This past week we needed to open two separate business banking accounts. (Something I’ve been meaning to do for months now). Since I have a broken leg and seem to have some extra time on my hands now, I figured I might as well get these loose ends tied up! Being the money focused brain I have, I decided to see if I can make this into a little extra cash for us! I did some research and found two fantastic sign-up bank account offers available. One was with Chase and the other was with M&T Bank.

Chase Bank

Chase Bank had a $300 offer for opening a business account. The only caveat was you had to open this in the branch, and there are no Chase Banks in Buffalo. So, we had to drive about an hour away to Brockport NY which was the closest branch. I set up an appointment and we were on our way! (This offer does expire June 3rd, but they typically come up with new ones fairly often.)

Requirements

When opening a new bank account for a bonus, they typically have some type of requirement. They all vary so you have to be sure to read the fine print to make sure you qualify for the bonus. For Chase, we had to deposit $1,000 of new money in the account within 20 days. Then we have to maintain a balance of $1,000 for 60 days from the date of the deposit. You also have to complete 5 qualifying transactions within 60 days. This could be debit card purchases, ACH wires, quick deposits and so on. After all the requirements are completed, the bonus will be deposited in 10 business days. Easy enough!

Monthly Fees

One thing to note is most of these bank accounts will have some type of monthly fee. However, there are usually ways to waive the fee. With Chase, to waive the monthly fee you have to keep a minimum balance of $1,500 or more or if you maintain a linked Chase Private Client Checking or Chase Sapphire Personal Account. The Chase personal Checking accounts required $75,000 or more in an account. So, we are opting for the easier route of keeping $1,500 in the account to avoid the monthly $15 fee.

Personal Checking

Don’t qualify for a business account? Open a personal Chase Bank account to get up to $350 with a Chase Total Checking + Chase Savings account with qualifying activities! Check out the offer here. Luckily the personal offer it seems like you can open online! Also note, most of these offers only apply if you have not opened a Chase Personal or Business account in so many months. Be sure to check the terms & conditions.

M&T

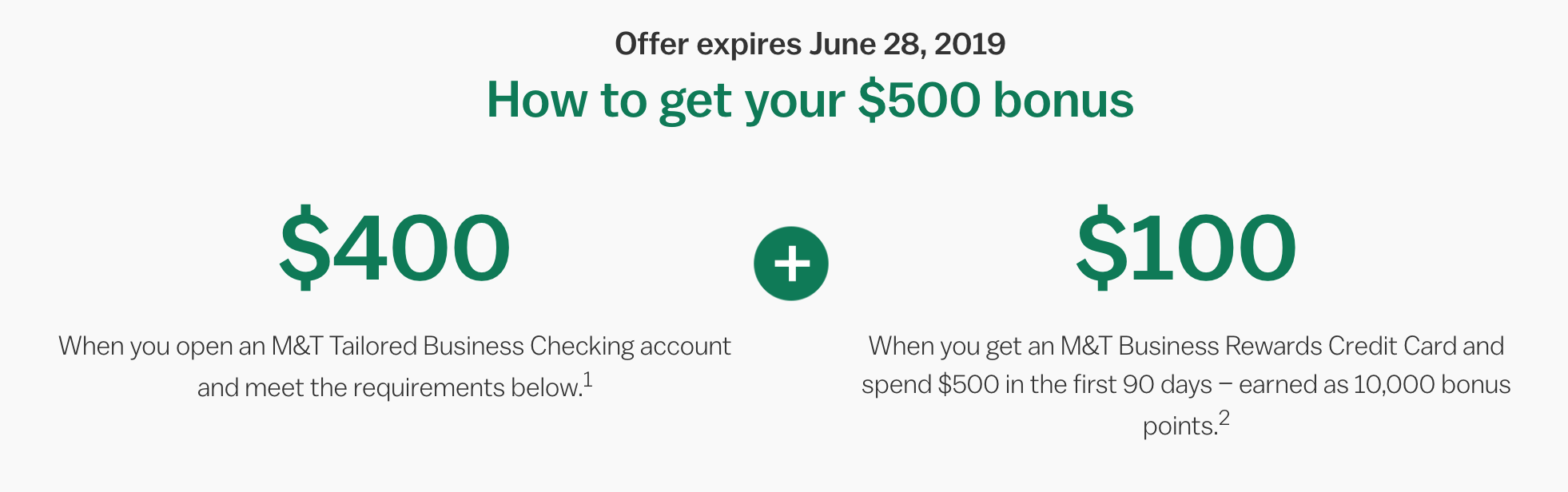

M&T has an offer for opening a Tailored Business Checking of $400 plus $100 for opening an M&T Business Rewards Credit Card. To get this offer you have to click here and sign up with your email to get a code. Then I made an appointment at my local branch to get my account all set up.

Requirements

M&T’s requirements for the $400 Tailored Business Checking Account bonus requires the average ledger balance in the account is at least $5,000 for the third calendar month after the account was opened. The bonus will be credited 45 days after the end of the third full calendar month after the account was opened. Terms also state you cannot have had a non-person M&T checking account within the previous 90 days to qualify for the bonus. Only one Checking Bonus will be awarded per customer regardless of how many new M&T Tailored Business Checking accounts opened.

Monthly Fees

The monthly maintenance fee for this account is $20. As stated on M&T’s website, there are four ways to waive the monthly fee:

- An Average Ledger Balance of $10,000 or more

- 1 or more deposits of M&T Merchant Services proceeds into the account

- Purchases made on a linked M&T Business Credit Card or M&T Business Rewards Card totaling $2,000 or more in the credit card statement cycle ending in that month

- The sum of the Average Ledger Balances of the account and any linked Commercial Savings account is $25,000 or more.

Personal Checking

M&T also has a great offer for personal checking accounts. The offer for M&T is a $250 bonus for direct deposits totaling $500 in 90 days. More info here. Offer expires July 1st, 2019. There are no monthly maintenance fees or balances required.

Please note, to open business checking accounts they typically require you to have your EIN as well as an Operating Agreement to verify it is a valid business.

Qapital

Lastly, I heard of a new app called Qapital. Qapital is actually a pretty cool savings app that lets you choose what you want to start saving for. So, for example, you can save for a trip, increase your savings, or save to pay off debt. Ways you can save are by rounding up purchases or depositing a certain dollar amount per day/week/month. There are many options and its pretty cool.

Requirements

Qapital is offering a $25 bonus per person for each personal referral. Both parties receive the $25 bonus. For the month of May, they were also offering a $750 bonus if you refer 7 people who also make a deposit by May 31st. There are 3 different accounts to sign up for. They are free for the first 30 days, then it will be $3 or more monthly fee. In order to qualify for the $750, the referrals account has to stay open until July 15. So technically your friend will only get $22 after the monthly fee. They also must deposit at least $1 into one of their savings accounts.

I wrote a detailed article on the Qapital Savings App you can check out to see how to sign up. Or you can use my Referral link. The code is gx3ma8sc in case it doesn’t automatically sync.

Update for June:

Looks like they rolled out a new offer. It is now only 5 friends to refer for $500. However, you get $10 for each referral and not $25. These offers typically change quickly so it is usually best to jump on them while they are fresh. To apply, you can use our referral link here to get $10 for signing up.

If all goes as planned, we will get $700 from bank bonuses, $100 credit card bonus and $750 from Qapital plus the $25 per person for referring 10 people which is another $250.

$1700 in a week is no small feat. Not bad for being laid up with a broken leg.

Just a small thing to note, these bonuses will be reported as taxable income. So you will receive documentation to file with your taxes.

Have you found any good offers for sign up bonuses? We usually sign up for a few of these a year to maximize our savings for travel! Let us know what you think.