Small Business Credit Cards come with many different perks like Increased Points and Miles Signup Offers, Bonus Categories for Business expenses, Travel Insurance and Rental Car Damage Waivers, and the Opportunity to Leverage Credit towards Building a Business.

There are many people out there that don’t believe that they qualify for a Small Business Credit Card despite the fact that they do! Be sure to read the Basic Guide to Small Business Credit Cards and 16 Side Hustles that qualify for a Small Business Credit Card to learn more about the Basic Business Card World.

Without a doubt, there is an incredible value to maximizing Small Business Credit Cards and this step-by-step guide to completing a small business credit card will help open that door!

Check out all of our Small Business Credit Cards Here.

Business Card Application

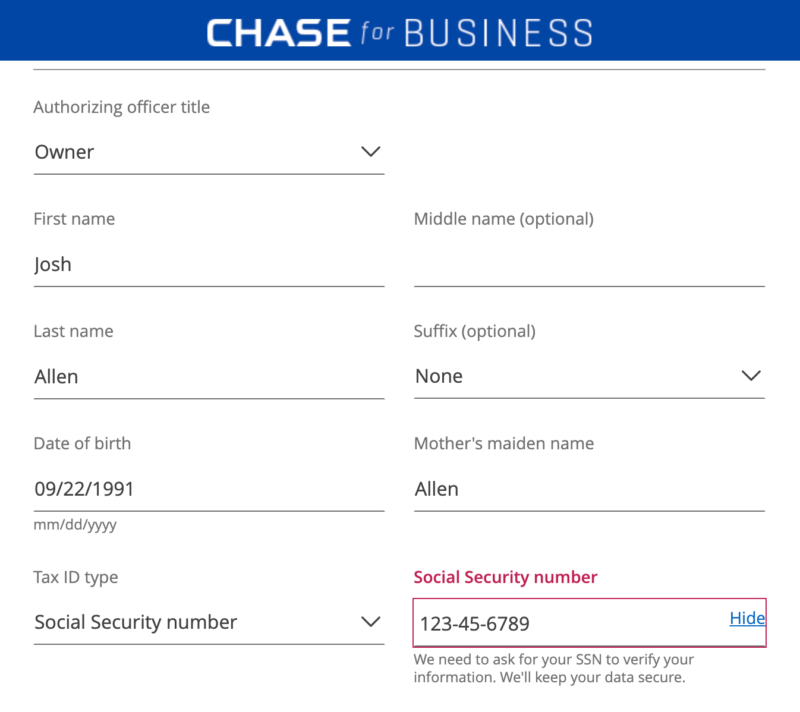

The majority of the Small Business Credit Card applications all look the same with a few minor differences from one to another. We will review Chase Bank’s Small Business Application below. This should provide an overview of the different questions asked and information required in order to complete any of the Small Business Applications from all of the Banks that offer them.

For the purpose of this article, I’m going to assume that you will be Applying As a Sole Proprietor given that all of the other business models have to be legally formed! Read the Basic Guide to Small Business Credit Cards for more information on what qualifies as a Small Business.

Chase Ink Business Unlimited® Credit Card

Chase Ink Business Unlimited® Credit Card

Chase Bank Small Business Credit Card Application

Part One – Business Information

Legal Name Of Business

To apply as a Sole-Proprietor, Use Your Legal Name Only. Nothing additional! Even if you are running a small bakery business outside of your house and have a name you go by, it’s important that you just use your legal name if you don’t have a tax ID. “Josh Allen versus Josh Allen’s Cookies”

Business Name on Card

Your legal name goes here. “Josh Allen”

Business Mailing Address

Use your home mailing address.

Type of Business

Sole Propretor

Tax Identification Number

Use your personal Social Security Number Here

Number of Employees

“1” Since this is a Sole Proprietorship

Annual Business Revenue/Sales

Be honest! If you’re just starting out, input zero. Banks love building a relationship with new businesses. If you earned $5,000 last year, then that is what you would enter here. For some people who have been collecting a 1099 and working as a Sole Proprietor for a number of years but did not know it, they can include that income here.

Years in Business

Indicate the number of years that you have been running this business. If you are just starting out, this would be zero. For some people who have been collecting a 1099 and working as a Sole Proprietor for a number of years but did not know it, they can include those here.

General Industry

There are lots of options to choose from within this dropdown. Be sure to select the option that most closely resembles what your business industry is. For Example, Josh Allen’s Cookie Business would be “Accommodation and Food Services”.

Category

Choose the Category that is presented after choosing the industry above. For our example, Josh would choose “Special Food Services”.

Specific Type

Choose the Category that is presented after choosing the Category above. For our example, Josh would choose “Caterers”.

Ink Business Preferred® Credit Card

Ink Business Preferred® Credit Card

Done with Part One!

That’s it for part one! If you have any questions about completing part one you could always shoot us an email or post in our Basic Travel Facebook Group.

Part Two – Personal Information

Your Title As Authorizing Officer

Since Josh is applying as a Sole Proprietor for his Cookie Business he would select “Owner”.

Input and check the following

- First and Last Name

- Check the box to indicate that the Home Address is the same as Business

- Date of Birth

- Phone Number

- Mother’s Maiden Name

- Email Address

- Social Security Number

- Total Gross Annual Income

Total Gross Annual Income

It’s important to note here that the Total Gross Annual Income here includes all income earned by Josh. This means that he (and you!) can include income from his day job and his wife’s (or domestic partner) income. Given that the credit card holder is personally responsible for any debt accrued, the total income gives the bank an idea of how much credit they can provide. This is especially important if the Small Business is not earning a ton of money or is a new business.

Is any portion of your total gross annual income non-taxable?

The answer to this question is no if you’re a sole proprietor.

Final Step!

Read the disclosures and hit submit at the bottom.

Chase Business Application Completed!

Time to wait! It’s VERY rare for a Chase Small Business Credit Card Application to be instantly approved, even if you’re credit score is perfect. It will typically say that “We need more time to review your application”. Since we are talking about a Chase Application here, don’t forget that you need to be below 5/24 (No more than 5 credit cards opened in the last 24 months) in order to be eligible for a Chase Business Credit Card.

Chase Ink Business Cash® Credit Card

Chase Ink Business Cash® Credit Card

Basic Review

I hope that this step-by-step guide to opening a Small Business Credit Card was helpful to you! Please feel free to email us, comment below, or post in our Basic Travel Facebook Group any questions that you have regarding Small Business Credit Card Applications. Good luck and be sure to check out our Top Small Business Credit Offers!