Amex Membership Rewards (MR) points are one of the top transferrable points currencies in the credit card rewards world. The MR points provide many options for redemptions across a variety of airlines, hotels, and a travel portal. Additionally, there are a handful of Credit Cards that can collectively be used together in order to maximize return on spending (ROS) and earn MR points. Learn more in our basic guide to Amex Membership Rewards points!

In this Basic Guide

- What are Membership Rewards Points

- Transferrable Award Currency

- How to Earn Membership Rewards Points

- Welcome Offers

- Spending Options

- Refer-a-friend

- How to Redeem Membership Rewards Points

- Travel Partners

- Travel Portal

- Statement Credit

- Invest with Schwab

- Pay With Points

- Basic Breakdown

What are Membership Rewards Points

A Membership Rewards (MR) Point is a form of award currency earned in a variety of ways. The most common being from American Express Branded Cards. The base value of an MR Point is between .06 to 1 cent. However, points are worth more when they are redeemed through the Amex Travel Portal with The Business Platinum Card® from American Express or transferred to a handful of partners. We will dig deeper into this below.

Transferrable Award Currency

One important distinction of MR points is that they are a transferable award currency. Basically, this means that the points are not locked into a specific use. For example, a co-branded credit card like one of the Hilton Honors Credit Cards can only earn points that can be redeemed at Hilton Hotels. Since MR points are transferrable, the options for redemption increase tenfold.

How to Earn Membership Rewards

Welcome Offers

The primary way to earn Membership Rewards points is via one or more of the Amex Membership Rewards Card options. All of the cards that earn MR points come with a welcome spending offer which can generate large sum points from meeting an initial minimum spending requirement. Over a period of time, it’s possible to open a handful of MR in order to accrue a large sum of points for an amazing redemption!

Cards that earn Membership Rewards Points

| American Express Personal Cards | American Express Business Cards |

| The Platinum Card® from American Express | The Business Platinum® Card from American Express |

| The American Express Platinum Card® for Schwab | American Express® Business Gold Card |

| The Platinum Card® from American Express Exclusively for Morgan Stanly | Business Green Rewards Card from American Express |

| American Express® Gold Card | The Blue Business® Plus Credit Card from American Express |

| American Express® Green Card | |

| Amex EveryDay® Preferred Credit Card | |

| Amex EveryDay® Credit Card |

Spending Options

In addition to the welcome offers, the Amex MR earning cards often run a variety of regular and targeted spending promotions for bonus points. For example, the American Express® Gold Card earns 4X MR Points at U.S. supermarkets up to $25,000 in spend per calendar year, 1x per dollar after. Terms Apply. That amounts to up to an additional 100,000 MR points annually from groceries.

Refer-a-friend

Another option for earning MR points is through the refer-a-friend program. Current Amex cardholders are typically able to refer friends and family members to open a card and earn a Referral Offer for each approved referral. The referral offer does vary depending on the card being referred. You can find these referral offers by logging into your Amex Online Banking account and clicking Refer-A-Friend at the bottom of the screen.

Basic Recap on Earning MR Points – Credit Card Welcome Offers, Targeted & Standard Spending Promotions, and the Refer-a-friend program.

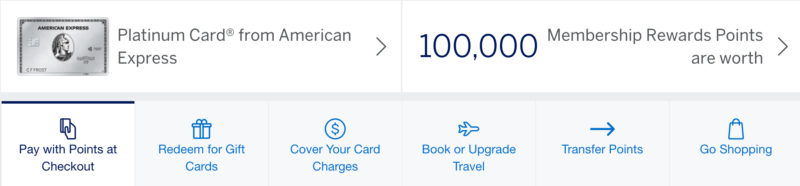

How to Redeem Membership Rewards Points

There are a handful of options when it comes to redeeming Amex Membership Rewards points. The value of the redemption certainly varies depending on how the points are redeemed with the largest value coming from utilizing the transfer partners.

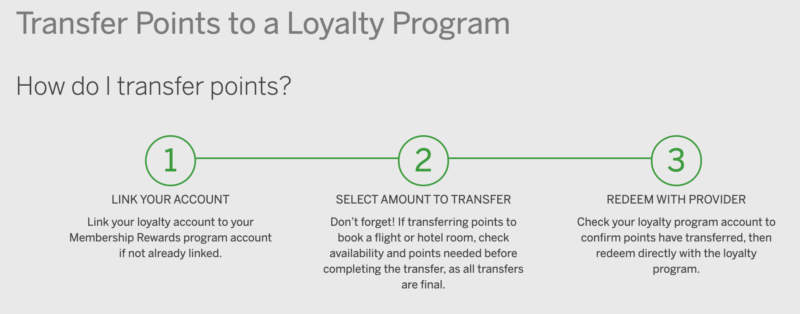

Travel Partners

Amex partners with 21 different airlines and hotels that allow the conversion of Membership Rewards points. All of the options listed below are mostly a one-to-one transfer ratio unless noted otherwise. For example, one Membership Rewards point equals one Delta Airlines SkyMile.

Membership Rewards Airline & Hotel Transfer Partners

| Amex Transfer Partner | Minimum Transfer | Ratio | Transfer Time |

| AeroMexico (Airline) | 1,000 | 1:1.6 | 2-12 Days |

| Air Canada (Airline) | 1,000 | 1:1 | Instant |

| Alitalia (Airline) | 1,000 | 1:1 | Instant |

| Aer Lingus (Airline) | 1,000 | 1:1 | Instant |

| ANA (Airline) | 1,000 | 1:1 | 3 Days |

| Avianca LifeMiles (Airline) | 1,000 | 1:1 | Instant |

| British Airways (Airline) | 1,000 | 1:1 | Instant |

| Cathay Pacific (Airline) | 1,000 | 1:1 | Average 1 Week |

| Choice Privileges (Hotel) | 1,000 | 1:1 | Instant |

| Delta (Airline) | 1,000 | 1:1 | Instant |

| Emirates (Airline) | 1,000 | 1:1 | Instant |

| Etihad (Airline) | 1,000 | 1:1 | Instant |

| FlyingBlue/AirFrance/KLM (Airline) | 1,000 | 1:1 | Instant |

| Hawaiian (Airline) | 1,000 | 1:1 | Instant |

| Hilton (Hotel) | 1,000 | 1:2 | Instant |

| Iberia (Airline) | 1,000 | 1:1 | 1-2 Days |

| Jetblue (Airline) | 250 | 1:.08 | Instant |

| Marriott (Hotel) | 1,000 | 1:1 | Instant |

| Qantas (Airline) | 500 | 1:1 | Instant |

| Singapore (Airline) | 1,000 | 1:1 | 1 Day |

| Virgin (Airline) | 1,000 | 1:1 | 1 Day |

Basic Pro Tip – Keep an eye out for Transfer Bonus offers from Amex to their partners. Occasionally there will be opportunities to get a 30-40% bonus on your points. Marriott and Hilton often run the 40% offer so be patient if you’re considering transferring to one of those!

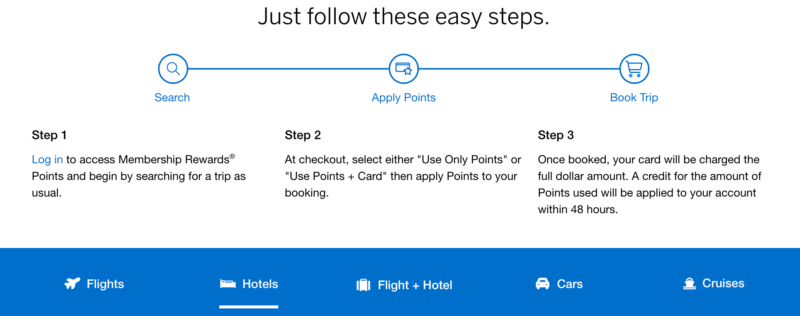

Travel Portal

The Amex Travel Portal offers cardholders the opportunity to book flights, hotels, and cruises with Membership Rewards Points. It is very important to point out that the valuation is 1 cent per point for airfare and .07 cents per point on everything else. Compared to the transfer partners or the Chase Ultimate Rewards (Chase Sapphire Reserve Card is standard 1.5 cents per point), the Amex Travel Portal this is much lower.

Bonus Points for Business Platinum and American Express® Business Gold Card holders in Amex Travel Portal

- Business Platinum Cardholders receive 35% of their points back when booking an economy ticket (On a pre-selected airline) using membership rewards points. Up to 500,000 points back per calendar year.

- Business Gold Cardholders receive 25% back.

- Business Platinum Cardholders receive 35% of their points back when booking a premium flight via Amex’s International Airline Program in the Travel Portal.

Invest with Schwab

The best strategy for cashing out Membership Rewards points is to utilize The American Express Platinum Card® for Schwab. By doing so, you’ll be eligible to redeem points directly into your Schwab brokerage account at 1.1 cents per point. For example, 10,000 MR points would equal $110.

Basic Pro Tip – Did you know that the Schwab Checking Account is one of the best options for travelers? It offers Fee-Free ATM withdrawals anywhere in the world!

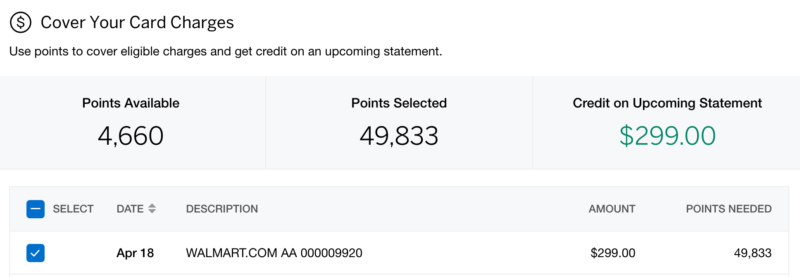

Statement Credit

It’s possible to redeem Membership Rewards points directly for credit card charges on your statement. However, the redemption value is a low .06 cents per point. For example, the same 10,000 MR points used in the Schwab example above are only worth $60.

Giftcards

Membership Rewards points can be redeemed for a variety of merchant gift cards with a valuation between .05 to 1.0 cents per point. You’ll find most popular merchants in the gift card portal like Delta, Panera, and Olive Garden.

Pay with Points at Checkout

Finally, it’s possible to pay with points directly when checking out at a variety of merchants. However, the value is low similar to the gift cards. Popular merchants like Amazon, Walmart, & Best Buy are a sample of the options which can be redeemed at .07 cents per point.

Basic Pro Tip – There is one example where paying with 1 point at Amazon makes sense. Often Amex & Amazon will run promotions that provide a bonus percentage or extra cashback when using points to checkout. What’s great about these promotions is that the minimum points redemption is only 1 in order to qualify!

Basic Breakdown

Amex Membership Rewards points are one of the best award currencies in the points & miles world. Given all of the different options for earning and redeeming, the MR points can lead to some fantastic value. Whether it’s cashback via a Schwab Platinum or flying in a premium cabin via an Amex transfer partner, the possibilities are endless!

Let us know!

What is your favorite aspect of the Amex Membership Rewards Program?

I’d love to hear in the comments below or over in our 8,700+ Member Basic Travel Facebook Group!

More Basic Reading

- Top Travel Credit Card Offers of the Month

- Hilton’s Mahogany Bay Resort in Belize Review ~ Yes, it was Amazing!

- 5 Reasons Why I Love the Amex Gold Card

- JetBlue Mint Class SFO to JFK Review

- Elevated Hilton Honors Offers

For rates and fees for American Express cards mentioned in this post, please see the following links: The Platinum Card® from American Express (See Rates & Fees; terms apply); American Express® Gold Card (See Rates & Fees; terms apply); The Business Platinum® Card from American Express (See Rates & Fees; terms apply); American Express® Business Gold Card (See Rates & Fees; terms apply)