Times have been tough with COVID-19, and with this banks have shifted to more cash back friendly features such as Chase “Pay Yourself Back”. Originally, this feature was only intended to be around temporarily, but Chase recently extended this benefit to be indefinite.

What is Chase “Pay Yourself Back” & How It Helped Me

The Chase Pay Yourself Back feature applies to grocery store, restaurant and home improvement purchases. You have 90 days from the original purchase date to “Pay Yourself Back” If you need a refresher on how to use this feature, or how it works, check out our Chase “Pay Yourself Back” Redemption Guide

In my waning months of my year long adventure trip, I ate in Thailand to my heart (and wallets) content. Leave it to me to turn an incredibly cheap country into something where I needed to reconcile my bank account. Luckily, I had this excellent feature to lean on.

How I did it

Granted, the food is relatively inexpensive there, and really all of SE Asia for that matter. However, I couldn’t stop helping myself to all of the intense flavors and spices that Thailand has to offer. For the record, this number did not include the cash I used to pay for street food. Thailand, maybe unsurprisingly, is not known for widespread credit card acceptance.

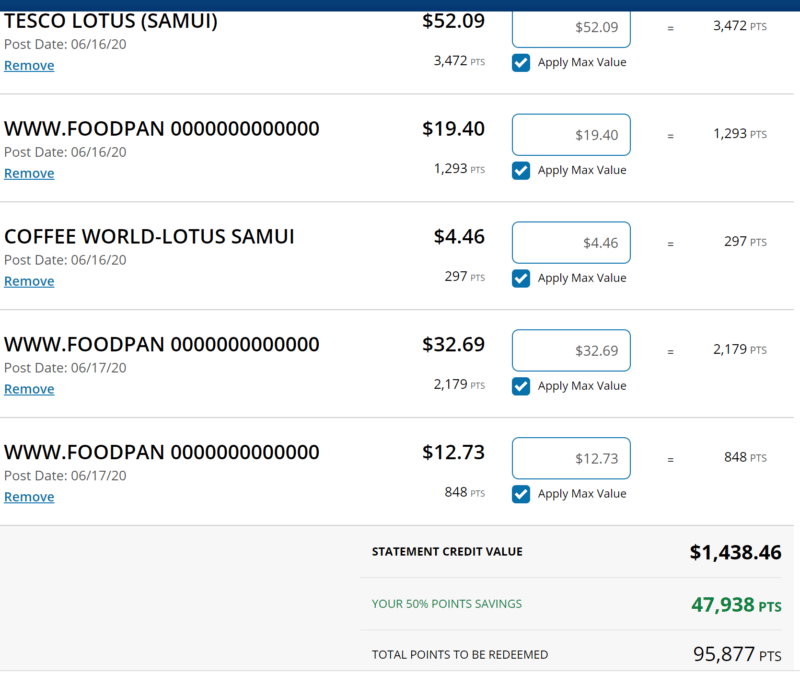

I spent a little over 50,000 UR Points to knock out over $750 of food and drinks in Thailand. This represented almsot TWO months of grocery store, food delivery and restaurant purchases. There was a period during peak quarantine/ curfew there were many days where the house was never left. Food delivery services like Food Panda, played a key role in my spending (and weight gain!)

Why I Chose “Pay Yourself Back” over Future Travel

My stash of Ultimate Rewards points isn’t massive, so I did not want to sacrifice a possible future redemption. However, given that I was returning to the US, the workforce and the working world, my last month was supposed to be a bit more budget conscious. Just a little statement credit boost would help go towards other things restarting my normal life in general was extremely helpful.

There are absolutely 100+ more valuable ways that I could have used these Chase Ultimate Rewards points. However, given that I had just traveled for 12 straight months, coupled with the fact that once I re-entered the US I wouldn’t be going anywhere for quite a while… I chose the short term benefit option.

A couple of things to note, even though you are redeeming these points, you still earn the same multipliers on purchases. This means restaurants and travel purchases still earn 3x for each dollar spent. Additionally, you need to consider the opportunity cost of redemption that you could have with Chase transfer partners.

All points aren’t made equal and while I spent 50,000 of my hard earned UR points here, this could have easily been a $1500 airline ticket on a transfer partner. So while it may look like the 50,000 would be equal on a 1:1 transfer, you have to consider the real cost of the ticket.

Basic Breakdown

I personally think that the Chase “Pay Yourself Back” feature has worked out great for me. Especially given that it will be tough to travel internationally for quite a while. What about you? Have you had any success using this feature? I’d love to hear from you down in the comments or over in the 4,000 + Member Basic Travel Facebook Group!