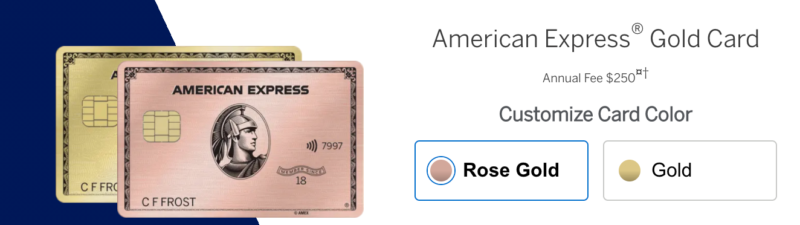

The American Express® Gold Card has been a fan favorite in my basic household for years! It sets the bar high as an everyday use card with elevated bonus categories on purchases at restaurants and U.S. Supermarkets. If you’re lucky, you can even get your hands on the rare Rose Gold Metal Card which makes an appearance once in a blue moon. Learn more about why I love the Amex Gold Card below!

5 Reasons Why I Love the Amex Gold Card

Reason 1: A Metal Rose Gold

I can’t write about the Amex Gold Card without mentioning the unique card design. The Amex Rose Gold is a unique rose gold design and is typically hard to get. Back in 2019, the only way to get one was by referral. For a limited time, Amex has opened up the sleek Rose Gold metal design to everyone!

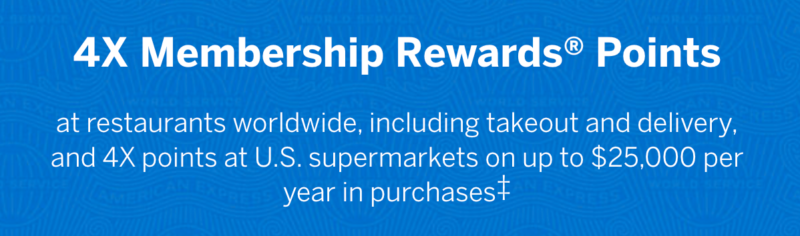

Reason 2: 4X on Food

In the American Express card world, the Amex Gold sets the bar for ROS (return on spend). Earning 4X on Restaurants worldwide and 4X on groceries at U.S. Supermarkets (on up to $25,000 in purchases per year, then 1x) is the primary benefit that makes this card stand out from the rest. The average family spends close to $1,000 per month on food. Multiply that times 12 months and you’ve got 48,000 Membership Rewards Points!

Reason 3: up to $240 in Credits! (Enrollment Required)

A unique perk of the Amex Gold Card is the monthly credits that cardholders receive. Enrollment is required. The up to $240 in credits are broken down into two categories, Uber and Dining. The credits are distributed in up to $10 increments each month for both categories. What I love about these credits is that they essentially eliminate the $250 Amex Gold Annual Fee. (Rates & Fees). Terms apply. The breakdown is as follows:

- Up to $120 for Uber/Uber Eats- Add your AMEX Gold Card to your Uber account and each month automatically get up to $10 in Uber Cash for Uber Eats or Uber rides in the U.S. totaling up to $120 per year. Enrollment required.

- Up to $120 for Dining at a variety of restaurants including Grubhub. Enroll in the Dining Credits offers to earn up to a $10 monthly statement credit when you pay with your AMEX Gold Card at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, Milk Bar and select Shake Shack locations. Enrollment required.

Reason 4: Huge Welcome Offer

Currently, Amex Gold is offering a welcome bonus for new cardholders who meet the minimum spend. Current offer can be seen below. For reference, you can fly roundtrip in economy from the U.S. to Asia/Africa for between 55,000 and 65,000 ANA Miles. Membership Rewards points can be transferred 1:1 to ANA and a handful of other transfer partners.

Reason 5: Behind the Scenes Benefits

There’s more than meets the eye when it comes to premium cards. Often these benefits are the ones that we don’t think about but are thankful we have when emergencies strike. For example, Extended Warranty and Purchase Protection can save hundreds of dollars if needed. Check out the whole list of benefits below.

Basic Breakdown

I’m a big fan of the Amex ROSE Gold Card and keep it close when I’m heading to any U.S. Supermarkets or out to eat. Given that the card pays for itself with the Uber and Food credits, it’s a no-brainer for me to keep long-term. If you’re considering applying, don’t forget that the Amex Gold is a pay over time card and does not count against the maximum of five personal cards you can have with Amex.

Let us know!

Are you going to grab an Amex Rose Gold?

I’d love to hear in the comments below or over in our 8,700+ Member Basic Travel Facebook Group!

More Basic Reading

- How to Earn Bonus Points and Miles in Q1 of 2021

- Elevated Hilton Honors Offers

- Basic Guide to Chase Ultimate Rewards Points

- Top Travel Credit Card Offers of the Month

- How to book a $4,386 two night stay at Miraval Arizona for $50

- Earn Free Money with these Sofi Bank Promotions!

For rates and fees for American Express cards mentioned in this post, please see the following links: American Express® Gold Card (See Rates & Fees; terms apply);