Edit: This article was updated on October 2nd, 2021

Last May 2020, Chase introduced a NEW feature called “Pay Yourself Back” which was targeted at helping cardholders get maximum value during the unprecedented times since travel came to a screeching halt. This Pay Yourself Back feature works with a few different Chase branded cards and has been extended multiple times since it was released. We will go into detail about what it is, how it works, and which cards have which categories to pay yourself back.

What is Chase Pay Yourself Back?

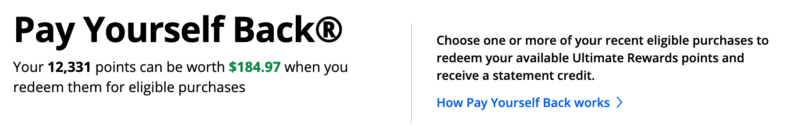

“Pay Yourself Back” is a feature by Chase Bank similar to a statement credit. However, you will get a better redemption value than you normally would. In addition, only certain categories qualify and there is a time limit of 90 days from the date of purchase.

What cards are included in Chase Pay Yourself Back?

Pay Yourself Back includes 3 different card types, and each has different redemption categories.

Chase Freedom Cards

- Chase Freedom Family (Chase Freedom, Chase Freedom Flex, Chase Freedom Unlimited, Chase Freedom Student)

- Redeem points for an extra 25% towards select charities

Chase Sapphire Cards

- Chase Sapphire Preferred Card

- AirBnb (25% Bonus when redeeming points through 3/31/2022)

- Away Travel (25% Bonus when redeeming points through 3/31/2022)

- Select Charities (25% Bonus when redeeming points through 12/31/2022)

- Annual Fee (25% Bonus when redeeming points through 12/31/2022)

Chase Sapphire Preferred® Card

Chase Sapphire Preferred® Card

- Chase Sapphire Reserve Card

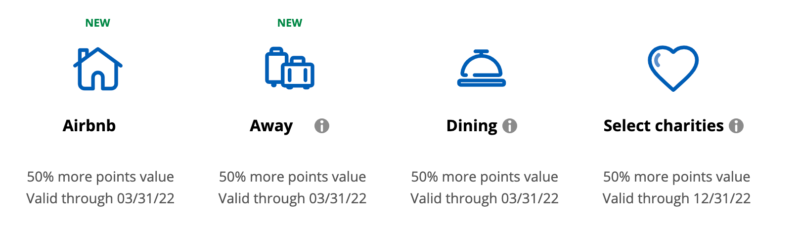

- AirBnb (50% Bonus when redeeming points through 3/31/2022)

- Away Travel (50% Bonus when redeeming points through 3/31/2022)

- Dining (50% Bonus when redeeming points through 3/31/2022)

- Select Charities (50% Bonus when redeeming points through 12/31/2022)

- Annual Fee (50% Bonus when redeeming points through 12/31/2022)

Chase Business Credit Cards

- Chase Ink Business Cash Credit Card& Chase Ink Business Unlimited Credit Card

- Internet (10% Bonus when redeeming points through 12/31/2022)

- Phone (10% Bonus when redeeming points through 12/31/2022)

- Cable (10% Bonus when redeeming points through 12/31/2022)

- Select Charities (25% Bonus when redeeming points through 12/31/2022)

- Chase Ink Business Preferred Credit Card

- Shipping (25% Bonus when redeeming points through 12/31/2022)

- Select Advertising (25% Bonus when redeeming points through 12/31/2022)

- Internet (25% Bonus when redeeming points through 12/31/2022)

- Phone (25% Bonus when redeeming points through 12/31/2022)

- Cable (25% Bonus when redeeming points through 12/31/2022)

- Select Charities (25% Bonus when redeeming points through 12/31/2022)

Ink Business Preferred® Credit Card

Ink Business Preferred® Credit Card

How to Pay Yourself Back

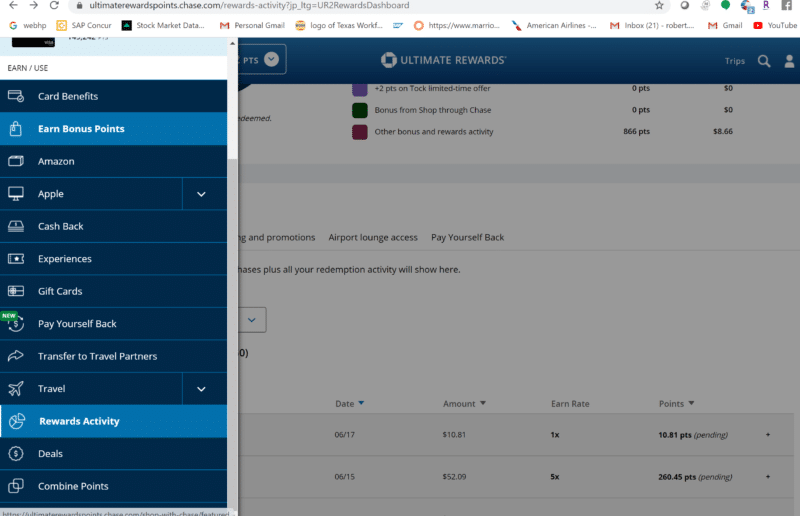

1) Once you are logged into your Chase Travel™, you can then select the option to go into the Pay Yourself Back feature on the left.

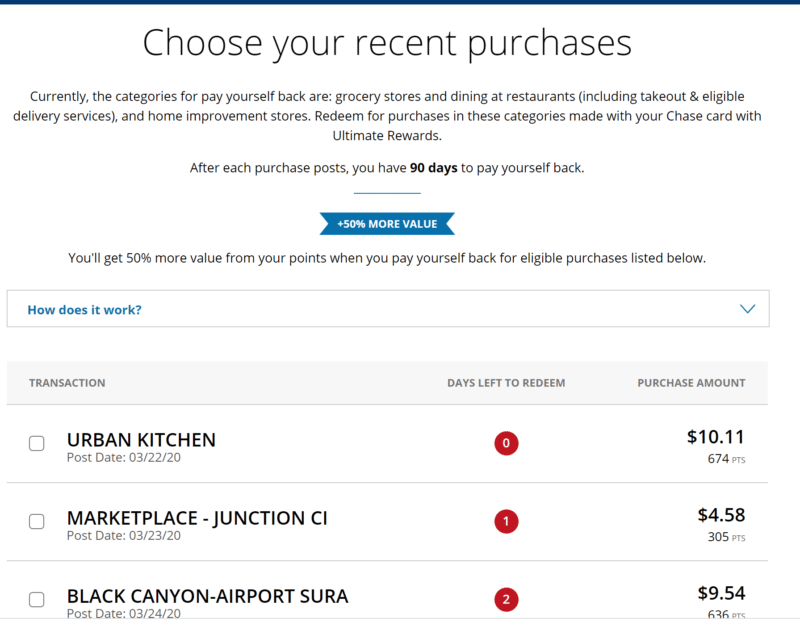

2) After you select the pay yourself back tool for redemptions you will see a list of the eligible purchases. For this example, I am using my Chase Sapphire Reserve Card. Taking a look at the list, you can click on eligible purchases and it will show you how many points per purchase you will use to “pay yourself back”

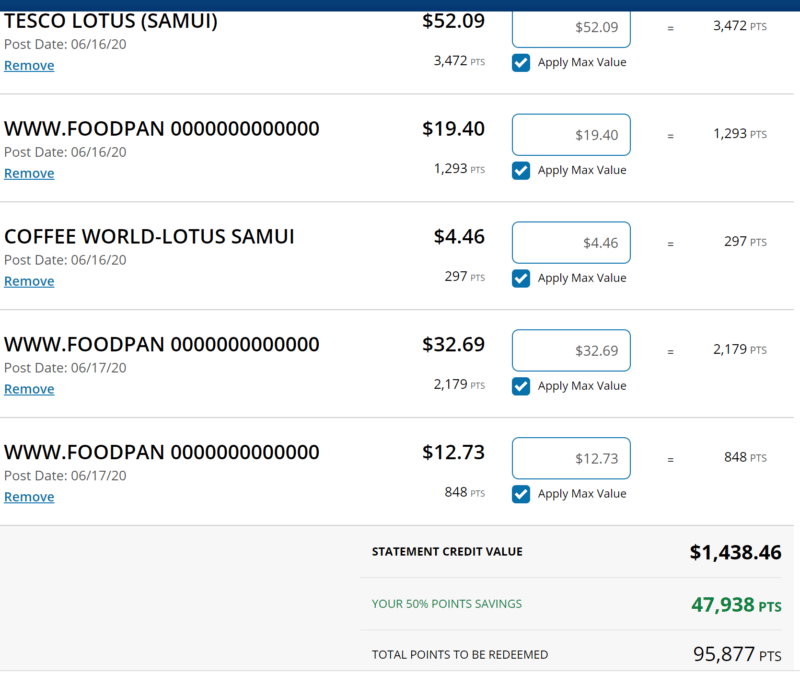

As an extreme example, I logged in and selected all of my eligible purchases to see what kind of value I could get. You do not have to redeem the full amount if you desire. If you plan on redeeming a large number of purchases, it’s a monotonous task, as there is no “select all”. If I went through with this, I could get almost $1,500 back to my card as a statement credit for “paying myself back” with 50% more value!

Once you click next, you are able to change the value if you choose to do so. As you can see in this screenshot, I would be getting $1,438.46 for 95,877 points instead of 143,846 points at a 1 to 1 ratio. If you have any of the other cards, it will be a 10-25% pay yourself back boost. The process is the same for any of the cards you choose to utilize the Chase Pay Yourself Back perk for.

Basic Breakdown

This is a generous move by Chase but as a result, will cause debate in the points and miles world. Do you think this feature might be useful to you? Are you saving your points for premium cabin redemptions? I am all for more options to utilize my Ultimate Rewards points and look forward to seeing this redemption option available long-term!

I’d love to hear in the comments below or over in our 8,700+ Member Basic Travel Facebook Group!

More Basic Reading

- How to Save Money on Groceries with 5 Basic Tricks

- Basic Guide to Reconsideration Phone Calls

- Why I Paid $95 to Upgrade my Credit Card (Hint – It’s to sleep somewhere special)

- How I Turned a Rotting Tree into 17 Free Hotel Nights

- 7 Reasons to Plan a Summer Road Trip

- Top Credit Card Offers of the Month