A while back I wrote an article on how to get a $600 HSBC Bonus. The bonus was supposed to end in 2020 but has been extended until January 31, 2021. I am always on the lookout for earning some extra cash by utilizing Bank Account Bonuses every so often. It recently occurred to me that this HSBC bonus could be tied with another- the SoFi Loan for $300 to maximize value. This means you could possibly not even use any of your own cash and still be able to make $900. If you have a player two, be on the lookout for the bonus at the end to earn up to $2,200. I would estimate this to take about an hour or so worth of your time. Let’s get to it.

How to get $900 in bonuses:

There are two accounts that come into play here. The first is the HSBC $600 Premier Checking Account. Second is the SoFi Loan for a $300 bonus. You will use the SoFi Loan money to count as your direct deposit for the HSBC Premier Checking account. If you follow all of the notes, you shouldn’t pay any type of fees.

So let me break down how you can get $900 for maybe an hour’s worth of work (plus 6-8 weeks or so of waiting).

Step 1: Open an HSBC Premier Checking Account.

You can read the full breakdown on this article, but I’ll give the basics if you just want the easy way. I will note a few things:

- To open this account you can’t have had an HSBC account in the last 3 years.

- You must call or go to the branch to open. There is an offer online but it is not the same as it has different monthly requirements.

- Reference “Share Your Experience” referral for opening a Premier Account. You have to use a referral code to get the $600 offer. Mine is: S015292168 (I appreciate it if you use my links)

- Requirements say to get the bonus you have to open an HSBC Premier Checking account. The terms say to have the account and waive the monthly fee, you need to deposit $5,000 per month. I confirmed with an HSBC rep that the monthly fee is waived for the first 6 months. So it sounds like you just have to open the account. To be safe though, I wanted to have at least one $5,000 deposit.

I opened my account with Peter (below). You can call or email him to set up a time to open your account. Tell him you want to open a Share Your Experience Premier Account. Note: he WILL tell you that you have to do direct deposit and that bank transfers do not count. Agree with him and move on to open the account.

HSBC Premier Relationship Manager:

- Peter Bushman

- 716-926-6596

- [email protected]

Referral Information:

- My name is Lisa Kulpa

- Referral code is S015292168

Once your account is opened, note the routing number and account number.

Step 2: Apply for a SoFi Loan for $300

SoFi loans can come in the form of refinancing a student loan, or just a personal loan. I believe either one works as long as you get the deposit into your HSBC account. You get a $300 bonus for getting the loan, and for referring you, I would also be compensated. To apply you can click this link to be taken to their secure website. What I really like about the SoFi loan is that there are absolutely no fees. No closing costs, no early pay off fees, nothing. There is a $5,000 minimum which ironically works out for the first step’s requirements. Just a quick note – not everyone will get approved for a loan with SoFi. I did not get approved but I know others who have and have gotten the bonus. (I also am not working right now so that could have been a factor).

So apply for the loan and when it asks for your bank account information, you will put in the HSBC account you just opened.

Step 3: Update your bank in the “Bonus Payout Methods” for SoFi

If you don’t do this, you won’t get the bonus. Do this as soon as you apply for the loan. Once this is done and the loan is approved, it should only take a few days to get the bonus.

How to update it: In the SoFi Money App (if you don’t have SoFi Money yet, use Dave’s referral link to get another $50).

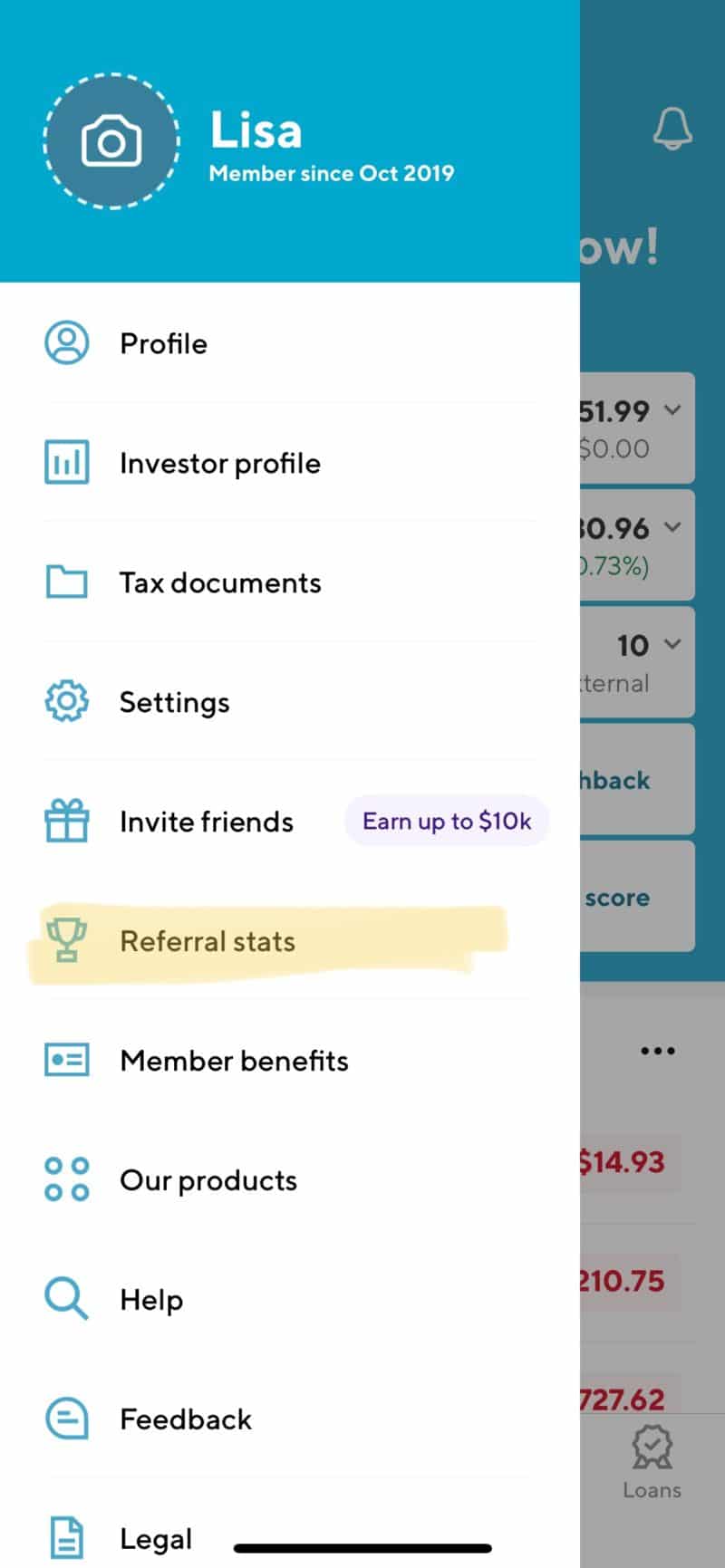

- In the app, click the little person in the top left corner

- Click Referral Status

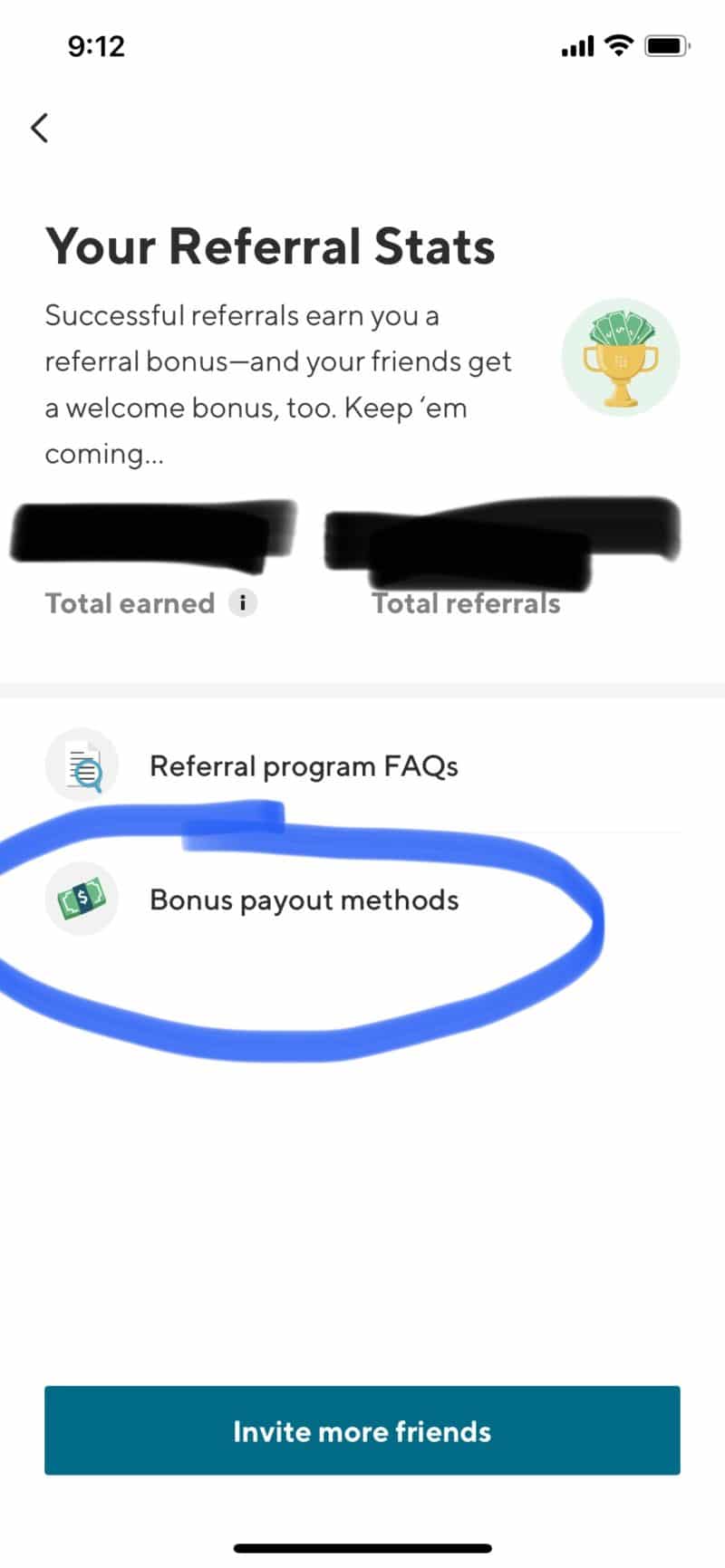

- “Bonus Payout Methods”

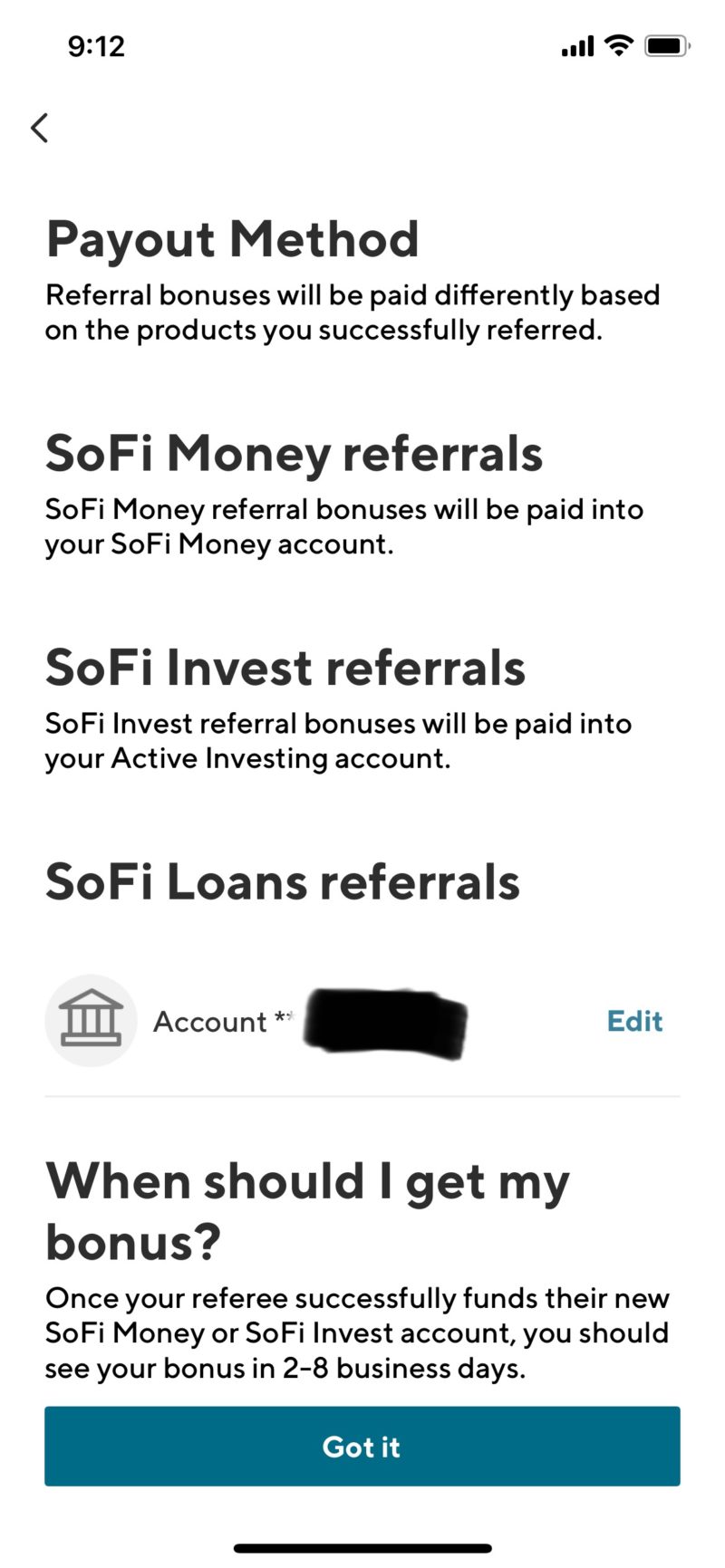

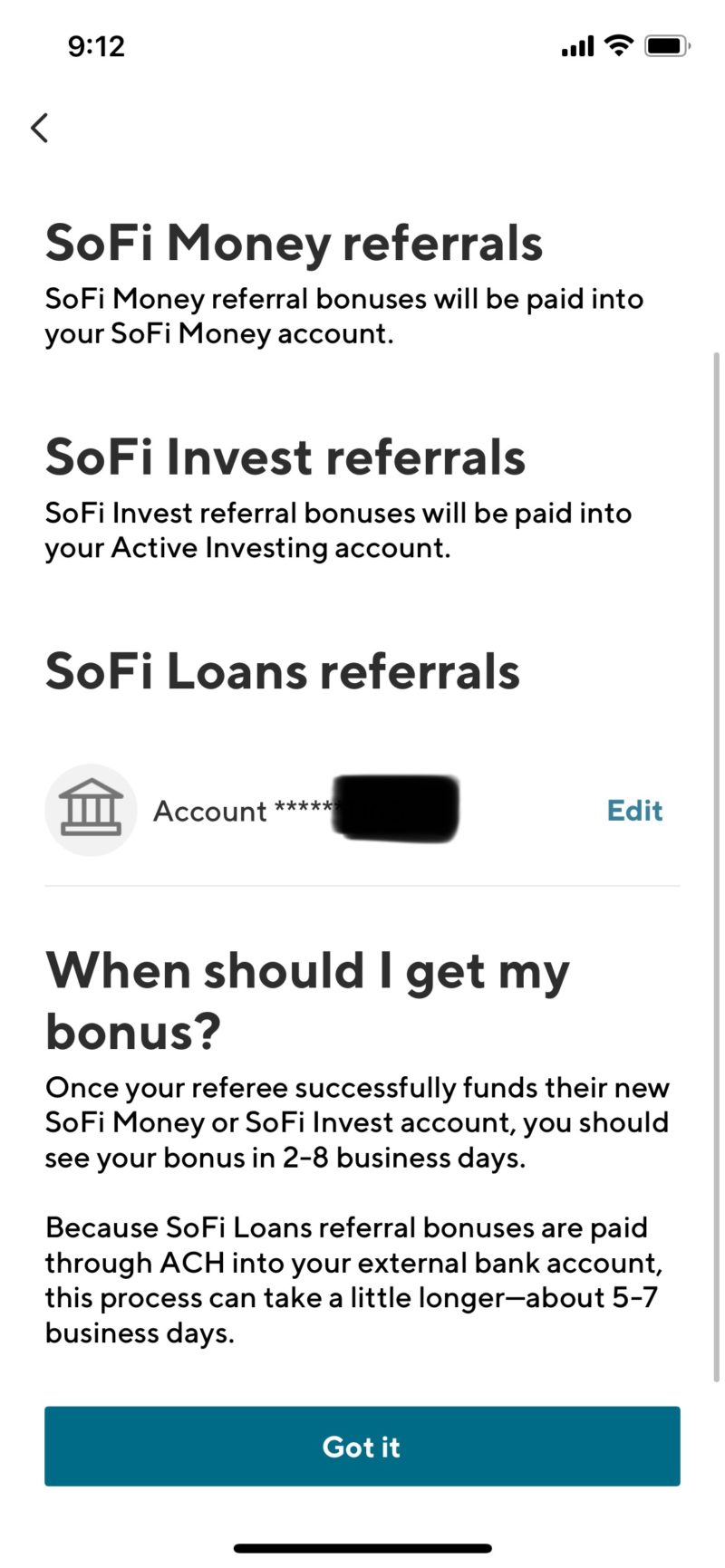

- Then under SoFi Loan Referrals, click Edit (Or maybe Add? Mine was already filled out so says edit now).

- ADD HSBC Bank Info or whatever bank you want (you should have also added this to your SoFi Loan)

Step 1 Step 2 Step 3 Step 4

Step 4: Wait for SoFi Loan to post

Once your $300 bonus posts from SoFi into your HSBC bank account, and the loan posts into your bank account, you can simply pay back your loan to SoFi from HSBC. Your SoFi Loan would be fulfilled, and you also had a deposit for HSBC to fulfill the $5,000 requirements. Make sure to pay this back asap if you do not plan to use it, otherwise, you will start to accrue interest fees.

Step 6: Wait for HSBC bank bonus

I opened my account on November 18th, 2020 deposited the $5,000 in December, and received the HSBC $600 bonus on January 6th, 2021. The terms say it should take about 6-8 weeks for the bonuses to hit. So if you open in January and get the deposit, I would imagine your bonus should come in March. Since the HSBC account offers no account fees for the first 6 months, I am going to determine then if I will keep the account open or downgrade to a fee-free account.

BONUS: Refer a friend or a spouse!

What’s great about both of these bank bonuses is that they work two ways. Not only do you get your bonus for signing up, but for referring a friend or family member you can also get an additional bonus.

- HSBC- $100 referral bonus

- SoFi Loan- $300 referral bonus

So not only would you get $400 for referring someone to both, but they would also get $900. If you refer your spouse, you would get a total of $2,200 between the two of you. That is $900 each, plus the extra $400 for referring them. This bonus is seriously not to be missed. You can get multiple bonuses on each. SoFi limits you to $10,000 referrals per calendar year and HSBC is 20 referrals on the premier account.

Basic Recap on double-dip of Bank Bonuses

This is honestly one of the easiest double dips you can do. Open HSBC, then SoFi. Get paid. Then refer friends and family. I’m really hoping the HSBC bonus extends again, but remember, you only have through January 31, 2021, to open your HSBC account. So jump on this before it’s gone. SoFi loan also can change their terms and loan bonus at any time, although I’ve seen this one around for quite some time.