It has been a rocky ride on the AAviator Train over the last 12 months. I have been actively trying to add the Barclays Bank AAviator Credit Card to my portfolio for quite some time. Back in August 2018, I was initially denied on my first attempt. After calling the Barclays Reconsideration Line, I learned that I was not approved. This was due to too many recent inquiries and new accounts opened. This is a pretty typical response but sometimes the customer service representatives can overturn the initial decision. After trying my best sales pitch, the representative recommended trying again in 6 months. Fair enough I replied and moved on with my Basic life.

Round 2

Fast forward to April 2019. I decided to pull the trigger on the 60,000 American Miles sign up offer on the Barclays AAviator Card. Time was of the essence as Barclays was planning on reducing the signup offer down to 50,000 American Miles on May 1st. My application submitted. 60 seconds later I received the dreaded “we cannot approve you for this offer at this time” pop up message.

A few days later I received the denial letter in the mail. Listed were the same reasons for not being approved as my first application back in August 2018. I picked up my iPhone and proceeded to call my friends again over at the Barclays Reconsideration Office. The Barclays Reconsideration Phone Number is 1-866-408-4064 if you ever need to make this same phone call.

The Approval

Maybe I was extra motivated due to burning a stash of American Miles on my recent trip to the Galapagos Islands. Or maybe I just happened to catch a Barclays Customer Service Representative on a good day because this time I hung up with an approval! I explained to the friendly Barclays Rep that this is my second time applying for this card and that I really REALLY wanted it. Luckily, he was able to change my application status over from denied to APPROVED!

Now if you take a look at the date of approval in the photo above you can see that it is dated May 1st. The same date that the 60,000 AA offer was being downgraded to 50,000 miles. Luckily, because I actually applied in April for the 60,000 offer I would still be eligible for it even though the approval took place in May.

Meeting the “Spend”

Now on to actually earning those 60,000 American Airlines Miles. One of the reasons why I wanted the AAviator Card so bad was because of how easy it is to meet the sign-up bonus requirements. In order to earn 60,000 Miles, I needed to purchase one item and pay the $95 annual fee. That’s it!

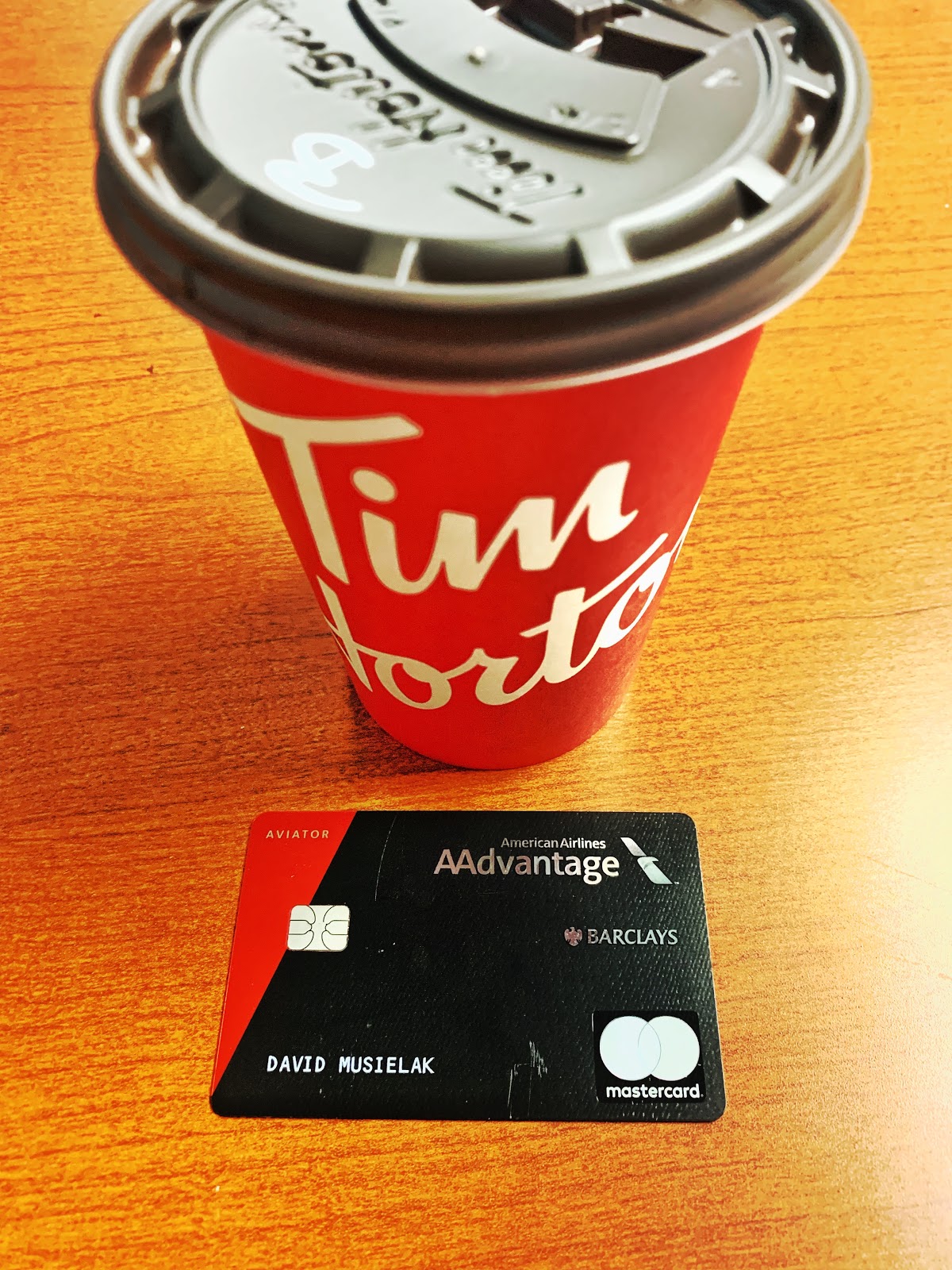

So after taking a short ride to my favorite coffee spot in western New York I was well on my way to 60,000 American Airlines Miles!

Annual Fee

The $95.00 Annual Fee showed up after my May statement closed on May 31st. I paid for it and the waiting game began!

On June 23rd my patience finally paid off in the form of 60,000 American Airlines Miles! Finally, the wait is over. If you include my initial application, I agonized for a long 11 months before being rewarded that bonus!

A few fun data points from my rocky AAviator train ride:

Initial Application: August 4th, 2018 or 322 Days before earning the Bonus

Second Application: April 18th, 2019 or 65 Days before earning the Bonus

Actually being Approved: May 1st, 2019 or 52 Days before earning the Bonus

Purchasing a coffee from Tim Hortons: May 7th, 2019 or 46 Days before earning the Bonus

Receiving the Annual Fee: May 31st, 2019 or 22 Days before earning the Bonus

New Offer

As of July 2nd, Barclays raised the current sign up offer back up to 60,000 American Airlines Miles! In addition to the sign-up bonus, there are a few additional benefits of opening this card that is worth mentioning. The AAviator provides the first checked bag free and preferred boarding for the cardholder and up to 4 companions. In addition, there are no foreign transaction fees, a $25 statement credit for in-flight Wifi purchases, and an opportunity to earn companion certificates. As you can see, this card offers a ton of benefits for the $99 annual fee and is a great option if you are considering flying American Airlines.

Be sure to check out our Top Credit Cards page for regularly updated rankings.

2 Responses

I have a Barkley credit card through American Airlines. It is in both names, my husband and me. He is attached to the points account, I am not. Trying to find out how to gets my account attached so I can earn points as well. Need help. Thanks

If you are an Authorized User on the card, you will not be able to earn points. Only the main cardholder can. You’d have to get your own card and link your AA account.