Recently the eligibility rules changed for both the Amex and Chase Marriott Bonvoy products. If you’re reading this, you might already have a good understanding that each bank already had a variety of internal rules out there. For example the Chase 5/24 Rule and the Amex 2/90 Rule. It’s important to know the rules ahead of time in order to prevent a wasted hard pull on your credit report for a card that you’re not eligible for. Learn how to know if you’re eligible for Marriott Credit Card in this basic breakdown!

Marriott Credit Cards

It is important to start by noting that Marriott has two different banks that offer co-branded credit cards. Both Chase and American Express have Personal and Small-Business Credit Cards. The breakdown below will provide eligibility information for each bank’s versions of the Marriott Bonvoy Credit Cards.

Chase Bank

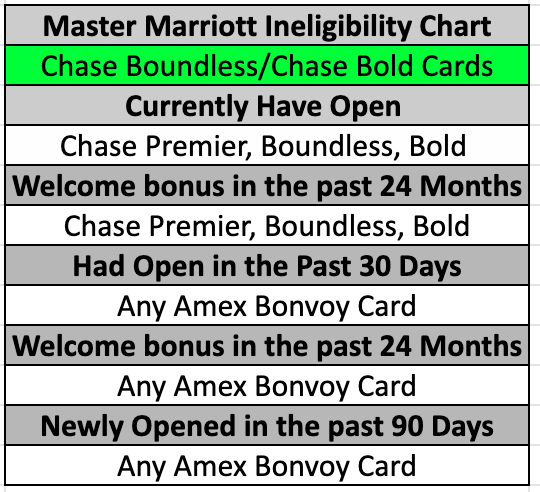

There are two Marriott Co-branded options through Chase Bank. The Marriot Bonvoy Boundless Credit Card and the Marriott Bonvoy Bold® Credit Card. When it comes to eligibility, there are two different categories: Opening the Card & Earning a Welcome Offer. Of course, if you open the card, you’re going to want to ensure that the associated welcome offer will be included.

You are not eligible for either card if you’re a

Current Cardmember of these three cards:

- Marriott Bonvoy Premier credit card (also known as Marriott Rewards Premier)

- Marriott Bonvoy Boundless credit card (also known as Marriott Rewards Premier Plus)

- Marriott Bonvoy Bold® credit card

Previous Cardmember of any of these cards AND received a new cardmember bonus within the last 24 months:

- Marriott Bonvoy Premier credit card (also known as Marriott Rewards Premier)

- Marriott Bonvoy Boundless Credit Card (also known as Marriott Rewards Premier Plus)

- Marriott Bonvoy Bold® credit card

Now that you have determined card eligibility, you must determine if you’re eligible for the welcome offer. Pay special attention to the number of days specified below.

The bonus is not available to you if you:

- Are a current cardmember, or were a previous cardmember within the last 30 days, of a Marriott Bonvoy American Express Card

- Are a current or previous cardmember of either Marriott Bonvoy Business® American Express® Card or Marriott Bonvoy Brilliant American Express Card and received a new cardmember bonus or upgrade bonus in the last 24 months

- Applied and were approved for Marriott Bonvoy Business American Express Card or Marriott Bonvoy Brilliant American Express Card within the last 90 days

Marriott Bonvoy Bold® Credit Card

Marriott Bonvoy Bold® Credit Card

American Express

There are two Marriott Co-branded options through American Express. The Marriott Bonvoy Brilliant® American Express® Card and the Marriott Bonvoy Business™ American Express® Card. When it comes to eligibility, American Express limits folks on earning the welcome offers but will still allow the opening of the card. Pay special attention to the number of days specified below. I’ll break down the eligibility for both the personal and business card options separately below.

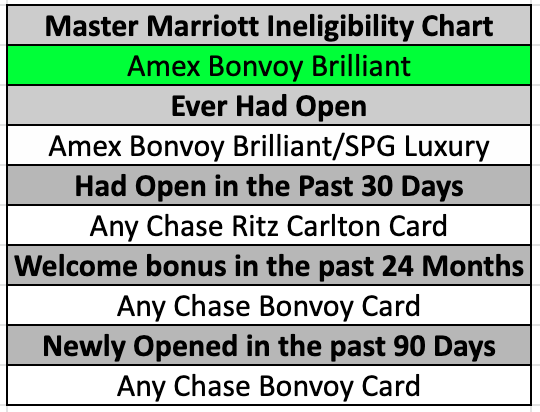

Marriott Bonvoy Brilliant American Express Card

The bonus is not available to you if you:

- Have EVER opened the Marriott Bonvoy Brillian American Express® Card

- Have EVER opened the Starwood Preferred Guest American Express Luxury Card

Had or have these cards in the last 30 days:

- The Chase Ritz-Carlton Credit Card or the Chase Ritz-Carlton Rewards Credit Card

Opened any of these cards in the last 90 days:

- The Marriott Bonvoy Boundless® Credit Card from Chase, the Marriott Rewards Premier Plus Credit Card from Chase, the Marriott Bonvoy Premier Credit Card from Chase, the Marriott Rewards Premier Credit Card from Chase, the Marriott Bonvoy Bold® Credit Card from Chase, the Marriott Bonvoy Premier Plus Business Credit Card from Chase or the Marriott Rewards Premier Plus Business Credit Card from Chase

Received a Welcome Offer or Upgrade Offer in the last 24 Months:

- The Marriott Bonvoy Boundless® Credit Card from Chase, Marriott Rewards Premier Plus Credit Card from Chase, the Marriott Bonvoy Premier Credit Card from Chase, the Marriott Rewards Premier Credit Card from Chase, the Marriott Bonvoy Bold® Credit Card from Chase, the Marriott Bonvoy Premier Plus Business Credit Card from Chase or the Marriott Rewards Premier Plus Business Credit Card from Chase

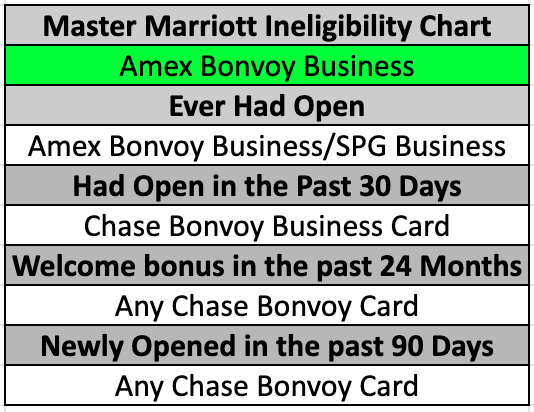

Marriott Bonvoy Business® American Express® Card

The bonus is not available to you if you:

- Have EVER opened the Marriott Bonvoy Business® American Express® Card

- Have EVER opened the Starwood Preferred Guest Business Credit Card

Had or have these cards in the last 30 days:

- Marriott Bonvoy Premier Plus Business Credit Card from Chase, the Marriott Rewards Premier Plus Business Credit Card from Chase, the Marriott Bonvoy Business Credit Card from Chase, or the Marriott Rewards Business Credit Card from Chase

Opened any of these cards in the last 90 days:

- The Marriott Bonvoy Boundless® Credit Card from Chase, the Marriott Rewards Premier Plus Credit Card from Chase, the Marriott Bonvoy Bold® Credit Card from Chase, the Marriott Bonvoy Premier Credit Card from Chase or the Marriott Reward Premier Credit Card from Chase

Received a Welcome Offer or Upgrade Offer in the last 24 Months:

- The Marriott Bonvoy Boundless® Credit Card from Chase, the Marriott Rewards Premier Plus Credit Card from Chase, the Marriott Bonvoy Bold® Credit Card from Chase, the Marriott Bonvoy Premier Plus Credit Card from Chase or the Marriott Rewards Premier Credit Card from Chase

Basic Breakdown

As you can see there are many disqualifiers when it comes to being eligible for a Marriott Bonvoy Credit Card. Despite the challenging eligibility factors, the Bonvoy cards due carry some fantastic value for folks looking for a major hotel credit card. I’ve carried Marriott Credit Cards for years and especially love getting great value out of the annual free night certificates, like staying at the JW Marriott during the Chicago Marathon. Hopefully, you’ll be able to navigate the qualifiers above to see if you’re eligible and always feel free to reach out if you have any questions!

Do you have any questions about the Marriott Bonvoy Credit Card Eligibility Rules?

More Basic Reading

- Basic Guide to Marriott Bonvoy Status

- Basic Guide to Earning Marriott Bonvoy Points

- Basic Guide to Redeeming Marriott Bonvoy Points

- Top 5 Aspirational Marriott Properties in the World for Points Redemptions

- How to Combine Marriott Bonvoy Points between Accounts

For rates and fees for American Express cards mentioned in this post, please see the following links: Marriott Bonvoy Business™ American Express® Card (See Rates & Fees; terms apply);Marriott Bonvoy Brilliant® American Express® Card (See Rates & Fees; terms apply);