The Blue Cash Preferred® Card from American Express is an entry-level premium cash back card. Offering generous cash back rewards on purchases at U.S. grocery stores, subscriptions to select streaming services, charges from U.S. gas stations and on transit. In addition, it’s a great choice for those looking to purchase electronics, furniture, tools and more, thanks to its generous extended warranty benefit.

Basic Review

The Blue Cash Preferred Card offers 3% cash back at U.S. gas stations and 6% cash back at U.S. supermarkets on up to $6,000 in purchases per year. (See Rates & Fees; terms apply) Out of the gate, you can earn $360 per year.

In addition to generous cash back in categories that most families can maximize, the card is one of the least-expensive ways to get access to both Return Protection and Extended Warranty. Return protection provides coverage for items you want to return. An extended Warranty can extend the manufacturer’s warranty on items you purchase using your card by up to one additional year.

This card is a great choice for anyone who buys a lot of groceries and is a strong contender for people who spend heavily in the card’s other bonus cash back categories.

Who Should Consider This Card

Almost anyone who buys groceries should strongly consider this card. The card offers 6% back on the first $6,000 in purchases at U.S. supermarkets per calendar year. If you buy $6,000 or more in groceries during the year, the $360 in cash back you earn from groceries alone will more than offset the card’s annual fee.

In addition, if you make a lot of purchases at gas stations, the Blue Cash Preferred Card is a great choice for its uncapped 3% rewards on purchases at U.S. gas stations.

Finally, take a look at the card’s additional 3% bonus categories. Included are trains, taxicabs, rideshare services, ferries, tolls, parking, buses, and subways. If you spend heavily in these categories, the Blue Cash Preferred card’s uncapped 3% rewards for this spending can increase the amount of cash in your pocket.

Welcome Offer

The Blue Cash Preferred Card from American Express has a great welcome offer below.

Learn More on How to Apply

You can learn more on how to apply for the Blue Cash Preferred Card from American Express from our partner below.

Card Rewards

The Blue Cash Preferred Card from American Express earns cash back rewards. Cash back can be redeemed for a statement credit through your account management portal at americanexpress.com once you accumulate $25 or more in cash back.

The Blue Cash Preferred Card from American Express earns cash back at the following rates:

- 6% cash back on purchases at U.S. supermarkets, up to $6,000 per year

- 6% cash back on select U.S. streaming subscription services

- 3% cash back on transit, including taxis, rideshare, parking, tools, trains, busses, and more

- 3% cash back on gas at U.S. gas stations

- 1% cash back on all other eligible purchases

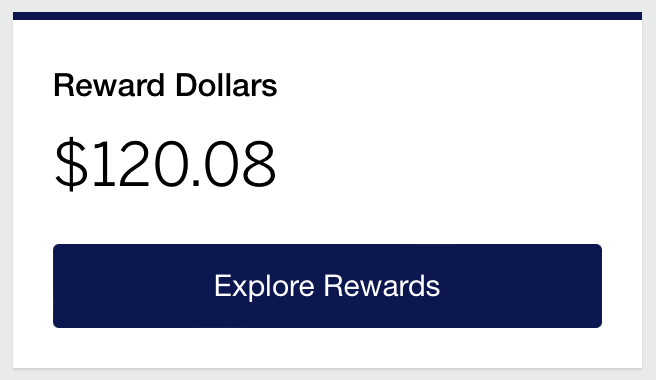

American Express makes it simple to understand how much cash back you’ve earned. You can redeem your cash back rewards from your Blue Cash Preferred card at americanexpress.com. Simply log in and look for the “Reward Dollars” panel and click “Explore Rewards”

To redeem your rewards as a statement credit, just click on “Redeem for Statement Credit.” Note that you must have at least $25 to redeem your rewards for a statement credit.

In addition to making it easy to redeem your cash back rewards, American Express offers a convenient tracker on the same web page to show you how much cash back you have earned this year.

Card Benefits

Extended Warranty

At some point, something you buy will break. You’ll find yourself wishing you had purchased an extended warranty because the manufacturer’s warranty expired last month. In many of these cases, the Extended Warranty benefit offered on the Blue Cash Preferred Card can come to your rescue. An Extended Warranty can cover repair or replacement of purchases that fail up to 1 year after the original manufacturer’s warranty expires.1

To use your Extended Warranty benefit, simply purchase your eligible items using your card. The Extended Warranty benefit extends the manufacturer’s warranty up to one additional year on the original manufacturer’s warranties of five years or less. Extended Warranty covers up to $10,000 per covered purchase and up to $50,000 per year, per eligible card.

Return Protection

Have you ever bought an item and decided that you wanted to return it, only to find out that the store you purchased it from has a restrictive return policy or charges a restocking fee? Return Protection has your back. When you purchase eligible items using your Blue Cash Preferred Card, American Express will refund up to the full purchase price if you choose to return an item and a merchant will not take it back within 90 days.2

Return protection covers eligible purchases, up to $300 per item. The return protection benefit is limited to a maximum of $1,000 per calendar year per card account. Purchase must be made in the U.S. or its territories.

Other Benefits

- $120 Equinox+ Credit – Enroll your card and pay for an Equinox+ membership to receive $10 monthly statement credits.

- Car Rental Loss and Damage Insurance – Use your card to reserve and pay for a car rental and decline the collision damage waiver at the rental company counter and you can be covered for damage to or theft of your rental vehicle.3

- Global Assist Hotline – Get 24/7 emergency assistance and coordination services, including medical and legal referrals, emergency cash wires, and missing luggage assistance whenever you are more than 100 miles away from home.

- American Express Experiences – Get access to exclusive ticket presales and cardmember-only events.

- Amex Send & Split – Split purchases with any other Venmo or PayPal users directly from the Amex app.

- Fraud Protection – You will not be held responsible for fraudulent charges. If you see a charge that is fraudulent, just call American Express at the number on the back of your card.

- Online Account Management – Manage your account online easily at americanexpress.com.

- Year-End Summary – Receive a summary of charges reflecting your entire year’s use of the card. Year-end summaries are typically available in January.

- Pay It – Tap a purchase amount under $100 in the American Express app to quickly make payments throughout the month.

- Plan It – Select purchases of $100 or more and split them up into monthly payments with a fixed monthly fee and no interest charges.

Terms, restrictions and limitations apply to all benefits. Cardmembers are responsible for costs charged by third-party services providers for Global Assistance services.

Basic Tips

Here are some basic tips to help you get the most value out of your Blue Cash Preferred Card from American Express.

Use the cash back tracker to maximize rewards. If you spend more than $6,000 at grocery stores in a year, use the cash back tracker at americanexpress.com to see how much you have spent cumulatively on groceries during the year. Once you have spent $6,000 on groceries during the calendar year, shift your grocery store spending to another card to maximize rewards, such as the Chase Freedom Flex Card.

Purchase electronics, small appliances, furniture, and other items with warranties on this card. American Express offers one of the most generous and hassle-free extended warranty benefits, which is why I purchase all of my electronics and other items with warranties using my Blue Cash Preferred card.

Check for Amex Offers frequently. American Express offers special promotions, discounts, and credits to cardmembers through its Amex Offers program. I’ve personally saved hundreds of dollars using Amex Offers for products and services that I would have purchased anyway. You can find details on all of your targeted Amex Offers when you log in to manage your card on the American Express website.

Annual Fee

The Blue Cash Preferred Card from American Express offers an introductory $0 annual fee for new cardmembers in their first year. After the first year, the card carries an annual fee of $95. (See Rates & Fees; terms apply)

Who can get this card?

American Express limits the number of personal credit cards to 5 per person. Cards with no preset limit, such as the American Express Platinum Card or the American Express Gold® card do not count against this limit.

In addition to limiting the number of cards you can have, American Express limits the number of welcome offers that new cardmembers can receive on any particular card to once per lifetime, so if you’ve had a Blue Cash Preferred card in the past, you may not be eligible for the welcome offer. If you are not eligible for the welcome offer, American Express will notify you during the application process prior to processing your application.

Will you be getting the Blue Cash Preferred Card?

I’d love to hear in the comments below or over in our 8,700+ Member Basic Travel Facebook Group!

New to Credit Card Rewards Points? Check out the BASICS Below!

- Learn how to utilize credit card points with our Basic Travel Course

- Basic Travel 101

- Basic Travel 102

- Credit Scores 101

- Knowing the Rules

- 5/24 Status

- Top Credit Card Offers

- How to Earn Credit Card Bonuses

- Expedited Airport Screening

- Cashback Sites

For rates and fees for American Express cards mentioned in this post, please see the following links: Blue Cash Preferred® Card from American Express (See Rates & Fees; terms apply)

- When an American Express® Card Member charges a Covered Purchase to an Eligible Card, Extended Warranty§ can provide up to one extra year added to the Original Manufacturer’s Warranty. Applies to warranties of five (5) years or less. Coverage is up to the actual amount charged to your Card for the item up to a maximum of $10,000; not to exceed $50,000 per Card Member account per calendar year. Eligibility and Benefit level varies by Card. Terms, Conditions, and Limitations Apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by AMEX Assurance Company.

↩︎ - With Return Protection, you may return eligible purchases to American Express if the seller won’t take them back up to 90 days from the date of purchase. American Express may refund the full purchase price excluding shipping and handling, up to $300 per item, up to a maximum of $1,000 per calendar year per Card account, if you purchased it entirely with your eligible American Express® Card. Purchases must be made in the U.S. or its territories. Eligibility and Benefit level varies by Card. Terms, Conditions, and Limitations Apply. Please visit americanexpress.com/benefitsguide for more details.

↩︎ - Car Rental Loss and Damage Insurance can provide coverage up to $50,000 for theft of or damage to most rental vehicles when you use your eligible Card to reserve and pay for the entire eligible vehicle rental and decline the collision damage waiver or similar option offered by the Commercial Car Rental Company. This product provides secondary coverage and does not include liability coverage. Not all vehicle types or rentals are covered. Geographic restrictions apply. Eligibility and Benefit level varies by Card. Terms, Conditions, and Limitations Apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by AMEX Assurance Company. Car Rental Loss or Damage Coverage is offered through American Express Travel Related Services Company, Inc. ↩︎