Another day and another credit! It seems like every few weeks there’s a new credit card benefit being added or swapped for an existing benefit. Now Instacart is getting in on the action with its new credit found on a variety of Chase Credit Cards. Learn more about this new benefit and how we redeemed it for $85 in groceries below.

Chase’s new Instacart Benefit

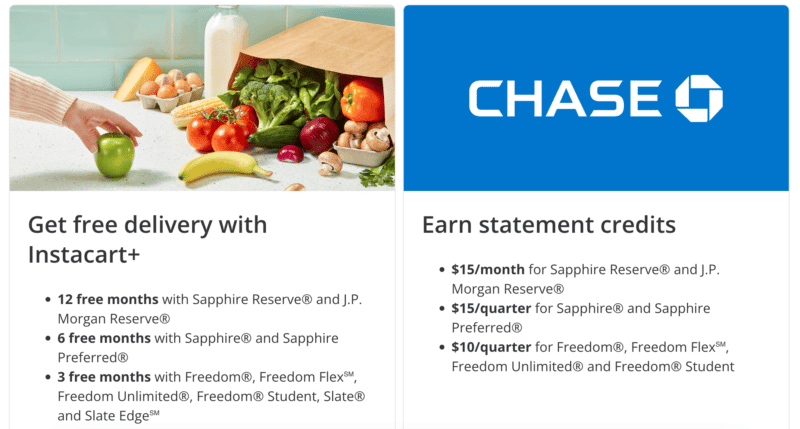

This new benefit includes both a statement credit and a complimentary Instacart+ membership which varies depending on the Chase card used.

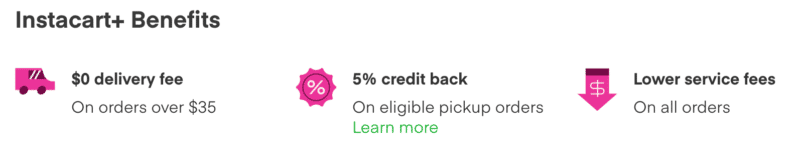

What is Instacart+?

Instacart+ is a premium service that includes free delivery on orders over $35, lower service fees, and 5% credit back on eligible pickup orders. The price for this membership is either $9.99/month or $99 for an annual subscription.

Which Chase Cards Qualify for the Instacart Benefit?

Both the Sapphire and the Freedom family of cards include a variation of the Instacart benefit. Below all of the options are broken down:

- Chase Sapphire Reserve Card

- 12 free months of Instacart+

- $15 monthly statement credit

- J.P. Morgan Reserve Card (No longer available for new applicants)

- 12 free months of Instacart+

- $15 monthly statement credit

- Chase Sapphire Preferred Card

- 6 free months of Instacart+

- $15 quarterly statement credit

- Chase Freedom Flex

- 3 free months of Instacart+

- $10 quarterly statement credit

- Chase Freedom Unlimited

- 3 free months of Instacart+

- $10 quarterly statement credit

- Chase Freedom (No longer available for new applicants)

- 3 free months of Instacart+

- $10 quarterly statement credit

- Chase Freedom Student Credit Card

- 3 free months of Instacart+

- $10 quarterly statement credit

- Chase Slate

- 3 free months of Instacart+

- Chase Slate Edge

- 3 free months of Instacart+

How often does the Chase Instacart quarterly credit reset?

The dates of the Chase quarters are:

- January through March (Quarter 1)

- April through June (Quarter 2)

- July through September (Quarter 3)

- October through December (Quarter 4)

When does the Chase Instacart benefit expire?

The Chase Instacart benefits are slated to expire in July 2024.

How to activate the Chase Instacart benefit

Click this link to be taken to the Chase Instacart landing page. You will need to create an Instacart account and add the eligible Chase card to activate the benefit.

Chase Sapphire Preferred® Card

Chase Sapphire Preferred® Card

My experience using the new Chase Instacart benefit

Between Lisa and I, we have seven eligible Chase cards that include the Instacart benefit. In situations like this, I like to create a spreadsheet to track redeeming credits to not lose out on any. I added all seven which resulted in $85 towards groceries on Instacart. One important pitfall I learned is that there is no way to add multiple cards to one single Instacart account and ended up creating a new one for each Chase card. Remember to add that login information to your spreadsheet. Seven Instacart accounts later and we earned a nice little bounty pictured below!

Basic Travel Tip ~ Don’t forget to set a reminder to cancel the Insatcart+ membership prior to being charged the full price! I added the date to my spreadsheet and set an alert on my calendar for each card.

Basic Breakdown

The new Chase Instacart benefit turned out to be a nice win for us. With our seven cards through July 2024, we will end up with a total of $975 worth of credits to use towards groceries on Instacart. It’s always great when the cards I currently hold provide even more value. What do you think of the new Chase benefit?

I’d love to hear in the comments below or over in our 8,700+ Member Basic Travel Facebook Group!

More Basic Reading

- Top Credit Cards of the Month

- Learn how to utilize credit card points with our Basic Travel Course

- How to book an Overwater Bungalow at the Conrad Maldives for cheap!

- Seven Steps to utilize credit card reward points to Save Money

- 16 Side Hustles that can Qualify for a Small Business Credit Card

- Step-by-Step Guide to Completing a Small Business Credit Card Application

11 Responses

So you made 7 accounts…were they concurrent with different email addresses, or were they sequential with one address? I want to do the sequential technique and wonder if anyone else has. I think the shorter free memberships should go first (to work out kinks and become familiarized if you’re a new instacart user), then intermediate, then longest, which is the CSR, as long as the CSR sign up is before July 2024. Also, I signed up with the Chase benefit in Sept ’22. Do I get $15 in Sept (Q2), $15 in Q4, and $15 in Jan or Feb (Q1) all before canceling the free 6 mo membership? Anyone have data points on this question?

Yes we used different email addresses with same address. Yes, you would get CSR each quarter before canceling. 🙂

Thanks for the response. I am doing sequential memberships, alternating with player2 cards. This is to defeat the ghost expiration date of free account period, even when you cancel membership early. I did get 3 $15 credits on CSP by starting the 6 mo free membership late in the calendar quarter, stretching the 6 months over 3 quarters. Will see how the 3mo $10/Qtr works next. I already have all the nonperishables I can use through the Chase gopuff credits, so Instacart is for perishables, thus the timeline instead of your method of all at once with various emails.

What do you mean by the ‘ghost expiration date of free account period even when you cancel…early” ?

Also you reminded me that I need to look into the gopuff credits that I have ignored until now -thanks!

I know this post is a few months old but I am just now looking at the Instacart benefits and noticed that you said that Slate cards are eligible for the statement credits. Other places do not mention that. I did not find one that specifically said Slate card holders are eligible for the three months of Instacart Plus but NOT the statement credits.

You are correct, I am no longer seeing the $10 statement credits. I will update the post. Thank you!

I’m not seeing a way to select “Pick-up”, instead of “Delivery” on my order.

Is the Chase benefit limited to “delivery” orders only?

No, you can also do pickup but not all locations have pickup options. I know for us in Buffalo/Rochester, we don’t have a pickup option available.

So i found I was able to add multiple chase cards to a single instacart account, and the instacart plus tenure was just compounded for each card.

I have 3 cards on one account, totaling 2 years of instacart+ membership. I just swap the payment method for each order, pretty simple.

This is a lot simpler than having 7 separate accounts.

great tip!! Things definitely could have changed since we wrote this post.

Thanks for this. I was just doing a search to see if I could use multiple cards on one account once I realized I could get the benefit for other cards.