In this article, we breakdown the Chase Trip Delay Insurance benefits, with step-by-step instructions to submit a claim should you need to use it. One of any traveler’s biggest fears is that of seeing a lengthy delay or flight cancellation up at the boarding gate. Travel delays happen, especially when you travel often. Buying travel insurance when you book travel is an option to protect yourself. However, if you look In your wallet you might have the same built-in coverage that you would have to pay for out of pocket in your pocket

Benefits of Chase Trip Delay

Recently, I had to travel for work and was the product of flight delays due to mechanical issues, then weather. Luckily, I had booked my flights with my Chase Sapphire Reserve card that provided Trip Delay Insurance. I knew if I was going to be stranded, to make sure I kept receipts and have proper documentation to file a claim with Chase Trip Delay once I had my trip figured out.

Let’s have a quick introduction to the benefit and when it applies.

What is Chase Trip Delay

Chase Trip Delay serves as a way to make your trip delay or cancellation more comfortable. As a cardmember of specific chase-branded cards, Chase will reimburse reasonable expenses up to a certain extent. Typically these protections are available on higher annual fee cards.

Who can use the benefit

This benefit is available to the cardmember, card member’s spouse or domestic partner, as well as dependent children under the age of 22. Each ticketed member of the flight itinerary that was booked with your Chase card, can claim up to $500. If you are the cardholder and bringing your spouse and a child, this would entitle you to up to $1500 in benefits. Charges covered can include hotels, meals, toiletries, and other reasonable expenses.

All Chase Sapphire Reserve or Chase Sapphire Preferred Card cardholders are automatically eligible for coverage, without any additional cost. The only requirement is that you need to pay for your travel expenses with your Sapphire Reserve or Preferred Card and then submit a claim when the occasion warrants it. The submission process is quick, but you will need to provide proof that a covered event has occurred in order to be reimbursed. Call the Chase Benefits Line to double-check if the agent feels like your situation warrants a submission.

Chase Sapphire Reserve®

When does this benefit kick in?

Trip Delay reimbursement will kick in after a certain time frame for covered hazards. Note that it does NOT cover a delay due to a covered hazard that was made public or know to you prior to your departure. Depending on which Chase Sapphire card you have will determine the amount of time for the coverage to kick in. In both cases, if the delay leads to an overnight accommodation requirement then it kicks in regardless. The time frame for each card is:

- Chase Sapphire Reserve: 6 Hours or more

- Chase Sapphire Preferred: 12 Hours or more

Also, note that any pre-paid expenses related to the trip are not eligible to be reimbursed. This includes tours or activities. For this case, we would recommend using trip insurance, such as World Nomads.

For more detailed information on the Chase Trip Delay Reimbursement visit HERE to download the complete guide to benefits.

Chase Trip Delay Submission Breakdown

Let’s walk through the process, step by step! First, you will need your Chase Sapphire Reserve or Preferred handy, as you will need to enter your account number. You will need to visit the website eclaimsline.com to start this process

Step 1

Once you go to the website, you will click on ‘New Claim’

Step 2

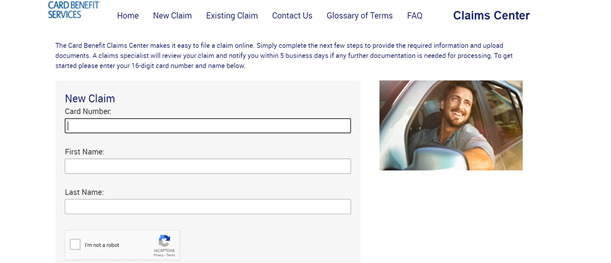

To validate you as an active cardmember, you will need your Chase Sapphire card used with the booking. Here you will enter your credit card number, as well as your first and last name.

Step 3

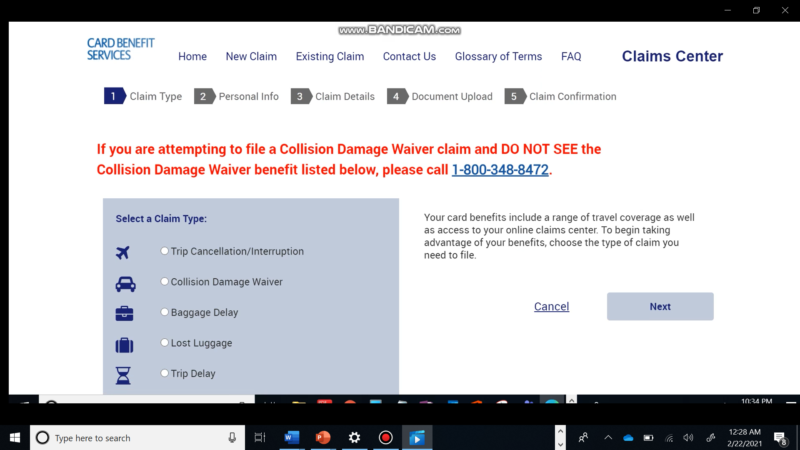

At this point you will need to select the type of claim you are going to file. You are going to choose ‘Trip Delay” for a delay of a trip. Trip cancellation/Interruption, Baggage Delay, Lost Luggage and Collision Damage Waiver can also be claimed through the process. However, the terms and conditions will vary for each claim type.

Step 4

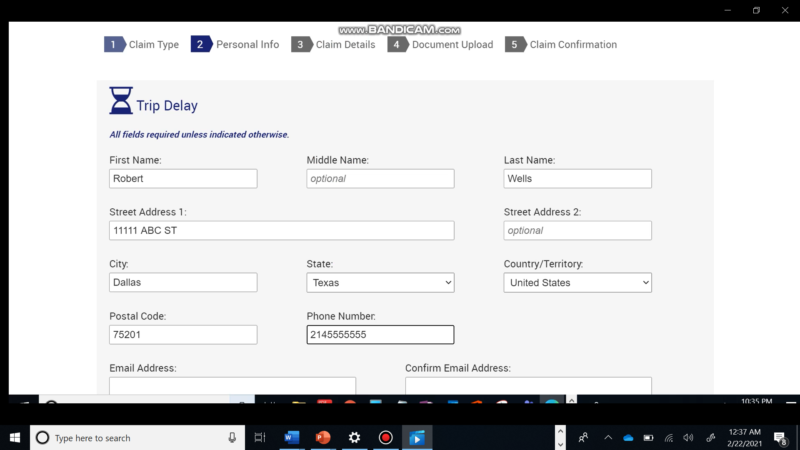

Follow the prompts to enter your information related to you. This includes your name and address for verification

Step 5

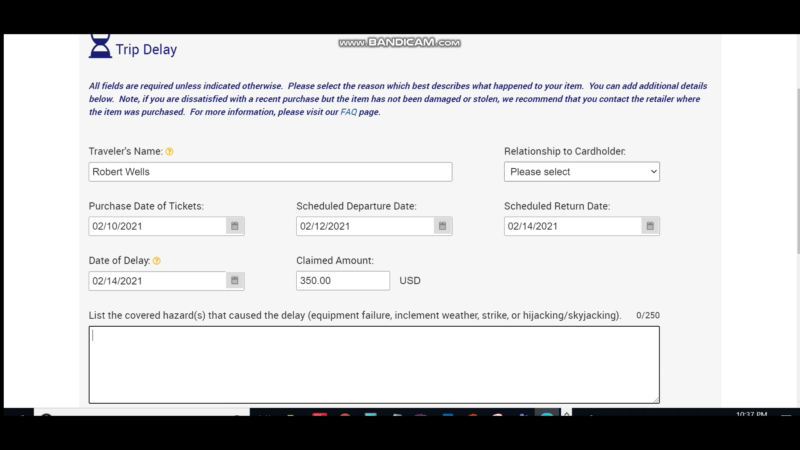

The first part of the next section is related to the trip itself and requires details on how you booked the trip and the dates. You will also need to total up all of your receipts so that you can enter a total claim amount. By the way, if you are not the one who is the cardholder entering the claim, you will need to write it in the “Relationship to Cardholder” section.

Step 6

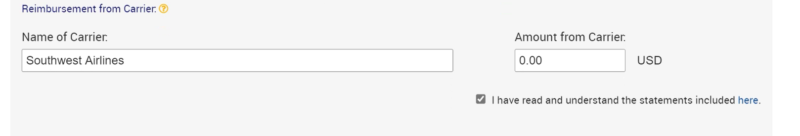

The bottom of this section is related to any carrier-supplied reimbursement. If your trip delay was mechanical and the airline provided certain accommodation or food vouchers, you would include this here. This benefit is labeled as secondary, which means Chase will only reimburse you in excess of what was supplied by the airline up to a limit. If nothing was provided, just type your airline name and “$0.00”

Step 7

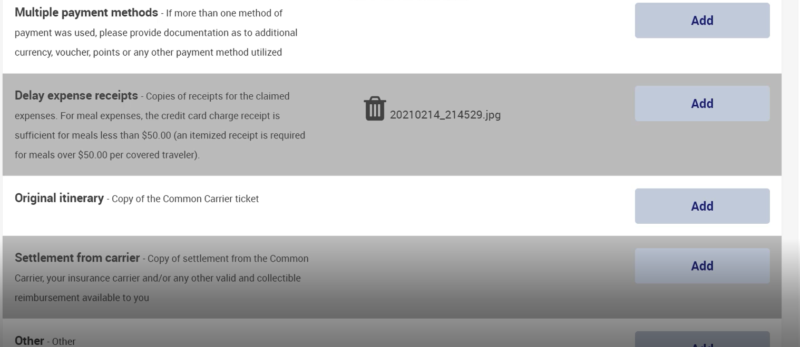

The final section of the Chase Trip Delay claim is where you will upload any documents and proof of the delay. Make sure you keep all receipts handy from the trip. Also, be sure to take pictures and/or screenshots of everything. If the claims team needs further verification, you will want to make sure you have it.

One note on the proof of the delay from the common carrier, you can use a screenshot of the delay or cancellation in the airline app. However, it is best practice to obtain an official statement from the airline. You can get this by contacting the customer service team for your carrier and asking for insurance proof of the delay.

That’s it! It is really a pretty simple process if you have all your receipts and proof organized. Now, you wait for a claims specialist to contact you for more information. This has varied waiting times and results, but the end-to-end process seems to be about 30 days.

Basic Breakdown

A trip delay is something no traveler wishes for on their journey. This can take an otherwise routine trip and make it much longer than it needs to be. Luckily, with several of these high-end annual fee cards, you have the security of knowing that at least if this must happen you won’t be any money out of pocket.

Have you ever used the Chase Trip Delay Insurance benefit before? Tell us about it in the comments below, or our 4,800+ Member Basic Travel Facebook Group!