Show me the money American Express! Just when you thought that the recent credit card promotions couldn’t get any better, Amex throws some free money in the form of credits to its cardholders. Learn more about the New Amex Offers (Enrollment required) which include a points-earning promotion, and dining & wireless credits on a handful of popular cards.

Appreciation Credits

Amex has been randomly awarding cardholders with a variety of appreciation credits. There doesn’t seem to be any rhyme or reason to these credits that we can deduct. Lisa and I each have many of the same cards, but only Lisa has received these appreciation credits on her cards. Apparently, I’m not appreciated 🙁

Check your email or login to your Amex Account to see if you are appreciated!

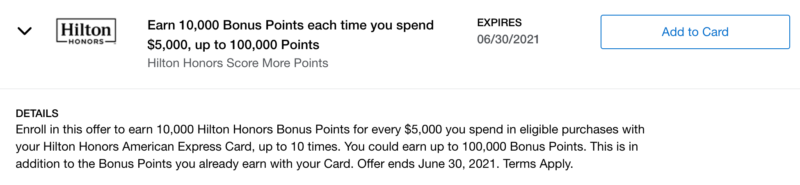

Points Promotions

Amex has targeted many cardholders with a variety of points earning promotions. I was targeted for an offer on my Hilton Honors American Express Surpass® Card. The offer was somewhat hard to find within my Amex offers. I had to click on the offers a few times and scroll down about 30% of the way through my 100 available offers.

There is a similar Amex Points earning Offer on the Marriott Cards

- Earn 7,500 Marriott Points after spending $7,500 on purchases up to 75,000 points earned.

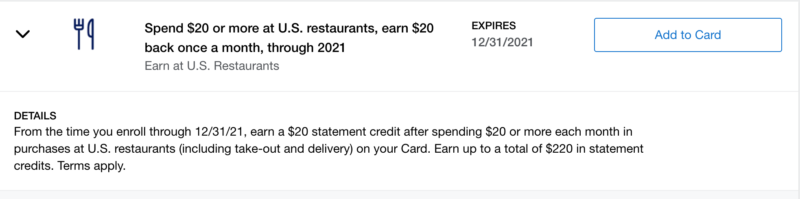

Amex Dining Credits

Check your Amex Offers for targeted Dining Credits. Similar to the points offer above, I had to click around the Amex offers in order to find mine. Depending on the card you have, the offers range from $5 to $20 and can be used every month through December 31st, 2021.

Here are the Amex Dining Credit Data Points (Enrollment Required)

- Hilton Honors American Express Aspire Card – $20 per month

- Delta SkyMiles® Reserve American Express Card – $20 per month

- Marriott Bonvoy Brilliant™ American Express® Card – $20 per month

- Delta SkyMiles® Platinum American Express Card- $15 per month

- Hilton Honors American Express Surpass® Card – $10 per month

- Delta SkyMiles® Gold American Express Card – $10 per month

- Marriott Bonvoy™ American Express® Card – $10 per month

- Hilton Honors American Express Card – $5 per month

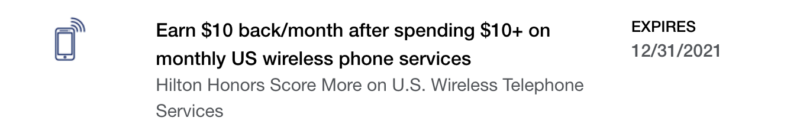

Amex Wireless Credits

Finally, Amex did not forget to show some appreciation to its co-branded business cardholders. If you have The Hilton Honors American Express Business Card, check your offers for a Wireless Credit Promotion. Depending on the card, there may be an offer for $10 to $20 per month. The Amex Wireless Credits can be used each month through December 31st, 2021.

Here are the Amex Wireless Credit Data Points:

- Delta SkyMiles® Reserve Business American Express Card – $20 per month (Enrollment Required)

- Delta SkyMiles® Platinum Business American Express Card- $15 per month (Enrollment Required)

- Delta SkyMiles® Gold Business American Express Card – $10 per month (Enrollment Required)

- Marriott Bonvoy Business™ American Express® Card- $15 per month (Enrollment Required)

- The Hilton Honors American Express Business Card – $10 per month (Enrollment Required)

card_name

card_name

Basic Breakdown

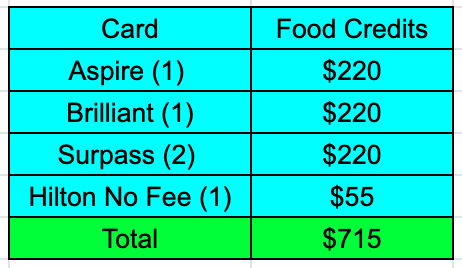

If you know me, you know I’m pumped for these offers. Lisa and I have many of the cards eligible for this promotion and will save a few hundred dollars over the next 11 months using these Amex offers. By my calculation, we have $715 in free food coming our way!

Let us know!

What do you think of the new Amex Offers?

I’d love to hear in the comments below or over in our 8,400+ Member Basic Travel Facebook Group!

More Basic Reading

- Double Dip the CSR DoorDash Credits with Fluz for More Savings!

- How to Earn Bonus Points and Miles in Q1 of 2021

- 2021 Credit Card Strategies and Goals with the Basic Travel Team

- Top Travel Credit Card Offers of the Month

- How to Complete the Atlantic City Status Match – Step by Step

For rates and fees for American Express cards mentioned in this post, please see the following links: Hilton Honors American Express Surpass® Card (See Rates & Fees; terms apply); Hilton Honors American Express Card (See Rates & Fees; terms apply); The Hilton Honors American Express Business Card (See Rates & Fees; terms apply) Marriott Bonvoy Business™ American Express® Card (See Rates & Fees; terms apply);Marriott Bonvoy Brilliant® American Express® Card (See Rates & Fees; terms apply); Delta SkyMiles® Platinum American Express Credit Card (See Rates & Fees; terms apply) Delta SkyMiles® Reserve American Express Card (See Rates & Fees; terms apply); Delta SkyMiles® Gold American Express Card (See Rates & Fees; terms apply)