I violated my number one finance rule – don’t incur credit card interest fees or other unnecessary fees. We all know that the easiest way to negate any value from points and miles is by paying the bank back in fees. Thankfully I was able to get this interest fee waived via an old fashioned phone call to the bank. Learn about my strategy for dealing with this situation in my latest basic breakdown!

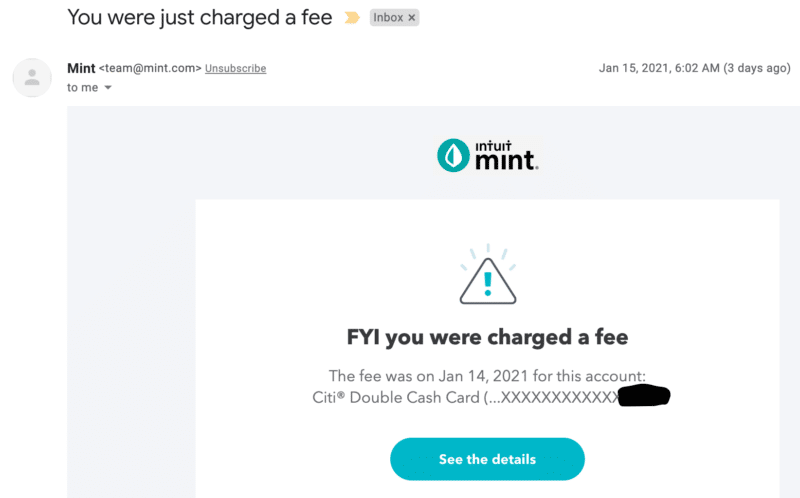

Shoutout to Mint

I’d be remiss if I did not give Mint some credit out of the gate for a very timely email notification. Mint emailed me as soon as the credit card interest fee was incurred. This allowed me to react quickly. Without Mint, I may have not seen this charge for a number of weeks.

What is Mint? – It’s a FREE website & mobile app that monitors all of your credit cards. Simply link each bank and you can view all of your credit cards in one place versus logging into multiple online banking platforms. Full disclosure, Mint is not a Basic Travel affiliate but I do enjoy their service and recommend it.

How did I make this mistake?

Now, this is certainly not a mistake that I am proud of. I write about and advocate for good record keeping when it comes to managing credit cards. This situation is a little different for a number of reasons that I will be writing about in the future. The teaser is that I borrowed money against my credit cards to invest in the stock market last spring. My mistake was that I mixed up one of the three 0% offers ending on February 1st.

Basic Disclaimer – I do not advocate for borrowing to invest. It’s a move that carries many risks. Please consult your own financial advisor when it comes to investing.

Credit Card Fees 101

Credit card fees come in many ways. It is important to note that none of these fees are ever set in stone. The vast majority of people make a faulty assumption that once a fee is assessed that they must pay it, no questions asked. The Basic Travel Method, however, is to fight those fees if they accidentally get charged. According to CNBC, Americans paid $104 Billion dollars in credit card interest fees. It’s a huge moneymaker for credit card issuers who are betting on another human slipup down the road. Since there is an acquisition cost associated with bringing on customers, banks are often willing to offer good faith credits for these mistakes.

How I got the $62.84 credit card interest fees reimbursed

Since I know that there is an acquisition cost and the banks would like the opportunity to hopefully earn interest off of me in the future, I have some leverage in this situation. I simply picked up my phone and called the number on the back of my credit card. I proceeded to explain to the representative that I always pay my cards on time (which I do) and made a mistake here. He said that these were the terms of the 0% finance offer I opted into and the fee cannot be waived.

Now, I could have accepted that and hung up the phone. However, I (and the banks) know that most people won’t follow up with facts on why I’d like the fee waived. I reinforced the points I made already and then highlighted my account history ending in stating that I want the fee waived and a one-time credit applied.

The representative put me on hold and came back with the good news. He stated that I would receive a one-time credit of $62.84 applied to my account as a good-will gesture. I thanked him for the assistance and logged into my account where I found the credit already applied.

Basic Breakdown

Always call the bank or issuer when you make a human mistake. We’re not robots and life happens no matter how many calendar alerts we set up. Given that the banks are making a ton of money via these fees and they want to protect acquisition costs the odds are in your favor but remember YMMV. I was able to save $62.84 all thanks to a ten-minute phone call and you can too!

Let us know!

Have you ever called in to get an interest charge waived? I’d love to hear from you down in the comments or over in the 4,700+ Member Basic Travel Facebook Group!