Welcome to 2021! WE MADE IT “cue the fireworks”. It goes without saying that 2020 was a long, long year and I am certainly looking forward to rebounding over the next 12 months. A new year equates to new opportunities to earn bonus points and miles. I’ll break down how to maximize your earnings all down below in this basic guide!

In this Basic Guide

- Quarter One Spending Promotions

- Targeted Spending Promotions

- Other Spending Promotions

- Annual/Monthly Credits

Quarter One Spending Promotions

Quarter one spending promotions are broken down by bank and credit card categories. These promotions we make sure to max out each and every quarter to earn bonus points and miles when you spend in those categories. Our favorites are the Chase Quarterly Categories where you can get up to an extra $300 per year per card if you max out each category each quarter.

Chase Bank

Chase Freedom & Chase Freedom Flex – Cardholders can earn 5X/5% on up to $1,500 in spend at Wholesale Clubs, on Internet, Cable, & Phone Services, and on Select Streaming Services. Cardholders need to opt-in to this promotion in order to receive bonus points.

Discover Bank

Discover It Cashback – Cardholders can earn 5% on up to $1,500 in spend at Grocery Stores, CVS, and Walgreens. Cardholders do need to activate this promotion via the online banking portal.

US Bank

US Bank Cash+ – Cardholders can earn 5% on up to $2,000 in spend at your chosen category. Cardholders do need to activate this promotion via the online banking portal.

Citi

Citi Dividend – Cardholders can earn 5% on up to $300 earned in cashback in bonus categories per year. The quarter one categories are Amazon and Select Streaming Services. Cardholders do need to activate this promotion via the online banking portal.

Targeted Spending Promotions

Chase

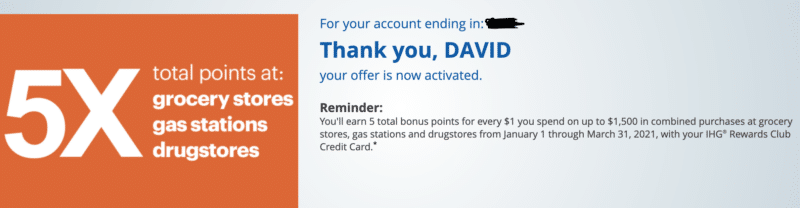

Many co-branded Chase credit cards have been targeted for a 5% bonus earning opportunity for quarter one of 2021. The targeted offers are for 5X/5% on up to $1,500 spent at Grocery Stores, Gas Stations, and Drugstores. To see if your co-branded credit has been targeted, use this link.

Examples of Chase Co-Branded Credit Cards that have been targeted include:

- Southwest

- IHG

- Hyatt

- Marriott

- United

- British Airways

Barclays

Barclays cardholders received targeted emails in November 2020 for a very generous spending offer. Targeted customers have the opportunity to earn up to $600/60,000 Miles via mixed spending.

- 10X on up to $1,000 spend at Grocery Stores

- 50,000 Points/Miles after spending $3,000

This offer ends on January 31st and does not require activation. In our basic household, my Cash Rewards and Lisa’s Arrival Plus card were both targeted for this offer. Many users of the Basic Travel Facebook Group reported that their Wyndham and American Airlines cards were targeted as well.

It’s important to note that this email can be lost easily. I was recently talking to my sister who was debating about product changing her Arrival Plus card and asked if she received the offer. She said no and I suggested that she do an email search. Sure enough, the email was there in her spam folder. That could have been a $600 mistake!

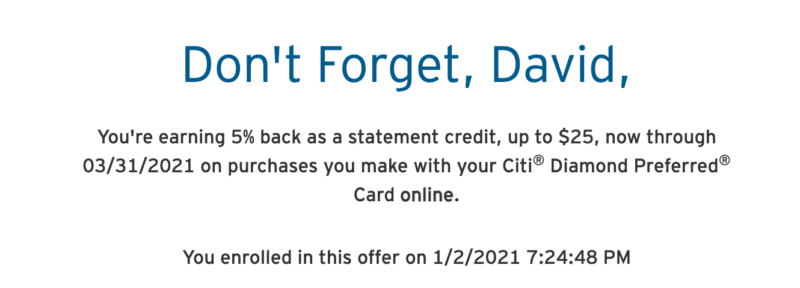

Citi

Citi has been sending out targeted spending offers over the last few months for online purchases. The ones that I have received are to earn 5% cashback on up to $500 spent at an online retailer. I suggest searching through your email (and spam) folder for these offers if you are a Citi credit cardholder.

American Express

The Platinum Card® from American Express holders have received some tremendous spending offers via American Express Offers. Enrollment Required. There have been a wide variety of these offers being sent out and it appears that the users who have been targeted opened the Platinum Card prior to November 1st, 2020. The Amex Offers listed below expire on June 30th, 2021.

- Best Buy (Earn up to $100)

- Avis (Earn up to $150)

- Home Depot (Earn up to $100)

- Insta Card (Earn up to $100)

- Home Chef (Earn up to $150)

Many The Business Platinum® Card from American Express holders have received a bonus spending offer if they opened the card prior to November 1st, 2020. This offer includes 4X bonus Membership Rewards points on up to $20,000 spend on the categories listed below. This spending offer also expires on June 30th, 2021.

- Gas

- Office Supplies

- Advertising

- Shipping

- Wireless

Other Spending Promotions

Chase

Chase Sapphire Cards – The Chase Sapphire Reserve Card card will earn 3X on grocery purchases up to $1,000 spent per month through April 30th, 2021. The Chase Sapphire Preferred Card card will earn 2X on grocery purchases up to $1,000 spent per month through April 30th, 2021.

2021 Credits

- Chase Sapphire Reserve Card

- Doordash – $60 Credit

- Amex Platinum

- Uber/Ubereats – you’ll receive $15 in Uber Cash to use on eligible orders with Uber Eats and rides with Uber in the US every month plus a bonus $20 in December, delivered through an exclusive Uber app experience. That’s up to $200 for Uber orders with Uber Eats and rides with Uber annually.

- PayPal – $30 per month (Ends June 30th, 2021)

- Saks Credits – $50 twice per year. January through June and July through December.

- $200 Airline Incidental Fee

- Terms Apply

- Amex Business Platinum

- Dell Credits – Enroll and get up to $200 in statement credits semi-annually on U.S. purchases with Dell Technologies on the Business Platinum Card through 12/31/24. That’s up to $400 back.

- $200 Airline Incidental Fee

- Terms Apply

- American Express® Gold Card

- $100 Airline Incidental Fee

- Terms Apply

- Amex Hilton Aspire

- $250 Airline Incidental Fee Enrollment Requiredc

- $250 Resort Credit

- Citi Prestige

- $250 Travel Credit *Grocery and Dining charges count towards this credit during covid-19 as a temporary change

Basic Breakdown

When it comes to earning bonus points & miles, spending offers can be a lucrative option for padding your account. I am very much looking forward to planning 2021 travel and will certainly be subsidizing those future trips with the points & miles that I’ll be earning thanks to all of the generous offers I’ve received in 2021.

Let us know!

What is your favorite spending offer so far in 2021?

I’d love to hear in the comments below or over in our 8,400+ Member Basic Travel Facebook Group!

More Basic Reading

- Top Credit Cards of the Month

- Learn how to utilize credit card points with our Basic Travel Course

- How to book an Overwater Bungalow at the Conrad Maldives for cheap!

- Seven Steps to utilize credit card reward points to Save Money

- 16 Side Hustles that can Qualify for a Small Business Credit Card

- Step-by-Step Guide to Completing a Small Business Credit Card Application