portal, Transfer them to various travel partners (Like Southwest, United, Jetblue…). You can also use the points for Hotels, Car Rentals, things to do, even cruises!

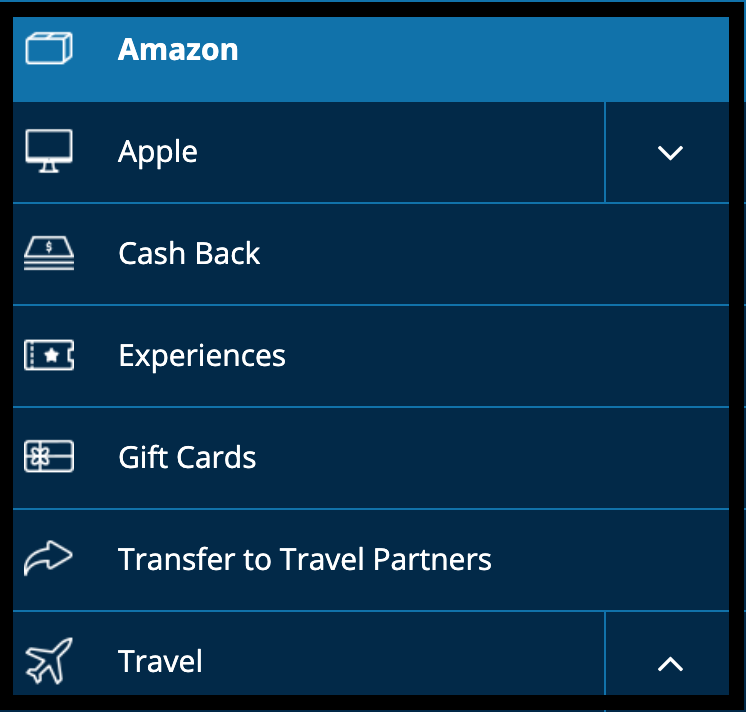

Maybe you don’t like or want to travel? No problem! You can also redeem points for Amazon, Apple, Cashback, Gift cards, and experiences!

Let us know if you have any comments or questions!