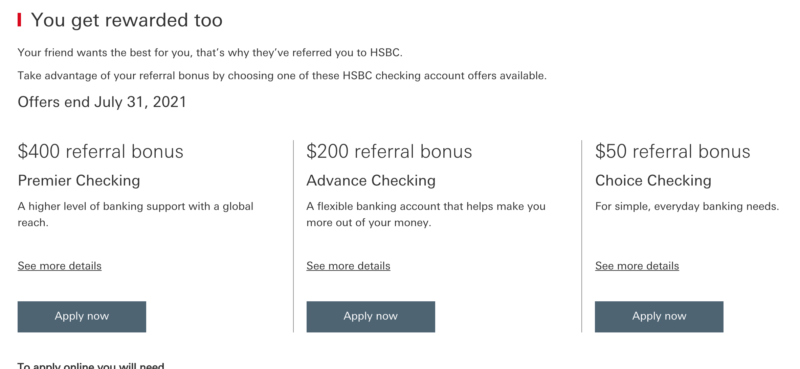

Bank account bonuses are some of our favorite ways to earn extra cash for our travel funds account. This year, since our travel seems to have dwindled, we have opted to use the money towards our upcoming wedding. No matter what your reason, extra cash in your pocket is always a plus. We typically snag a new bank account bonus a few times a year as a lot of them require some type of direct deposit. When a new offer comes out that doesn’t require one, it makes grabbing these types of bonuses even easier. HSBC currently has one of the highest bank bonus offers out there, and they even offer a referral opportunity. They actually have a few offers ranging from $400, $200, and $50. I will break down each bonus and details but I think the best bet here will be the $400 bonus.

Quick h/t to frequentmiler.com, viewfromthewing.com, and doctorofcredit.com for providing information and data points.

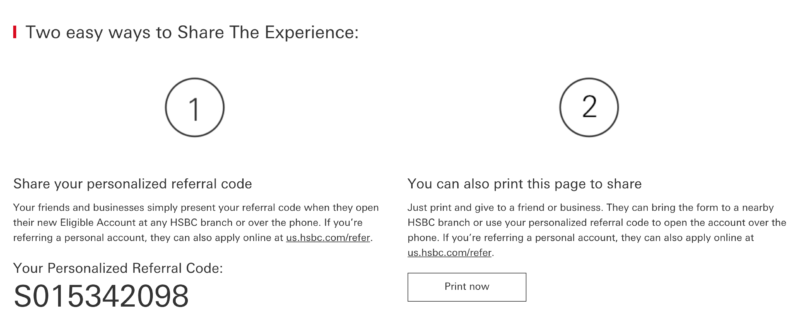

Share the experience

HSBC recognizes that oftentimes word of mouth can be the best way to gain new customers. Whether you are a new or existing HSBC customer, there is a way for you to earn a bank bonus. Now through July 31st, 2021, HSBC is offering a ‘Share your experience’ referral bonus. HSBC Fusion and HSBC Personal Checking Customers can refer friends who are in the market for either a new personal or a new business checking account. Once you do, you can earn up to $2,000 once you refer friends or businesses who open a qualifying account. As a referrer, you will receive a $100 referral bonus to your Eligible Account for all referrals who open a new Eligible Account for the Share Your Experience Bonus per calendar year.

Existing HSBC Customers

If you are currently an account holder of the below HSBC accounts in the United States, you are eligible to “Share Your Experience” with friends, family, or businesses for a referral bonus:

Personal Banking:

- Premier

- Advance

- Choice Checking

Business Banking:

- HSBC Fusion Professional

- Fusion Smart

- Fusion First Checking Relationship

Referral bonuses of $100 will be deposited into your eligible account within 8 weeks of referrals eligible account opening. Note, if you currently hold a consumer account and refer yourself for your business, you are ineligible for a referral $100 bonus, but you may be eligible for a new customer bonus. This also applies if you have a business account and refer yourself to a personal account. You will be ineligible for the $100 referral bonus but may receive a new customer bonus. This will not work to refer your own business to another business of yours. You will not receive either bonus.

New to HSBC?

If you are new to being an HSBC customer or haven’t had an account in the last 3 years, there are 4 options for opening an eligible account to receive a bonus. To open a Share your experience referral account, you must:

- Open an account in-person in a branch OR by phone with a Premier Relationship Business Manager

- Open M-F 8 am-4 pm EST

- Reference “Share the Experience Offer”

- You will also need to reference a referral code. Ours is: S015342098

- (It is a zero and not the letter o for the second digit)

Before opening an account, be sure to read the below types of accounts and terms and conditions. I would suggest the HSBC Premier as it has the highest offer and I will go into details. There IS a Premier Bonus offer available online, but this IS NOT THE SAME as the Share the Experience Bonus. This will require you to direct deposit $3400 per month for 6 months to get a 3% bonus each month of $100 each month.

To open an account

You can call Peter at HSBC or email him to set up a time to open an account. It takes about 30-45 minutes to open. Be prepared, you will need to answer some questions regarding your credit file. Information you will need includes:

- Social security number

- Driver’s license number

- Drivers license issue/expiration date

- Date of birth

- Citizenship

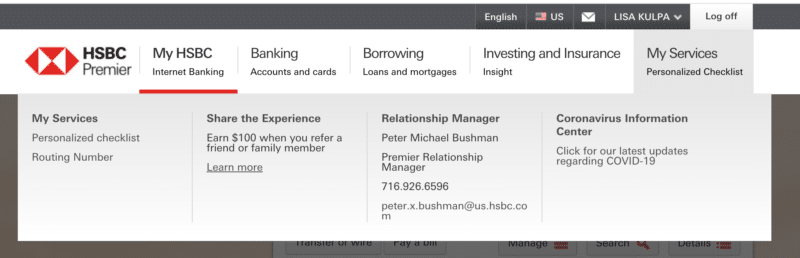

(For all of my Buffalo friends, you might recognize that area code.)

HSBC Premier Relationship Manager:

- Peter Bushman

- 716-926-6596

- [email protected]

Referral Information:

- Maria Kulpa

- The referral code is S015342098

If you prefer to go to the branch, you can click here to download and print this referral page to bring with you to the branch to apply.

Ineligible:

Before we get into the 4 different types of accounts, I just want to say a few quick caveats. You are ineligible to receive bonuses if you meet the following criteria:

- Consumers who currently hold or have held in the past 3 years an HSBC consumer deposit or investment account

- Businesses who currently hold or have held in the past 3 years, any HSBC business account

- Estate and Trust accounts are ineligible to make referrals or be referred under this offer

Types of Accounts and terms:

As stated above, there are 4 types of accounts you can open that come with a welcome offer. The qualifying information below is relayed from HSBC’s website that you can review here. A few notes that apply to all accounts:

- The Account Opening date is on the date on which the account is opened, and considered day one.

- You will automatically receive the bonus within 8-12 weeks of the date the new account is fully qualified.

- The New Referrals account must remain open for at least 15 business days

- The new Eligible Account must be open without being changed to a product with lower requirements and in good standing at the time of gift fulfillment.

- Limit one Referral Bonus per new customer, including all individual and joint accounts — the first line name on the joint account is considered the customer for gift purposes.

- A customer can use only one referral code at the time of account opening.

- For both you and the individual who referred you, the bonus deposit(s) to your Eligible Account will be reported on the applicable IRS form.

1. HSBC Premier Checking- $400

The HSBC Premier Relationship offers a $400 one time bonus. The interesting thing about this is that the terms and conditions state to qualify for the bonus, the new account must meet the qualifying requirements within 90 calendar days of account opening.

I haven’t been working my w2 job for quite a few months, so I often look for bonuses I can get that are eligible from bank transfers. There are some data points from frequentmiler.com and doctorofcredit.com that ACH pushes qualify as direct deposits, which make it fairly easy to get the bonus. You can also check here to see what methods may qualify as a direct deposit. I will most likely use T-Mobile Money as my ACH push and will update once it goes through to say what it codes as. I cannot say this is guaranteed to work. It could be an easy workaround.

To qualify for an HSBC Premier relationship, you need to open an HSBC Premier checking account and maintain:

- Balances of $75,000 in combined U.S. consumer and qualifying commercial U.S. Dollar deposit and investment* accounts; OR

- Monthly recurring direct deposits totaling at least $5,000 from a third party to an HSBC Premier checking account(s); OR

- HSBC U.S. residential mortgage loan with an original loan amount of at least $500,000, not an aggregate of multiple mortgages. Home Equity products are not included.

- Consumers who maintain Jade status.

A monthly maintenance fee of $50 will be incurred if one of these requirements is not maintained.

I also want to note that I was told by the bank representative and from comments on doctorofcredit, the monthly fee will be waived the first month of account opening, plus 6 additional months. So I am not 100% sure you have to do a $5,000 direct deposit to get this bonus. I would rather not risk it so I will just be doing the $5,000 deposit.

2. HSBC Advance Relationship- $200

HSBC Advance Relationship is a $200 bonus. Requirements are similar to the above, however, have lower requirement limits. The information below is relayed from HSBC’s website that you can review here.

To qualify for an HSBC Advance relationship, you need to open an HSBC Advance checking account and maintain:

- Balances of $5,000 in combined U.S. consumer and qualifying commercial U.S. Dollar deposit and investment* accounts; OR

- Monthly recurring direct deposit from a third party to an HSBC Advance checking account; OR

- An HSBC U.S. residential mortgage loan. Home Equity products are not included.

A monthly maintenance fee of $25 will be incurred if one of these requirements is not maintained.

3. HSBC Choice Checking Relationship – $50

To qualify for an HSBC Choice Checking relationship, you need to open an HSBC Choice Checking account and maintain:

- Balances of $1,500 in combined U.S. consumer U.S. Dollar deposit and investment* accounts; OR

- Monthly recurring direct deposit from a third party to an HSBC Choice Checking account.

A monthly maintenance fee of $15 will be incurred if one of these requirements is not maintained.

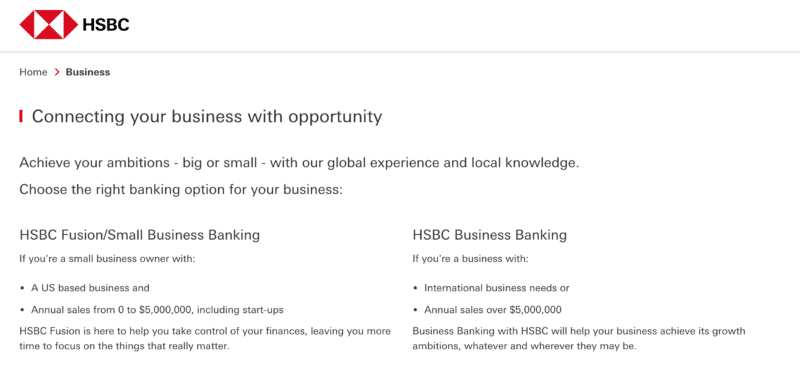

4. Business Accounts- Fusion Professional, Fusion Smart or Fusion First Checking- $400, $300, or $200

If you are a business owner, you can open a business account for a bonus. To qualify for the referral bonus for the new qualifying HSBC Fusion Professional, HSBC Fusion Smart, or HSBC Fusion First Checking account, you will need to complete the following:

- Open your new HSBC business checking account 1 (Fusion Professional, Fusion Smart, or Fusion First Account); and

- Deposit a minimum Qualifying Balance of $5,000 or more in New Money 2 in the eligible HSBC business checking account (Fusion Professional, Fusion Smart, or Fusion First Account) within 30 calendar days of account opening; and

- Register, and Log On to HSBCnet 3 using the personal credentials you created and your security device within 45 days of account opening; and

- Maintain at least the minimum Qualifying Balance(s) in your eligible business checking account (Fusion Professional, Fusion Smart, or Fusion First Account) for 90 calendar days from the date you deposit the minimum Qualifying Balance.

There are more details that you can view here regarding business accounts.

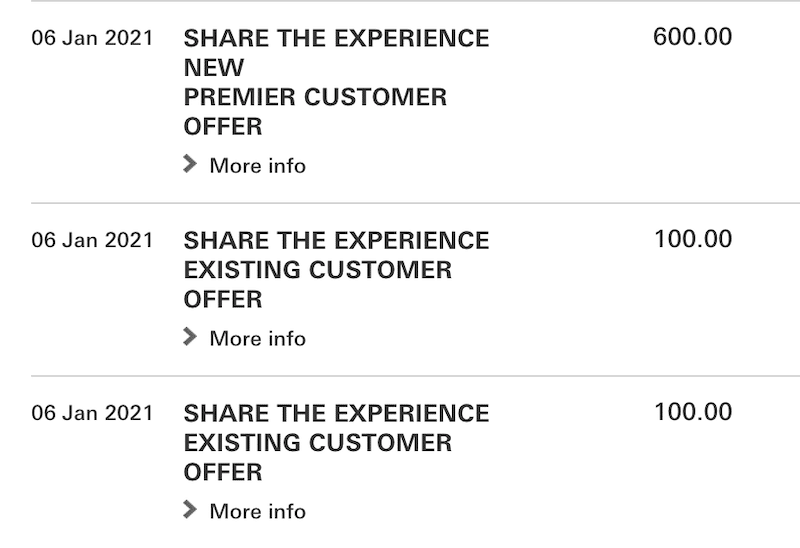

Double Dipping

My favorite thing about bank bonuses if you are in a relationship is being able to ‘double-dip’ on those bonuses to earn even more. I applied first and then passed my referral code onto Dave. This means that I will get the $400 bonus for premier checking, plus $100 for referring Dave, and then Dave will also get $400. This is an easy $900 win.

I also like the wide variety of accounts you can actually open if you do not want to commit to the Premier checking account. I definitely think it is a no-brainer but to each their own. Once you have your account opened, be sure to refer friends and family through the end of the year for your own opportunity to get a $100 bonus per successful referrer sign-up (limited to 20 people).

Once you sign up, it will take 2-3 business days for your referral code to generate. I opened my account on Monday and had the code by Wednesday. I found the code at the bottom of my page when I logged in under ‘recommended for you.’

Data Points

- Opened Account on November 18th, 2020

- Nov 20th: T-mobile Money transfer of $3,000 (transferred out the 23)

- Nov 24- T-Mobile Money tranfer of $1,000

- Dec 8: T-Mobile Money transfer of $2,000

- Dec 11: T-Mobile Money transfer of $3,000

- Jan: T-Mobile Money transfer of $1,500

- Bonus deposited January 6, 2021

Basic Review

I highly suggest this bonus. Working with Peter at HSBC was actually a very pleasant experience (even though the Bills suffered a loss the day prior). Peter was friendly, informative, and got my account set up in no time. The Premier Checking account bonus is worth the $400 and can even get you up to $900 for you and player 2. Bonus if you then refer your parents and others.

Let me know in the comments of your timeline if you received the bonus and which one you went for. This bank bonus is even better than some of the Top Credit Card Offer bonuses and it is seemingly less work. Yes, you will have to make a phone call, but I’ll make an hour phone call any day if I have to for $400.