My new iPhone 12 Pro slipped through my hand down into the floor leaving me with a $597 bill. Accidents happen, no matter how careful we are and often they can be expensive. Thankfully, there are a handful of credit cards that provide insurance for these situations. Learn how to use the Chase Ink Business Preferred Credit Card Cell Phone Protection Benefit in my latest basic breakdown!

How the Chase Ink Business Preferred Cell Phone Protection works

To take advantage of the Chase Ink Business Preferred Cell Phone protection the wireless carrier bill must be paid in full with the card. By doing so, if a phone under the plan is damaged or stolen, it will be covered up to $600 with a $100 deductible. It’s important to note that lost, second-hand, and preowned phones do not qualify for cell phone protection coverage. Only new phones!

The Cell Phone Protection benefit can be used up to three times in a 12-month period. It’s important to note that coverage beings the first day following the cell phone bill being paid with the Chase Ink Business Preferred Credit Card. Finally, if a phone is stolen, a police report must be filed within 48 hours of the occurrence.

Steps to filing a Chase Ink Business Cell Phone Protection Claim

Authorized Repair Center – Important!

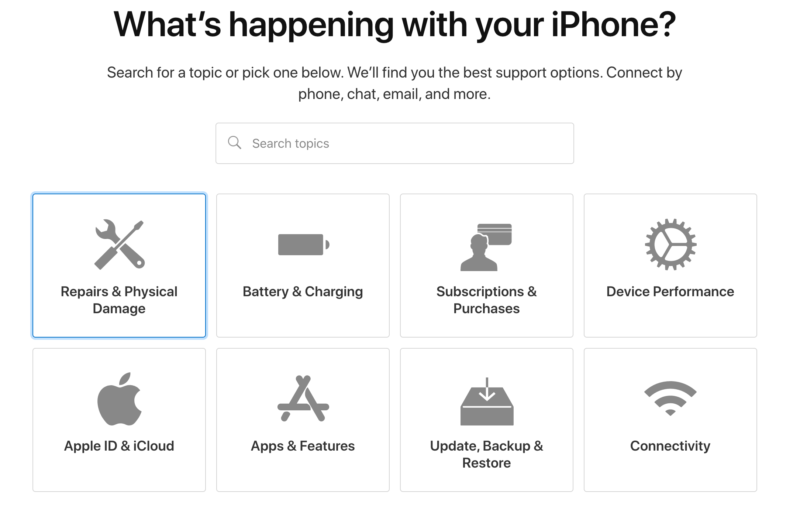

It is important that the device is seen by an authorized repair center. The benefits claim specifically defines an authorized repair center as a facility authorized by the manufacturer to perform repairs on the device(s) or a licensed business that provides a warranty on services provided for repair. For iPhones, simply click through their portal to find one. If you are unsure if the business you are considering having your phone repaired by is authorized, call the claims department directly at 1-888-320-9956.

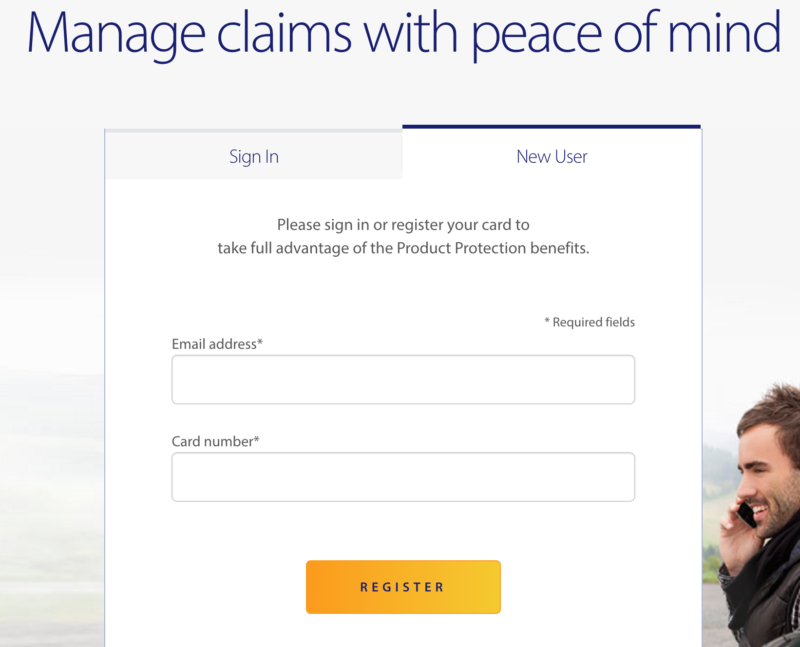

Step 1 – Create an account

There are two ways to file a Chase Ink Business Preferred cell phone claim. First, you can either file a claim over the phone by calling 1-888-320-9956 in the US. Secondly, you can file online via cardbenefitservices.com. To file online, you’ll need to create an account using your email address and Chase Ink Business Preferred Credit Card number. The online option is the best one in my opinion.

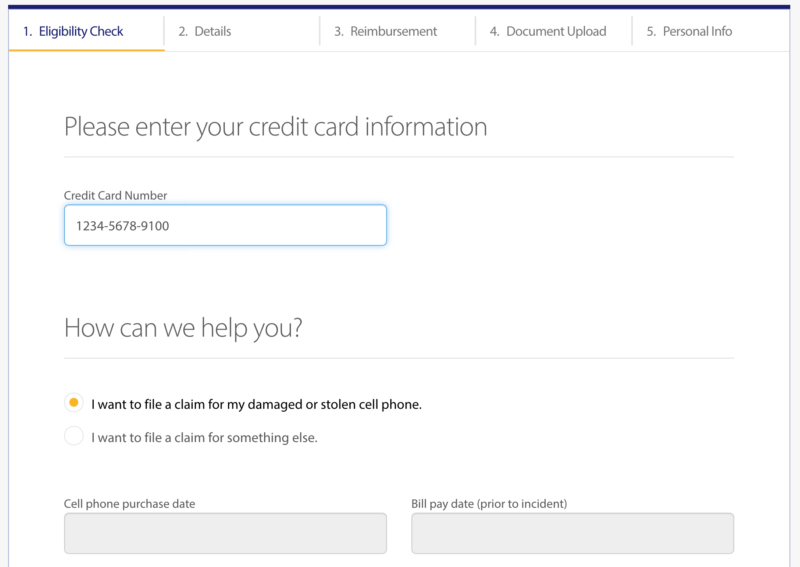

Step 2 – Eligibility Check & Details

The second step is to enter details related to your credit card, cell phone, and wireless carrier. Then select the appropriate bubble indicating that you are filing a cell phone claim. Finally, a narrative of what happened to the phone will be required to move forward.

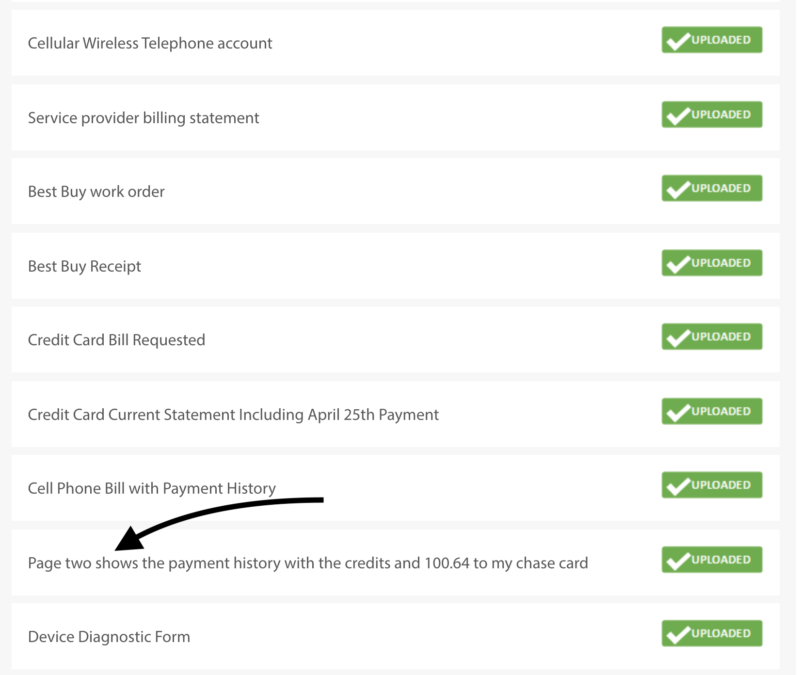

Step 3 – Upload Documents

This is the most time-consuming step of all. A handful of documents need to be uploaded to process a cell phone protection claim. In my experience, I had to upload my cell phone bill multiple times while going back and forth with the claims administrator. The trick I found was actually indicating specifically where the information is found within the uploaded document. See my photo below for my example!

Documents Continued

The device diagnostic form is something that can hang up the claims process. My recommendation is to bring this form with you ahead of time to the authorized repair center and complete it when the phone is being fixed. This will save you both time and multiple trips back to the repair center. The other important documents needed to file a claim are:

- Chase Ink Business Preferred Credit Card Statement

- Download from online banking

- Wireless Cell Phone Bill

- Download from the online wireless portal

- Document showing the phone is linked to you with the cell phone number, serial number, IMEI

- I found this in my wireless online account portal

- Receipt/Work Order from the Authorized Repair Center

- Police Report (Only if the phone was stolen)

Step 4 – Choose how to receive your reimbursement

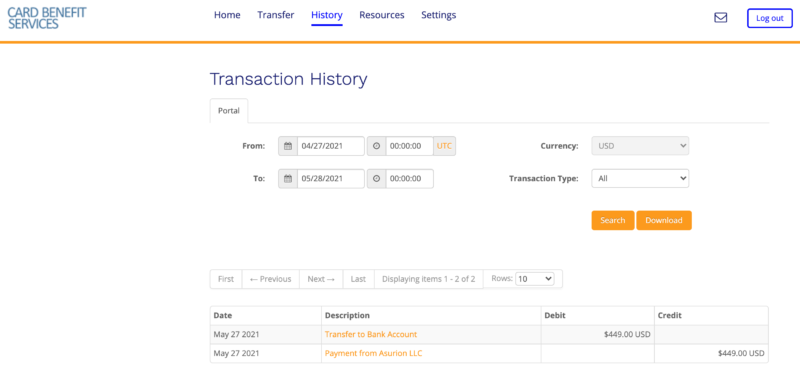

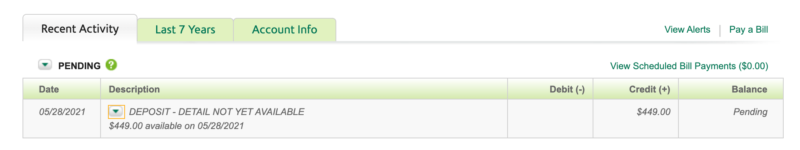

Once the claim is approved you will receive an email noting the decision. In addition, you will receive a link to another portal with a unique username and password. Simply log in and select how you would like to receive the reimbursement. The choices are a mailed check or a direct deposit to any checking account. I opted for the direct deposit which two exactly one day to post to my checking account.

Payment – $597 or $449?

I received a total reimbursement of $449 by using the Chase Ink Business Preferred Cell Phone Protection coverage. However, if you remember from the opening paragraph, the cost to repair my phone was $597. So where did the $148 go? The answer is NY sales tax and the $100 deductible.

Timeline

Here is the timeline from when I broke my phone through being reimbursed. The incident took place on May 16th, 2021 and I was paid out on May 28th, 2021. It took me a total of 12 days to receive my reimbursement which includes a lot of back and forth between the claims department and uploading documents. If you follow the steps above, I’m sure that you could get paid out even quicker!

Bill paid in Full requirement and Amex Wireless Credits?

This is one of the stipulations that I thought I might have got hung up on with my claim. Why was I worried? Well like many folks in the points & miles hobby, we were gifted at the beginning of the year a handful of monthly credits from Amex. One of those credits being a monthly credit towards a wireless bill. We have two cards that qualify for $10 and $15 credits which we have been utilizing. Thankfully paying our wireless bill with those two Amex cards did not disqualify me from utilizing the Cell Phone Protection benefit!

Chase Ink Business Preferred Credit Card

Earn 100,000 bonus points once you spend $15,000 on purchases within the first 3 months from account opening. Learn More Here.

Basic Breakdown

Hopefully, if you are reading this you’ll be able to benefit from some of the things that hung me up in the process of my claim like the device diagnostic form. If you are wondering, yes I am not the proud owner of both a new iPhone and a new iPhone case. Breaking a cell phone stinks but it’s good to know that I am covered. This is another great example of why I love credit cards and how the lesser-known benefits offer huge value!

Let us know!

Have you utilized the Chase Ink Business Preferred Cell Phone Benefit?